What is a Higher Priced Mortgage Loan?

Contents

A Higher Priced Mortgage Loan is a mortgage loan with an annual percentage rate that exceeds the average prime offer rate by more than 1.50 percentage points.

Checkout this video:

Introduction

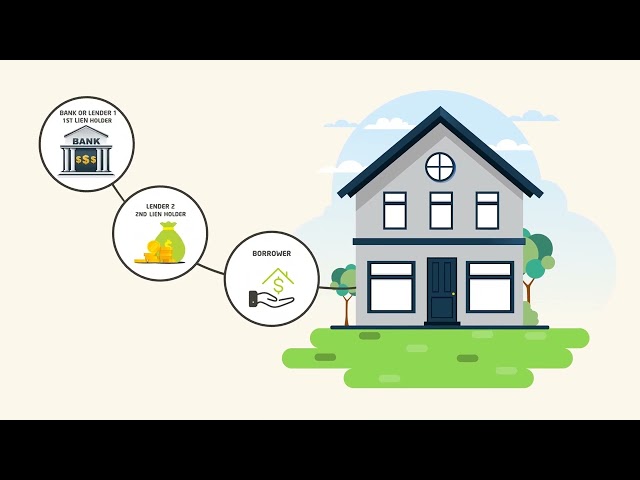

A Higher Priced Mortgage Loan (HPML) is a mortgage loan that has an Annual Percentage Rate (APR) that is greater than the Average Prime Offer Rate (APOR) by at least 1.5 percentage points for first-lien loans, and by at least 2.5 percentage points for junior-lien loans. The APR is the cost of credit to the consumer expressed as a yearly rate and includes certain charges in connection with the loan transaction, such as loan origination fees, discount points, and other prepaid or financed financing costs.

The term “Higher Priced Mortgage Loan” applies to both Adjustable Rate Mortgages (ARMs) and fixed-rate loans. An HPML is not necessarily a subprime loan or a predatory loan.

What is a Higher Priced Mortgage Loan?

A higher priced mortgage loan is defined as a mortgage loan with an annual percentage rate (APR) greater than a benchmark rate called the Average Prime Offer Rate (APOR). The APR on a higher priced mortgage loan includes certain fees and points paid to the lender, broker, or other service providers.

The Three Criteria That Must Be Met

In order to be considered a higher priced mortgage loan, a loan must meet all three of the following criteria:

The annual percentage rate (APR) must be greater than the Average Prime Offer Rate (APOR) by 1.5 percentage points for first-lien mortgages, and by 3.0 percentage points for subordinate-lien mortgages. The APR is a standardized measure of the cost of credit, expressed as a yearly rate, that includes certain loan fees charged by the lender.

The total points and fees payable by the consumer at or before closing must be greater than 8 percent of the total loan amount. In certain cases, the 8 percent threshold may be exceeded where the borrower is not required to pay any points and fees at or before closing.

The mortgage cannot be an irregular home purchase transaction, as defined in Regulation Z (Truth in Lending). This would include transactions where there are multiple advances on the same day or advance is made more than three business days prior to consummation.

How to Determine If You Have a Higher Priced Mortgage Loan

In order to find out if you have a higher priced mortgage loan, you will need to compare the Annual Percentage Rate (APR) on your loan to the Average Prime Offer Rate (APOR).

The Average Prime Offer Rate (APOR) is an index published monthly by the Consumer Financial Protection Bureau (CFPB) that reflects the average interest rate, points, and other terms offered on conforming mortgages. Currently, APOR equals 4.21%.

The APR is the total cost of borrowing for a loan stated as a percentage. In addition to interest, it includes certain fees charged by the lender. The APR will be higher than the interest rate on your loan if there are negative points or other fees involved in getting the loan.

If your APR is equal to or greater than 1.5 percentage points above APOR, your mortgage is considered a higher priced mortgage loan.

You can find out what your APR is by looking at the Truth in Lending Disclosure that you received when you closed on your loan. The Truth in Lending Disclosure will also list the APOR for comparison purposes.

The Advantages and Disadvantages of Higher Priced Mortgage Loans

A higher priced mortgage loan is a loan that has an annual percentage rate (APR) that is greater than the average prime offer rate for a similar mortgage loan. The average prime offer rate is the median interest rate offered by banks and other lenders to their most creditworthy borrowers. Higher priced mortgage loans are sometimes called jumbo loans or non-conforming loans.

There are both advantages and disadvantages to taking out a higher priced mortgage loan. Some of the advantages include:

-You may be able to get a lower interest rate than you would with a conventional loan.

-You may be able to get a longer term than you would with a conventional loan, which could lower your monthly payments.

-You may be able to qualify for a higher loan amount than you would with a conventional loan.

Some of the disadvantages of taking out a higher priced mortgage loan include:

-You may have to pay private mortgage insurance (PMI) if you make a down payment that is less than 20% of the home’s purchase price or appraised value, whichever is less.

-You may have to pay origination points and other fees associated with the loan. These fees can add up and increase the cost of your loan.

How to Get the Best Mortgage Rate on a Higher Priced Mortgage Loan

There are a few things that you can do to make sure that you get the best mortgage rate on a higher priced mortgage loan. The first thing that you need to do is to make sure that you have a good credit score. The higher your credit score, the lower your interest rate will be. You should also shop around for the best rates and fees. There are a lot of different lenders out there and each one has their own fees and rates. You need to find the lender that has the best deal for you. Finally, you need to make sure that you compare apples to apples when you are comparing rates and fees. Make sure that you are comparing the same thing from each lender so that you can make an informed decision.

Conclusion

In conclusion, a higher priced mortgage loan is one that has an annual percentage rate (APR) that is equal to or greater than the average rate on comparable loans as determined by the Federal Reserve Board. The APR on a higher priced mortgage loan may be higher than the APR on a conventional mortgage loan because of the added risk associated with the higher price.