What Score Does Your Credit Start At?

Contents

If you’re wondering what credit score you need to start with, the answer is that it varies. There is no one “right” answer, as each lender sets their own standards. However, there are some general guidelines you can follow to help improve your chances of getting approved for a loan. Check out our blog post for more information.

Credit Start At?’ style=”display:none”>Checkout this video:

Credit Basics

Most people think that their credit starts at zero, but this is not the case. Your credit starts at a score of 300 and goes up from there. The higher your score, the better. A good score is anything over 700.

What is credit?

Credit is simply borrowing money with the understanding that you’ll pay it back later. It’s a service that allows you to borrow money when you need it and pay it back over time.

Most people use credit to make large purchases, such as a car or a house. But credit can also be used for smaller things, like buying gas or renting a hotel room. You can even use credit to get cash when you need it.

There are two main types of credit: revolving and installment. Revolving credit is what we usually think of when we think of credit cards. With revolving credit, you have a set limit that you can borrow against, and you can borrow as much or as little as you need up to that limit. As you pay off your balance, your available credit increases so you can borrow again if necessary. Installment credit is for larger purchases that you pay back over time, like a car loan or a mortgage.

No matter what type of credit you have, it’s important to remember that credit is not free money—you will have to pay interest on the money you borrow, and if you don’t repay your debt in full and on time, your creditors can take legal action against you.

How is credit scored?

Credit scoring is based on publicly-available information including your credit report and how you have handled debt in the past. A FICO® Score is calculated using many different pieces of credit data in your credit report. This data is grouped into five general categories as outlined below. The weight given to each category may vary depending on the type of credit score being used.

Payment history (35%)

Are you making payments on time? Do you have a history of late or missed payments? Payment history is the most important factor in credit scoring, so it’s important to keep up with your payments.

Credit utilization (30%)

Credit utilization is a measure of how much of your available credit you are using. It’s important to keep your credit utilization low, because it shows that you are not maxing out your credit cards and that you are able to manage your debt. A good rule of thumb is to keep your credit utilization below 30%.

Credit history (15%)

How long have you been using credit? A longer credit history will generally result in a higher credit score, because it shows that you have a history of managing debt responsibly.

Credit mix (10%)

Do you have a mix of different types of debt, such as revolving debt (credit cards) and installment debt (car loans)? Having a mix of different types of debt can help your score, because it shows that you can manage different types of payments.

New credit (10%)

Have you recently opened any new lines of credit? Opening new lines of credit can impact your score, because it can show that you are taking on new debt. If you are looking to improve your score, it’s generally best to avoid opening new lines of credit.

The Starting Score

Why is the starting score important?

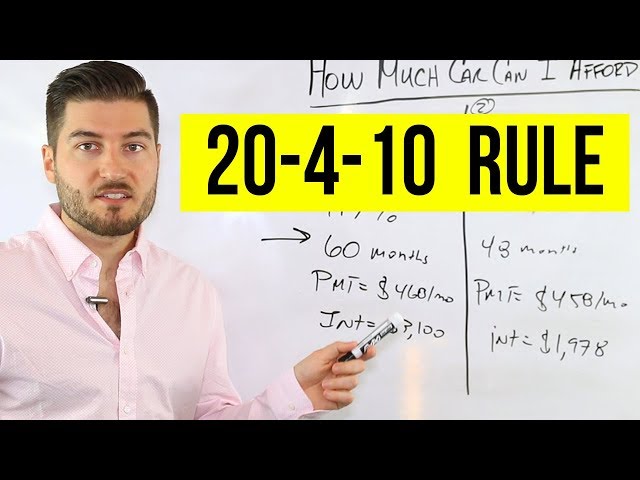

The starting score is the first number that lenders will look at when considering a loan application. This number is used to determine the interest rate and the terms of the loan. A high starting score means that the borrower is a low-risk and is more likely to get a lower interest rate. A low starting score means that the borrower is a high-risk and is more likely to get a higher interest rate. The starting score is important because it can save the borrower a lot of money in interest over the life of the loan.

What is a good starting score?

A good starting score is one that is in the upper range of what is considered to be a “good” credit score. For most scoring models, this means a score of 700 or above. However, it’s important to keep in mind that different lenders may have different standards for what they consider to be a good credit score. So, even if your score is in the upper range of what is considered to be a good score, you may still not be able to qualify for certain loans or credit products.

How to Improve Your Starting Score

When you first get your credit report, your score will likely be on the lower end. This is because you have no credit history. You can improve your score by doing things like paying your bills on time, maintaining a good credit history, and using a credit monitoring service.

Ways to improve your credit score

There are a number of ways to improve your credit score, but the most important factor is always going to be paying your bills on time. Other factors that influence your score include the amount of credit you have available to you, the types of credit you have, the length of your credit history, and any derogatory marks on your report.

You can also improve your score by using credit counseling services to help get your debts under control. These services can help you work out a payment plan with your creditors, and they also often offer debt management advice and budgeting counseling. If you use these services responsibly, they can help you get your financial life back on track and improve your credit score in the process.

What is the best way to improve your credit score?

There is no easy answer when it comes to improving your credit score. However, there are a few things you can do that may help. One of the best things you can do is to make sure you keep updated on your credit report so you can identify any potential issues early on. You can also try to keep your credit balances low and make sure you make all of your payments on time. Additionally, using credit counseling services can help you work on your budget and get your finances back on track.