How Long Does It Take for Your Credit Score to Go Up?

Contents

If you’re wondering how long it will take for your credit score to go up, you’re not alone. Many people are curious about how credit scores are calculated and what factors influence them. While there is no one-size-fits-all answer to this question, there are some general guidelines you can follow. In this blog post, we’ll explore how long it takes for your credit score to go up, what factors influence your credit score, and some tips for improving your credit score

Checkout this video:

The credit scoring process

How credit scores are calculated

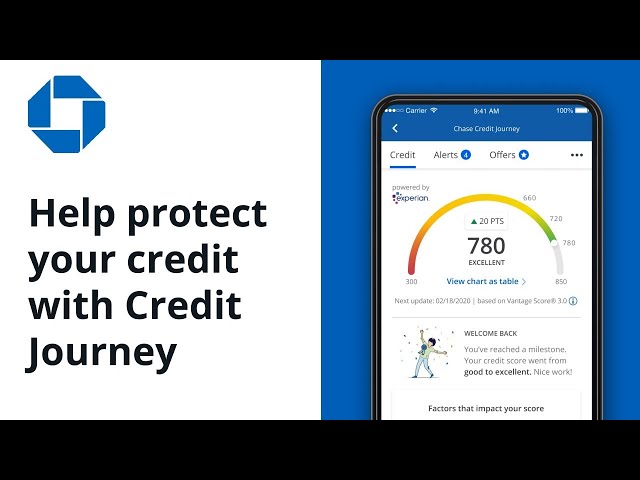

There are many factors that go into calculating your credit score. The three main credit reporting agencies, Experian, TransUnion, and Equifax, all use similar methods to calculate your score. They look at both positive and negative information in your credit report. The most important factors in your credit score are:

-Payment history: This includes whether you pay your bills on time or not. It is the most important factor in your score, accounting for 35% of your total score.

-Credit utilization: This is how much of your available credit you are using at any given time. It makes up 30% of your credit score.

-Credit history: This is how long you have been using credit. It makes up 15% of your score.

-Credit mix: This is the variety of types of credit you have, such as installment loans, revolving loans, and lines of credit. It makes up 10% of your score.

Remember that each agency may weight these factors differently when they calculate your score. That’s why it’s important to check all three of your scores when you’re trying to improve your credit health

The impact of late payments

One of the biggest factors that can negatively impact your credit score is a late payment. If you have any late payments on your record, it will take longer for your credit score to improve.

The effect of a late payment on your credit score depends on how late the payment is. A single 30-day late payment can drop your score by as much as 100 points. The good news is that the effect of a late payment starts to fade after about 12 months, so if you can avoid any new late payments, your score should start to rebound relatively quickly.

How long it takes for your credit score to go up

It can take anywhere from a few months to a couple of years to see a significant increase in your credit score. It all depends on how much debt you have, how long you’ve been paying your bills on time, and what your credit utilization is.

The effect of paying off debt

If you have debt, paying it off should be your top priority. Here’s why: Your payment history has the biggest impact on your credit score—it’s 35% of your FICO® Score—so by definition, paying off debt will have a positive effect on your score. And the sooner you can pay off debt, the better; 30% of your credit score is based on your credit utilization ratio, which measures how much of your available credit you’re using. So if you’re carrying a balance on a credit card with a $5,000 limit, paying off that debt will have a bigger impact on your score than if you’re carrying a balance on a card with a $10,000 limit.

Paying off debt also helps improve your credit utilization ratio, which is another important factor in your credit score. Your credit utilization ratio is the amount of revolving debt you have divided by the sum of your revolving credit limits. So if you have $500 in balances and $1,000 in total limits across all your cards, your utilization ratio would be 50%. The lower your utilization ratio, the better for your credit scores—experts generally recommend keeping it below 30%. So if you’re able to pay down debt so that you have less than $300 in balances and $1,000 in total limits across all cards, that would help improve both your payment history and credit utilization ratios, and could lead to a significant jump in your credit scores.

It’s important to remember that while paying off debt can have a major impact on improving your credit scores—especially if it helps get rid of any past-due accounts or collection accounts—it won’t happen overnight. It could take months or even years to see major improvements in your scores depending on how much debt you’ve paid off and what other negative information is still being reported about you by creditors.

