What Is a Working Capital Loan?

Contents

A working capital loan is a type of business loan that helps businesses finance their short-term operational costs. Read on to learn more about how these loans work and how they can benefit your business.

Checkout this video:

Introduction

A working capital loan is a loan that is used to finance a company’s day-to-day operations. This type of loan is typically used to cover expenses such as payroll, inventory, and other operating costs.

Working capital loans can come from a variety of sources, including banks, venture capitalists, and online lenders. These loans are typically short-term in nature, with terms ranging from a few months to a couple of years.

Working capital loans can be an important tool for businesses of all sizes. They can provide the funds necessary to keep a business running smoothly, while also giving the company time to generate revenue and grow.

What Is a Working Capital Loan?

A working capital loan is a loan that is taken out to finance a company’s everyday operations. The loan is used to cover expenses such as inventory, payroll, and other operational costs. Working capital loans are typically short-term loans that are repaid within a year.

Short-Term Loans

Short-term working capital loans are generally used to finance receivables and inventory. The short-term nature of these loans means they usually have terms of one year or less, although some loans may have terms of up to three years. Short-term working capital loans are typically repaid with the cash generated from the sale of receivables and inventory.

These loans are typically made by commercial banks, although alternative lenders such as online lenders and invoice factoring companies are increasingly becoming a source of short-term working capital for small businesses.

Lines of Credit

A working capital loan is a loan that is used to finance a company’s daily operations. The loan is used to cover expenses such as inventory, accounts receivable, and payables. Working capital loans are typically short-term loans, with terms ranging from one year to five years.

In most cases, working capital loans are lines of credit that can be used as needed. The borrower only pays interest on the portion of the loan that is used. When the borrower repays the borrowed funds, the line of credit is replenished and can be used again.

There are also term loans that can be used for working capital purposes. Term loans are fixed-term loans that must be repaid in full by the end of the loan term. These loans typically have higher interest rates than lines of credit and are better suited for borrowers who need a large amount of funds upfront.

Invoice Financing

Invoice financing is a type of working capital loan that enables businesses to access the cash tied up in their unpaid invoices. With invoice financing, businesses can receive an advance on their invoices, giving them the funds they need to continue operating and growing.

There are two main types of invoice financing:

-Factoring: In this type of arrangement, the lender purchases the business’s outstanding invoices at a discount and then collects payment from the customer.

-Invoice financing: In this type of arrangement, the lender provides the business with a loan based on the value of its outstanding invoices. The business is responsible for collecting payment from its customers.

Invoice financing can be a helpful tool for businesses that are struggling to manage their cash flow. It can provide the funds businesses need to pay their employees, suppliers, and other bills on time. It can also help businesses avoid late fees and penalties associated with late payments.

How Does a Working Capital Loan Work?

A working capital loan is a type of loan that is typically used to finance a company’s day-to-day operations. The loan is used to cover expenses such as inventory, payroll, and other operating costs. The loan is typically repaid over a short period of time, usually within one year.

Qualifying for a Loan

In order to qualify for a working capital loan, businesses must have a good credit score and a strong history of financial stability. Lenders will also want to see that the business has a healthy cash flow and will be able to repay the loan within a reasonable amount of time.

How Much Can You Borrow?

The amount you can borrow with a working capital loan depends on your business’s revenue and expenses. Generally, you can borrow up to 20% of your annual revenue, up to a maximum of $2 million. But the actual amount you’re approved for will also depend on your credit score, loan term, and other factors.

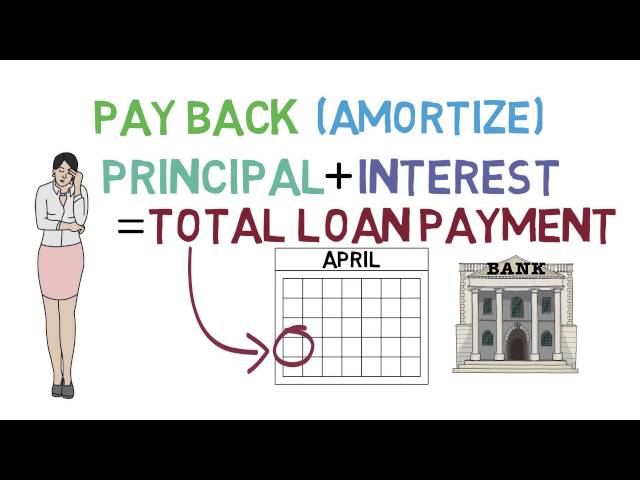

Repaying a Loan

There are a few different ways that you can repay a working capital loan. The first is through what’s called a “balloon payment.” This is when you make one lump sum payment at the end of the loan period that covers the entire outstanding balance. The second way to repay a working capital loan is through what’s called “monthly installments.” With this method, you make smaller payments each month until the loan is paid off. And lastly, you can also repay a working capital loan through a “line of credit.” With this method, you only make payments on the amount of money that you actually borrow, and you can borrow and repay funds as needed throughout the life of the loan.

