What Time Does World Finance Open?

Contents

- Is World finance a legitimate company?

- Does world finance do a hard inquiry?

- Is World Acceptance the same as world finance?

- What is refinancing a loan?

- What kind of company is world finance?

- Do loan companies check your bank account?

- Who started Worldfinancing?

- Does refinancing loans hurt your credit?

- Does your loan amount go up when you refinance?

- How many times can you refinance a house?

- What is a gold loan?

- Do banks loan money?

- Which type of loan has the lowest interest rate?

- Is TitleMax closing in Illinois?

- Why did TitleMax close in Illinois?

- Can you get payday loans in Illinois?

- Is World finance a magazine?

- What is a personal installment loan?

- Can you go to jail for lying on a loan application UK?

- What should you not tell a mortgage lender?

- What is proof of income for a loan?

- Does refinancing your house lower your credit score?

- Does refinancing lower your car payment?

- Why did my credit score go down 40 points?

- Is it worth refinancing to save $100 a month?

- How can I lower my house payment without refinancing?

- Is it worth refinancing to save $200 a month?

- How much cash can I take out in a refinance?

- How long should you wait to refinance a house?

- What happens to equity when you refinance?

- What are the 4 types of loans?

- Who will borrow me money?

- What is a good credit score?

- How can I get a 5000 instant loan?

- Conclusion

Similarly, Does world finance help build credit?

We assist consumers in determining an equal monthly payment depending on their capacity to repay the loan. We assist consumers in establishing credit and establishing long-term financial stability.

Also, it is asked, Does world finance report to credit?

Yes, we do do a credit check on you. When you apply for a personal loan with World Finance, we look at a variety of factors before making a decision. Your name, address, Social Security number, income, and other personal information will be required.

Secondly, What happens if you don’t pay world finance?

If you don’t pay, you’ll owe more money as a consequence of the fines, fees, and interest charges that will accumulate on your account. Your credit score will suffer as well. 1 It may take many years to restore your credit and borrow again, but you may do it in as little as a few years. So don’t lose heart.

Also, What credit bureau does World Finance use?

Do you inform the credit bureaus about your credit history? Yes, we report all credit transactions to Equifax, Experian, and TransUnion once a month.

People also ask, What is the interest rate for world finance?

Amounts of Loans Amount of Loan/Months/Payments 407.60681.29 percent APR $1,062.2011 is 49.11 percent of $1,062.2011 $3,023.802827.50 is a percentage of $3,023.802827.50.

Related Questions and Answers

Is World finance a legitimate company?

World Finance is a reputable lending firm that has been providing loans for many years.

Does world finance do a hard inquiry?

If you are not accepted, the online pre-qualification will have no effect on your credit since it is merely a soft credit check. We won’t retrieve your credit report, which might affect your credit score, until you’ve finished the whole application and decided to proceed.

Is World Acceptance the same as world finance?

You can rely on World Finance as a reliable partner. World Acceptance Corporation is a NASDAQ-listed business with the ticker code WRLD.

What is refinancing a loan?

Refinancing your mortgage entails exchanging your previous loan for a new one, with a potentially higher sum [1]. When you refinance your mortgage, your bank or lender pays off your previous loan and replaces it with a new one; this is why the word refinance is used.

What kind of company is world finance?

World is one of America’s leading suppliers of installment loans, a sector that flourishes in at least 19 states, largely in the South and Midwest; it has more than 10 million clients; and it has withstood recent legislative measures to limit lending with high interest rates and fees.

Do loan companies check your bank account?

Lenders examine your bank accounts when you apply for a mortgage to verify where the money originates from and that you can be trusted with the loan amount. Lenders must verify that borrowers have sufficient funds in their accounts to repay the loan. Lenders consider the following factors: Having a steady income.

Who started Worldfinancing?

Guillermo Hernández-Cartaya (Guillermo Hernández-Cartaya)

Does refinancing loans hurt your credit?