The effect of opening a new credit account

Opening a new credit account will likely have an immediate impact on your credit scores—typically a drop of five to 10 points. That impact will dissipate over time as the new account becomes part of your credit history and is factored into your FICO® Scores.

The big picture: How long does it take for a new account to affect my scores?

For most scoring models, including FICO® Scores, it takes about six months of credit history on an account to generate a score. So, if you’re looking at your scores shortly after opening a new account, the difference may not be reflected yet. However, if you’ve had the account long enough for it to be reported on your credit report—and therefore influence your scores—you may see a difference.

In addition to the length of time, the number of new accounts you open also affects your scores. A recent study by FICO shows that people with six or more inquiries on their credit reports (indicating they applied for new credit) in the past six months had lower average scores than people with fewer inquiries. So, if you’re opening several new accounts in a short period of time, this activity could have a negative effect on your scores.

Ways to improve your credit score

Your credit score is important. It is used by lenders to determine whether or not you’re a good candidate for a loan. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. There are a few things you can do to improve your credit score, and we’ll go over them in this article.

Paying your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time. This includes both credit card payments and other types of loan payments, such as car loans, student loans, andmortgages. Payment history is one of the biggest factors that goes into calculating your credit score, so even if you have other negative marks on your report, paying on time can help offset those issues.

If you have missed any payments in the past, it’s important to focus on catching up as soon as possible. Not only will this improve your credit score, but it will also make it easier to qualify for loans in the future. If you have any questions about making a payment or need help catching up, reach out to your lender or creditors—they may be willing to work with you to create a payment plan or negotiate a lower interest rate.

Another way to improve your credit score is by keeping your credit utilization low. Credit utilization is the amount of debt you have compared to your total credit limit. For example, if you have a $1,000 credit limit and owe $500, your credit utilization would be 50%. The lower your credit utilization, the better for your score—experts recommend keeping it below 30%.

If you’re looking to keep your utilization low, one tactic is to pay down your debt gradually over time. Another option is to ask for a higher credit limit from your lender—this will immediately lower your utilization ratio without increasing the amount of debt you owe. You can also try transferring some of your debt to a 0% APR balance transfer credit card so you can chip away at it without accruing interest.

Keeping your credit utilization low

Your credit utilization is the second most important factor in your credit score—it’s responsible for 30% of your score. This refers to the percentage of your credit limit you’re using at any given time. For example, if you have a $1,000 credit limit and a $500 balance, your credit utilization is 50%.

The lower your credit utilization, the better for your credit score. Credit scoring models generally recommend keeping your credit utilization below 30%, but the lower the better.

If you have a high balance on one or more of your cards, there are a few things you can do to lower your credit utilization and improve your credit score:

• Pay down your balances: The most obvious way to reduce your credit utilization is by paying down the balances on your accounts. If you can pay off some of your debt, you’ll immediately see a decrease in your credit utilization—and an increase in your credit score.

• Request a higher credit limit: Another way to reduce your credit utilization is by asking for a higher credit limit from your creditors. If they agree to raise your limit, you’ll have more room to charge without increasing your overall debt load and harming your credit score. Just be sure not to use this extra room!

• Spread out your debt: If you have multiple debts with high balances, you may want to consider transferring some of that debt to another account with a lower interest rate or shorter repayment term. This will help you pay off the debt faster while also lowering your monthly payments and freeing up some cash flow.

Avoiding hard inquiries

A hard inquiry, also called a hard pull, can happen when you apply for a new credit card, a loan or other type of credit. Credit bureaus view hard inquiries as indications of risk, and too many of them in a short period of time can result in a drop in your credit score.

That’s why it’s important to avoid hard inquiries if you’re trying to improve your credit score. If you can’t avoid them altogether, there are some things you can do to minimize the impact:

-Space out your applications. If you need to apply for multiple forms of credit within a few months, try to space out your applications so that they’re not all bunched together. This will give each inquiry less weight.

-Limit your applications to one type of credit. Applying for both a car loan and a mortgage at the same time will result in two hard inquiries on your report. If possible, focus on just one type of credit at a time.

-Opt for soft pulls instead. There are some situations where you can get the information you need without triggering a hard pull – for example, when you check your own credit score or when you prequalify for a credit card.