What is a Private Loan?

Contents

If you’re considering taking out a private loan , you might be wondering what exactly it is. A private loan is a type of financing that you can obtain from a private lender, as opposed to a bank or other financial institution.

Private loans can be used for a variety of purposes, including consolidating debt, financing a large purchase, or covering unexpected expenses. They typically come with higher interest rates than traditional loans, but they can be a good option if you have good credit and

Checkout this video:

What is a private loan?

A private loan is a form of financing that you obtain from a private lender, such as a bank, credit union, or online lender. Private loans are sometimes also called alternative loans or non-federal loans.

Unlike federal student loans, which are issued by the government, private loans are issued by private lenders. The interest rates on private loans can be either fixed or variable, and they typically have higher interest rates than federal student loans. Private loans also usually have less favorable terms and conditions than federal student loans.

Private loans can be used to finance your education costs, including tuition and fees, room and board, books and supplies, and other education-related expenses. Private loan limits vary depending on the lender and the type of loan, but they typically range from $5,000 to $20,000 per year.

If you’re considering taking out a private loan to help finance your education, it’s important to compare multiple lenders and compare the terms and conditions of each loan before you apply. It’s also important to understand that you may not be able to discharge a private student loan in bankruptcy.

How do private loans work?

A private loan is a type of financing that is not provided by the government and instead comes from a private lender, such as a bank, credit union, or online lender. Private loans are often used to fill the gap between what you need to pay for school and what you’re able to get in financial aid.

Unlike federal student loans, which have fixed interest rates and offer flexible repayment options, private loans generally have variable interest rates and require borrowers to start making payments immediately after graduation. For these reasons, private loans should be a last resort after you’ve maxed out your federal loan options.

If you do decide to take out a private loan, it’s important to compare offers from multiple lenders to find the best interest rate and terms. You can use Credible to compare rates from our partner lenders in just two minutes.

What are the benefits of private loans?

There are several benefits of private loans, including:

-Lower interest rates: Private loans usually have lower interest rates than federal loans. This can save you money over the life of your loan.

-Flexible repayment terms: Private loans often have more flexible repayment terms than federal loans. This means you can choose a repayment plan that fits your budget.

-No origination fees: Many private lenders do not charge origination fees, which can save you money up front.

-No prepayment penalties: Some private lenders do not charge prepayment penalties. This means you can pay off your loan early without penalty.

What are the drawbacks of private loans?

There are several potential drawbacks to taking out a private loan, including:

-You may have to pay a higher interest rate than you would with a federal loan.

-Your payments may be due immediately after you graduate or leave school, which could be a shock if you’re not prepared.

-The total amount you can borrow may be less than with a federal loan.

-You may not be able to discharge the loan in bankruptcy.

How to compare private loans?

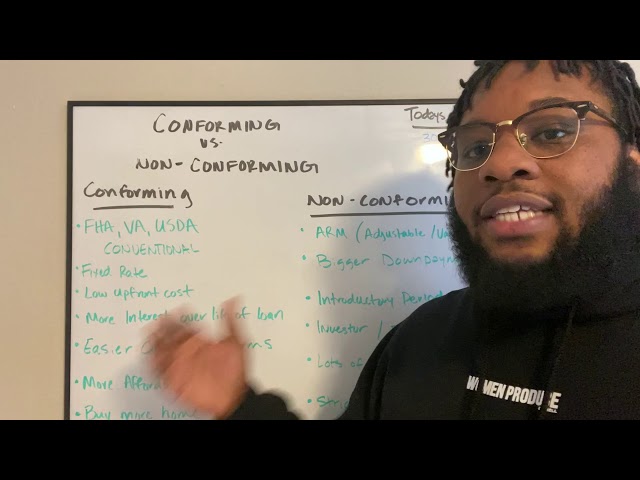

One important factor to consider is the interest rate. Fixed interest rates will never change, meaning your monthly payments will stay the same for the life of the loan. Variable interest rates can fluctuate, meaning your monthly payments could go up or down.

Another important factor to compare is the repayment term. This is how long you have to repay your loan, and it can range from 5 to 20 years. shorter terms will have higher monthly payments, but you’ll pay less in interest overall. Longer terms will have lower monthly payments, but you’ll pay more in interest overall.

You should also compare the fees associated with each loan. origination fees are charged by the lender for processing the loan, and they can range from 0% to 8% of the loan amount. Prepayment penalties are charged if you pay off your loan early, and they can range from none to several thousand dollars.

Finally, make sure you understand the consequences of defaulting on your loan. Private loans are not federally insured, so if you default on your loan, the lender can take legal action against you. This could include wage garnishment or seizure of assets.