Overall, owing to the hard queries from the applications and the establishment of a new credit account, refinancing personal loans may result in a modest decline in your credit ratings. If you consistently make on-time payments on your new loan, your credit scores may recover and then grow over time.

Does your loan amount go up when you refinance?

Your loan amount may increase. We had paid down the initial debt to roughly $250,000, but the refinancing increased it to around $256,000, including closing charges.

How many times can you refinance a house?

The amount of times you may refinance your house loan is unrestricted by law. However, mortgage lenders have a few conditions that must be completed each time you apply for a refinancing, and there are some additional factors to keep in mind if you want a cash-out refinance.

What is a gold loan?

A gold loan is a secured loan in which the borrower deposits gold in the range of 18K to 24K with a bank or financial institution as security and receives funds in exchange.

Do banks loan money?

Banks provide a number of lending options, including mortgages, personal loans, vehicle loans, construction loans, and other types of finance. They also provide options for customers who want to refinance an existing loan at a lower rate.

Which type of loan has the lowest interest rate?

Because mortgages are considered secured loans, they have some of the lowest interest rates of any kind of loan. Although variable rate loans are sometimes available, most house purchasers choose fixed-rate mortgages, which are at all-time lows by the end of 2020.

Is TitleMax closing in Illinois?

Repayment Options for Illinois Title Loans TitleMax is no longer issuing new loans in the state of Illinois as of March 23rd, 2021. This has no impact on the conditions of any current or ongoing loans, or on your commitment to repay your loan as agreed.

Why did TitleMax close in Illinois?

After Illinois Governor JB Pritzker signed the Predatory Lending Prevention Act into law on Tuesday, many payday and title loan businesses in the state will close. The law was created to protect disadvantaged Black and brown populations from being exploited by lenders.

Can you get payday loans in Illinois?

A payday loan in Illinois may range from $100 to $35,000. You have the option of choose how long you want to borrow and when you want to return it. If you choose a short-term loan, you will return the money in one lump sum 2-4 weeks later. This allows you to wait until your next payment arrives.

Is World finance a magazine?

World Finance is a highly regarded journal and website that covers and analyzes the financial sector and the global economy in detail.

What is a personal installment loan?

A personal installment loan is a form of loan in which you borrow a certain amount of money and must repay it in predetermined installments. Personal installment loans are closed-end loans, which means the lender delivers you the whole amount upfront.

Can you go to jail for lying on a loan application UK?

In the worst-case scenario, lying on a mortgage application in the UK may result in a sentence of up to ten years in jail. Serious mortgage fraud has a maximum penalty of five years in prison, although opportunistic mortgage fraud by an individual is more likely to result in a fine or a suspended term.

What should you not tell a mortgage lender?

1) Anything that isn’t true Lying to a mortgage lender might jeopardize your application. Furthermore, supplying false information on a loan application is a criminal. Welcome to the world of mortgage scam! You may attempt to conceal certain information, but lenders are compelled to verify important financial records.

What is proof of income for a loan?

Pay stubs are the most common type of evidence of income accepted, although bank statements, W2s, 1099s, personal tax returns, and social security award letters may also be acceptable.

Does refinancing your house lower your credit score?

Your credit score will momentarily drop when you refinance a loan, not just because of the hard query on your credit report, but also because you are taking on a new debt and haven’t yet demonstrated your capacity to repay it.

Does refinancing lower your car payment?

Refinancing and extending your loan term might reduce your payments and put more money in your pocket each month, but you may wind up paying more in interest over time. Refinancing to a lower interest rate for the same or a shorter period than you have today, on the other hand, will save you money in the long run.

