What is a Piggyback Loan?

Contents

If you’re thinking about taking out a home loan, you may have heard of something called a “piggyback loan.” But what is a piggyback loan? In this post, we’ll explain everything you need to know about this type of financing.

Checkout this video:

What is a Piggyback Loan?

A piggyback loan is a second mortgage placed on a property that is being purchased at the same time as a first mortgage. The piggyback loan can be for 10, 15 or 20 percent of the property’s purchase price and for 30-year terms.

Piggyback loans can help buyers avoid private mortgage insurance (PMI), which is required when a buyer makes a down payment of less than 20 percent on a conventional loan. PMI protects the lender if the borrower defaults on the loan.

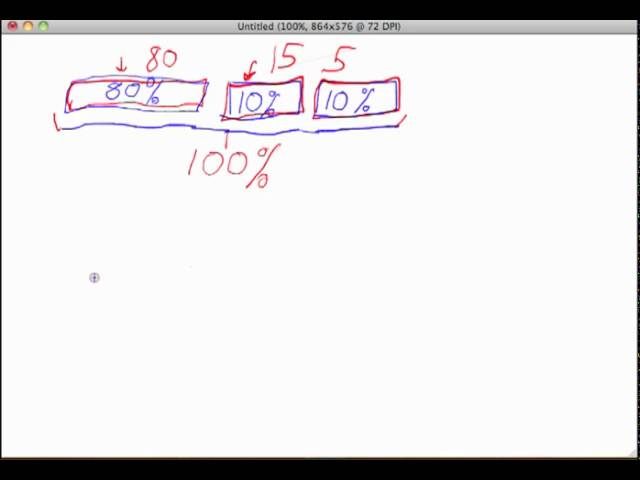

Piggyback loans are also known as combination loans, 80-10-10 loans or 80-15-5 loans. These loans can be an attractive option for borrowers who have good credit and enough income to qualify for the additional monthly payment.

How Does a Piggyback Loan Work?

A piggyback loan is a mortgage loan where a separate loan is taken out for a portion of the purchase price of the home. The most common piggyback loan is an 80/10/10, where the mortgage lender provides an 80% first mortgage, the borrower puts down 10%, and then takes out a second mortgage for 10% of the purchase price.

Piggyback loans can help borrowers avoid private mortgage insurance (PMI), and can also be used to avoid paying jumbo mortgage rates. However, these loans typically have higher interest rates than a standard first mortgage, so borrowers need to be sure they are getting the best possible rate before taking out a piggyback loan.

Advantages of a Piggyback Loan

A piggyback loan, also called a second mortgage, is a loan taken out in addition to your primary mortgage. The most common type of piggyback loan is a home equity loan or home equity line of credit (HELOC). Piggyback loans are used to avoid private mortgage insurance (PMI) or to approximate the size of a jumbo loan without incurring the higher interest rates.

There are several advantages to taking out a piggyback loan:

-You can avoid PMI: If you put less than 20% down on your home, you’re typically required to pay PMI. But if you take out a piggyback loan for part of your down payment, you can avoid PMI altogether.

-You can get a lower interest rate: Interest rates on piggyback loans are often lower than the interest rate on your primary mortgage. This can save you money over the life of your loan.

-You can buy a more expensive home: If you’re looking to buy a more expensive home than you could otherwise afford, a piggyback loan can help you make up the difference. This is especially helpful in high-cost housing markets where jumbo loans are common.

Disadvantages of a Piggyback Loan

There are a few things to watch out for before taking out a piggyback loan. First, since these loans add to your monthly mortgage payment, you want to make sure you can afford the increase. Also, since piggyback loans are typically second mortgages, you may have to pay for private mortgage insurance (PMI) if you don’t have 20% equity in your home.

Piggyback loans can also be harder to qualify for than first mortgages, and they may come with higher interest rates. You may also have trouble finding a lender that offers them, as they’re not as common as first mortgages.

Alternatives to a Piggyback Loan

If you’re looking for an alternative to a piggyback loan, there are a few options available. One option is to take out a conventional loan with private mortgage insurance (PMI). Another option is to take out two separate loans – a first mortgage and a home equity loan or line of credit. Or, you could possibly put down a larger down payment to avoid the need for PMI altogether. Ultimately, the best option for you will depend on your unique financial situation.