Pros and Cons of a Working Capital Loan

A working capital loan can provide your business with the funds it needs to cover short-term expenses and keep operating smoothly. However, there are some potential downsides to taking out a working capital loan that you should be aware of before making a decision. In this article, we’ll go over the pros and cons of a working capital loan so you can make an informed decision for your business.

Pros

There are several key advantages to taking out a working capital loan, which include:

-You can use the funds for any number of business purposes, including inventory, marketing, expansion, and more.

-The loans are typically easy to qualify for and have relatively lenient requirements.

-The interest rates on working capital loans are generally lower than other types of business financing, such as lines of credit or business credit cards.

-You can often get a working capital loan with no collateral required.

-The repayment terms are typically flexible, which can give you the time you need to repay the loan without putting undue strain on your cash flow.

Cons

There are some potential drawbacks to taking out a working capital loan, which include:

-You may end up paying more in interest and fees than you would with other types of loans.

-If you don’t use the loan wisely, you could end up in a worse financial position than you were in before.

-You may have to put up your business assets as collateral, which could put them at risk if you can’t repay the loan.

Alternatives to a Working Capital Loan

A working capital loan is a type of loan that is used to finance a company’s everyday operations. The loan is used to finance inventory, accounts receivable, and other short-term operating expenses. Although a working capital loan can be a helpful way to finance a company’s operations, there are alternatives to a working capital loan that may be more suitable for your business.

Business Credit Cards

Business credit cards can be a great option for financing your business. They can offer you a flexible line of credit that you can use for everyday expenses or larger purchases. Many business credit cards also come with rewards programs that can help you save money on your business expenses.

Personal Loans

Personal loans can be a great option for business owners who are looking for an alternative to a working capital loan. Personal loans are typically unsecured, meaning that they do not require collateral, and they can be used for a variety of purposes, including business expenses. The interest rates on personal loans are often lower than the rates on working capital loans, and the terms can be more flexible.

If you are considering taking out a personal loan for your business, it is important to compare different offers from different lenders to make sure you are getting the best deal possible. You should also make sure that you understand the repayment terms of the loan before you sign anything.

401(k) Loans

If your business is established and you have built up equity in your 401(k) retirement account, you may be able to take out a loan against it. This can be a good option because the interest you pay on the loan goes back into your account.

Remember that if you leave your job, you will have to repay the loan plus interest within 60 days or face paying taxes and penalties on the outstanding balance.

Another downside of a 401(k) loan is that it can}. reduce the long-term growth of your retirement savings, so make sure to weigh the pros and cons before deciding if this is the right option for you.

FAQs

A working capital loan is a type of loan that helps businesses with their everyday expenses. This type of loan is usually used to cover expenses such as inventory, payroll, and other operating costs. Working capital loans are usually short-term loans, which means they have to be paid back within a year or two.

What is the difference between a working capital loan and a business loan?

The main difference between a working capital loan and a business loan is that a working capital loan is used to finance a company’s day-to-day operations, while a business loan is used to finance specific business investments or initiatives.

Working capital loans are typically shorter term loans, with maturities of one year or less, while business loans can have maturities of two years or more. And working capital loans usually have smaller loan amounts than business loans – often under $100,000, while business loans can range from $100,000 up to millions of dollars.

How can I get a working capital loan with bad credit?

There are a few ways to get a working capital loan with bad credit. The first is to find a lender that offers bad credit loans. There are a number of online lenders that specialize in bad credit loans, so this should not be too difficult. The second is to try to get a secured loan. A secured loan is one where you put up some form of collateral, such as your home or your car, in order to secure the loan. The third option is to try to get a cosigner for your loan. A cosigner is someone who agrees to sign the loan with you and be held responsible for the debt if you default on the loan.

How long does it take to get a working capital loan?

The time it takes to get a working capital loan varies depending on the lender, but it is typically much faster than getting a traditional bank loan. Many online lenders can approve and fund your loan within a few days, and some even offer same-day funding.

Conclusion

In conclusion, a working capital loan is a type of business loan that can be used to finance day-to-day operations or unexpected expenses. This type of loan typically has a lower interest rate than other types of business loans, making it a good option for businesses that need short-term financing.