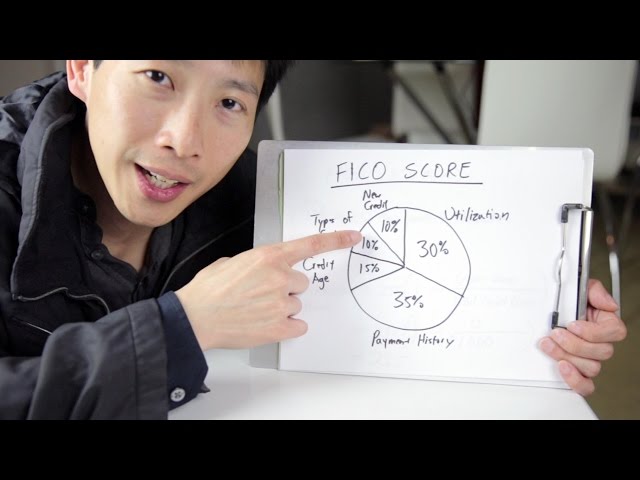

Why did my credit score go down 40 points?

Late or missing payments, fluctuations in your credit usage rate, a change in your credit mix, closing older accounts (which may reduce your total credit history), or applying for new credit accounts may all cause your credit score to decline.

Is it worth refinancing to save $100 a month?

When you intend on maintaining the loan long enough to pay the cost of refinancing, it’s worth it to refinance to save $100 each month.

How can I lower my house payment without refinancing?

You have the option to change your payment. Make a one-time additional payment each year. Each month, “round up” your mortgage payment. Set up a bi-weekly payment schedule for your mortgage. To cancel your mortgage insurance, contact your lender. Make a loan modification request. Submit a request for a reduction in your property taxes.

Is it worth refinancing to save $200 a month?

In general, a refinancing is profitable if you plan to stay in your house long enough to reach the “break-even point” — the point at which your savings balance the refinance closing fees. Consider this scenario: you’ll save $200 per month by refinancing, and your closing fees will be roughly $4,000.

How much cash can I take out in a refinance?

In general, lenders will only allow you to borrow up to 80% of the value of your property, although this varies by lender and may be contingent on your unique circumstances. VA loans are an exception to the 80 percent rule, since they allow you to borrow up to the entire amount of your current equity.

How long should you wait to refinance a house?

Before refinancing, you must wait at least seven months – long enough to make six monthly payments. Any mortgage payments that were due in the previous six months must have been made on time, and you can only have one late payment (30 days or more) in the six months prior to that. FHA streamlines the process.

What happens to equity when you refinance?

When you refinance, do you lose any equity? Yes, if you utilize a portion of your loan amount to cover closing costs, you may lose equity when refinancing. However, when you return the loan and the value of your property rises, you will recover equity.

What are the 4 types of loans?

The following are the many sorts of loans accessible in India Different types of secured loans Obtaining a mortgage. Property as collateral for a loan (LAP) Loans secured by insurance policies Loans in gold. Loans secured by mutual funds and stock. Loans secured by fixed deposits.

Who will borrow me money?

Banks. A personal loan from a bank may seem to be an appealing alternative. Credit unions are a kind of financial cooperative. A credit union personal loan can be a better alternative than a bank personal loan. Lenders on the internet. Payday loan companies. Pawn shops are a kind of pawn store where you may A credit card cash advance is a loan that is obtained with the use of a credit card. Friends and family. A 401(k) is a kind of retirement account.

What is a good credit score?

Credit scores between 580 and 669 are regarded fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and higher are considered exceptional, depending on the credit scoring methodology.

How can I get a 5000 instant loan?

How to Apply for a Rs. 5000 Money View Loan Check to See if You’re Eligible. Visit the Money View website or download the loan app and fill out all of the relevant information. Select a Loan Program. Documents must be provided. Loans are disbursed within 24 hours.

Conclusion

World Finance is a company that provides financial services. They are open from 9:00am to 5:30pm EST on weekdays and 10:00am to 4:30pm on Saturdays.

This Video Should Help:

World Finance is an online investment company that offers a variety of products and services. The company has been around since 1997, but it recently moved to the UK in 2016. It’s important for people to know when World Finance opens because it can be difficult to find the time of day on their website. Reference: world finance sign in.

Related Tags

- world finance payments

- world finance near me

- world finance credit score requirements

- world finance app

- world finance loan requirements