Where Can I Finance A Macbook?

Contents

- Can I pay installment in Apple Store?

- What credit score is needed for an Apple Card?

- Are Apple monthly payments worth it?

- Does Apple Store accept Afterpay?

- Is it easy to get approved for Apple Card?

- Can I finance a MacBook without Apple Card?

- Can I get an Apple credit card with no credit?

- Does Apple do credit checks?

- Does Apple do a soft credit check?

- What is the max credit score?

- What is the highest credit limit for Apple Card?

- How much APR is too much?

- Can I use debit card for Apple installment?

- Can I use debit card for installment?

- What is easy payment plan?

- Can I get Apple Card with 620 credit score?

- How can I raise my credit score to 800?

- Can I pay off my Macbook early?

- How to use Apple Pay Later?

- Can I Afterpay MacBook?

- Does Apple have affirm?

- Does Best Buy use Afterpay?

- Why was my Apple Card denied?

- What bank does Apple credit card use?

- Can you have a 700 credit score with collections?

- How long does Apple Card approval take?

- What credit score do you start with?

- Conclusion

Similarly, Can a MacBook be financed?

Fortunately, with MacBook finance, you may be able to stretch out your payments over time. For a complete overview of MacBook financing alternatives, including Apple provides as well as other forms of credit products including personal loans and student loans, see the table below. Is it necessary for you to get a new Apple computer?

Also, it is asked, Can you buy a MacBook with monthly payments?

Apple Card Monthly Installments is a convenient way to pay. Instead of paying everything at once, you may use Apple Card Monthly Installments to pay for a new iPhone, iPad, Mac, or other qualified Apple device and enjoy interest-free, low monthly payments.

Secondly, Where can I pay for a MacBook monthly?

When you purchase at Apple, choose Apple Card Monthly Installments. Simply pick Apple Card Monthly Installments as your payment option when making a purchase on apple.com, in the Apple Store app, or in an Apple Store.

Also, How much credit do you need to finance a MacBook?

— To be accepted for the Apple Card, you must have a FICO credit score of at least 600, which is in the fair range.

People also ask, Is Apple financing hard to get?

Credit Score for Apple Financing A credit score of 640 or better, according to Apple, makes you “more likely to be accepted” for their financing. Users claim to have been authorized with a score as low as 600. It will assist if your revolving balances are minimal and you have fewer than six enquiries.

Related Questions and Answers

Can I pay installment in Apple Store?

ACMI is a 0% APR payment option available at checkout for selected Apple items bought through Apple Store locations, apple.com, the Apple Store app, or by phoning 1-800-MY-APPLE, and is subject to credit approval and credit limit. Learn more about the goods that are eligible.

What credit score is needed for an Apple Card?

What is the minimum credit score for the Apple Card? Customers with credit scores below 600 may not be authorized for the Apple Card, according to Apple. This implies that although some candidates with fair or ordinary credit (scores ranging from 580 to 669) may be approved for the Apple Card, others may be denied.

Are Apple monthly payments worth it?

The Apple Card is a suitable credit card for consumers with strong credit who buy Apple goods and services on a regular basis, as well as iPhone, Mac, and iWatch customers who are comfortable making transactions using Apple Pay. Owning a Goldman Sachs Apple Credit Card doesn’t have to be expensive.

Does Apple Store accept Afterpay?

Yes, as long as the business takes Afterpay as well as Apple Pay! When you’re ready to buy, follow these steps: To view the pre-approved amount you have available to spend, open the Afterpay app and touch the ‘In-store’ option.

Is it easy to get approved for Apple Card?

The Apple Card application is really simple to complete. Once you’ve been asked to apply, you may do it right from your iPhone’s Wallet app. Your Apple ID will be used to pre-fill a lot of your information.

Can I finance a MacBook without Apple Card?

With Apple’s “Pay Later” program, you may finance purchases without having to use an Apple Card.

Can I get an Apple credit card with no credit?

If you don’t have any credit, you won’t be eligible for the Apple Credit Card. To be approved for this card, you must have good or outstanding credit.

Does Apple do credit checks?

When applying for the Apple Card, a credit check is necessary. Goldman Sachs is in charge of approvals, while TransUnion is in charge of credit checks. You will need to unfreeze your TransUnion credit if you have a credit freeze.

Does Apple do a soft credit check?

Apple and Goldman Sachs, on the other hand, are taking a different path. If you are authorized and accept your Apple Card offer, you will only be subjected to a rigorous inquiry. Any other circumstance (you are refused, or you are accepted but decline the offer) will result in a soft credit inquiry.

What is the max credit score?

What is the highest credit limit for Apple Card?

The cardholder’s credit score, credit age, and income at the time of application determine the limitations. Credit limits as low as $50 and as high as $15,000 have been reported by cardholders. Apple Card Family may be used to share an Apple Card. To share the card, each participant must be at least 13 years old.

