What is the Graduate Plus Loan?

Contents

The Graduate Plus Loan is a type of federal student loan that can be used to cover the cost of graduate or professional school. If you’re considering taking out a Graduate Plus Loan, here’s what you need to know.

Checkout this video:

Introduction

The federal Graduate PLUS loan is a credit-based federal student loan available to graduate and professional students enrolled at least half-time in a degree program at an eligible school. This loan is in addition to any other aid you may receive, such as Stafford Loans. You can borrow up to the cost of attendance minus any other financial aid you receive.

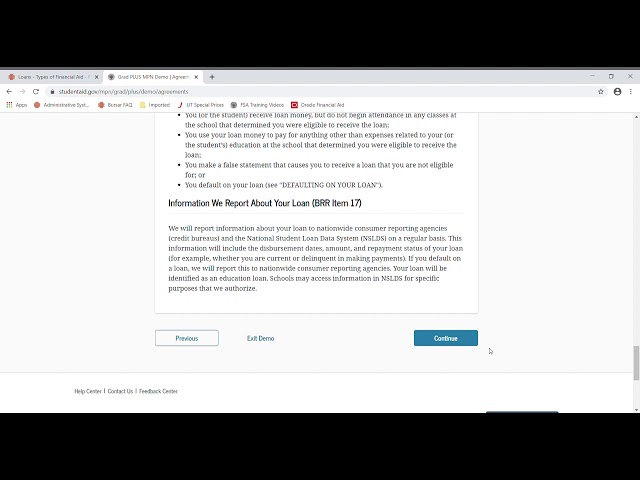

To qualify for a Graduate PLUS loan, you must first complete the Free Application for Federal Student Aid (FAFSA®) form. You will then need to complete a Master Promissory Note (MPN) and go through a credit check. If you have an adverse credit history, you may still be able to get a PLUS loan by getting an endorser who does not have an adverse credit history.

The interest rate for Graduate PLUS loans first disbursed on or after July 1, 2019, and before July 1, 2020, is 7.08%. The interest rate for loans first disbursed on or after July 1, 2020, and before July 1, 2021, is 4.53%.

What is the Graduate Plus Loan?

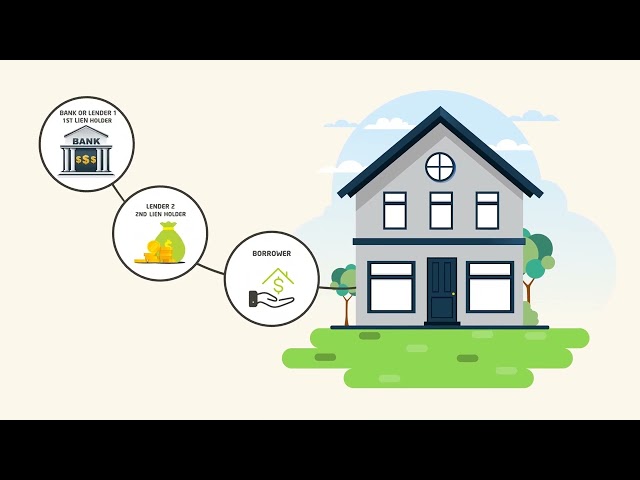

The Graduate PLUS Loan is a federal student loan available to graduate and professional students enrolled at least half-time. The loan allows you to cover educational expenses not paid for by other financial aid. PLUS loans have a fixed interest rate and are not based on your financial need. You may borrow up to the cost of your education minus other financial aid you receive.

How to Apply for the Graduate Plus Loan

The first step in applying for the Graduate PLUS Loan is to complete the Free Application for Federal Student Aid (FAFSA®) form for the academic year for which you are requesting aid. Include graduate or professional school as your level of study on the FAFSA form.

You will need to provide information about your parents’ income and assets on the FAFSA form if you are a dependent student, as defined by federal student aid regulations. You can find out whether you are considered a dependent or an independent student by reading the definitions of these terms on fafsa.ed.gov.

If you will be attending two schools during an academic year, you must complete a FAFSA form for each school. The schools will use the information from your FAFSAs to determine how much financial aid you are eligible to receive at each school.

Once you have submitted your completed FAFSA form, the U.S. Department of Education will send a Student Aid Report (SAR) to you and your school or schools. The SAR contains information from your FAFSA form, as well as your expected family contribution (EFC). Your EFC is used to determine your eligibility for federal student aid, including the Federal Perkins Loan, Federal Work-Study, and most types of federal student loans.

Repaying the Graduate Plus Loan

The repayment for a Graduate Plus Loan starts six months after you graduate or leave school. Unlike the Stafford Loan, there is no grace period for the Graduate Plus Loan. Interest will accrue during your time in school and during your grace period, and will be added to your principal balance when repayment begins.

You will have up to 10 years to repay your loan in full, although you may elect to repay it sooner if you are able. You can make payments while you are still in school if you choose, but it is not required. If you do make payments while in school, they will go toward the interest first and then any remaining balance will go toward the principal.

The repayment amount for the Graduate Plus Loan will be based on your income and other factors, and will be determined when you first enter repayment. Your monthly payment amount may change over time as your income changes, but it will never exceed 10% of your discretionary income. You can see an estimate of what your monthly payments might be using the repayment estimator on the Department of Education’s website.