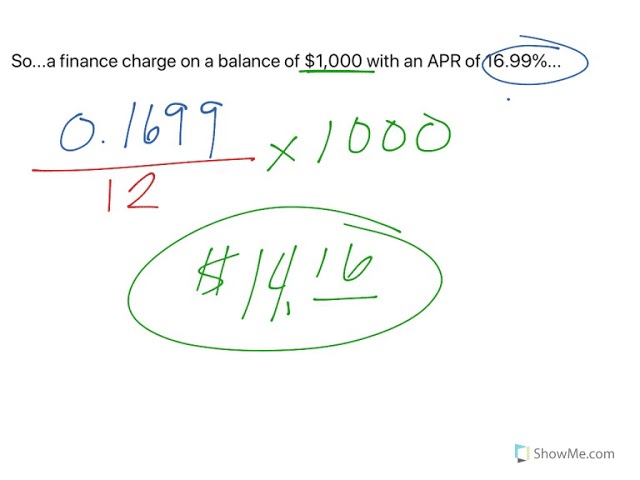

How much APR is too much?

A credit card with an APR of less than 10% is ideal, but you may have to travel to a local bank or credit union to locate one. The Federal Reserve keeps track of credit card interest rates, and an APR that is lower than the national average is regarded acceptable.

Can I use debit card for Apple installment?

You’ll need a valid and qualified U.S.-issued personal, small company, or corporate/commercial credit or debit card to sign up for iPhone Payments. The use of prepaid cards is not permitted. The terms and conditions of your cardmember agreement govern the usage of your credit or debit card. Payment of the First Installment

Can I use debit card for installment?

Yes, you certainly can! PAYLATER accepts both debit and credit cards for payment.

What is easy payment plan?

An easy payment plan (EPP), also known as a flexi payment plan (FPP), is a credit card installment plan that enables you to break down your purchase(s) into smaller payments over a certain period of time.

Can I get Apple Card with 620 credit score?

Some have been authorized with credit scores as low as 620, according to reports. As a result, if you want a good chance of being accepted, you’ll need to make sure you have at least “fair” credit.

How can I raise my credit score to 800?

How to Get a Credit Score of 800 Always pay your bills on time. Paying your invoices on time is perhaps the greatest approach to demonstrate to lenders that you are a responsible borrower. Maintain a low credit card balance. Keep a close eye on your credit history. Make your credit mix better. Take a look at your credit reports.

Can I pay off my Macbook early?

To make an early payment, open the Wallet app and choose Apple Card. Tap the More button, then choose Monthly Installments from the drop-down menu. You can check the balance for all of your monthly payments if you have more than one. Then hit Continue after paying early.

How to use Apple Pay Later?

To use Apple Pay Later, you must first apply for the service and wait for acceptance. Because Apple Pay Later is a lending business, Apple will need to undertake a credit check before deciding whether or not to provide you a loan to help you finance a purchase.

Can I Afterpay MacBook?

On Kogan.com, you may choose from a variety of Afterpay MacBook models, including both new and reconditioned ones. Buy a MacBook on Afterpay now and pay in simple installments afterwards.

Does Apple have affirm?

You may purchase with Affirm and pay over time with no hidden costs, whether you want a new Apple MacBook Pro, iPhone, AirPods, or another item. Details may be found in the bottom.

Does Best Buy use Afterpay?

Best Buy does not accept Afterpay payments at this time. Instead, customers may pay for their purchases using Best Buy credit cards and lease to their own payment schedules.

Why was my Apple Card denied?

If any of the following circumstances apply to your Apple Card application, Goldman Sachs may be unable to accept it. You are now behind on a financial commitment or have previously been behind on a debt obligation. A bank has closed your checking account (for example, due to repeatedly spending more than your available account balance).

What bank does Apple credit card use?

Goldman Sachs is a financial services firm based in the United States.

Can you have a 700 credit score with collections?

Yes, it is possible to have a credit score of at least 700 while also having a collections notation on your credit report, although this is a rare occurrence. It is influenced by a number of variables, including changes in the scoring models utilized.

How long does Apple Card approval take?

seven to ten business days

What credit score do you start with?

Because everyone’s credit experience is unique, there is no one-size-fits-all credit score. However, you will not begin with a score of zero. You simply will not have a score. Because your credit ratings aren’t computed until a lender or another institution asks for them to gauge your creditworthiness, this is the case.

Conclusion

The “macbook pro financing no credit check” is a question that many people want to know the answer to. If you are looking for a place to finance your MacBook, these are some of the places that you can try.

This Video Should Help:

The “apple payment plan bad credit” is a question that has been asked many times. The answer is that you can finance your macbook through apple or Best Buy.

Related Tags

- can you finance a macbook at best buy

- apple payment plan for students

- can you do monthly payments on apple without apple card

- macbook payment plan students

- apple financing