What is Loan Payoff?

Contents

If you have a loan , you probably want to know what loan payoff is. Loan payoff is the process of paying off your loan, and it can be a bit complicated. Read on to learn more about loan payoff and how it works.

Checkout this video:

What is Loan Payoff?

Loan payoff is the process of repaying a loan in full. This can be done at any point during the loan term, but is most often done when the borrower has the funds available to do so. While there is no penalty for paying off a loan early, borrowers should be aware that they will likely lose any interest that has accrued on the unpaid portion of the loan.

How to Pay Off Loans

There are a few different ways to approach loan payoff. You can choose to pay off your loans in full, or you can make minimum payments until the loan is paid off. You can also choose to consolidate your loans, which can help you save money on interest and make your payments more manageable.

If you’re struggling to make your loan payments, it’s important to talk to your lender. They may be able to offer you a forbearance or deferment, which can help you stay on track with your payments.

Paying off your loans in full is the best way to save money on interest and get out of debt as quickly as possible. If you’re able to do this, it’s important to start by paying off the loans with the highest interest rates first. This will help you save money in the long run.

If you’re not able to pay off your loans in full, make sure you’re at least making the minimum payments on time. This will help you avoid late fees and damage to your credit score. You should also try to pay more than the minimum payment whenever possible. Even an extra $50 per month can make a big difference in the amount of time it takes to pay off your loan.

Consolidating your loans can also help you save money on interest and make your payments more manageable. When you consolidate your loans, you’re essentially taking out one new loan to pay off several smaller loans. This can help reduce your monthly payments and give you some breathing room if you’re struggling to make ends meet.

Loan Payoff Strategies

Loan payoff is the process of repaying a loan, either in full or in part. There are several strategies that can be used to payoff a loan, and the best strategy for you will depend on your individual circumstances.

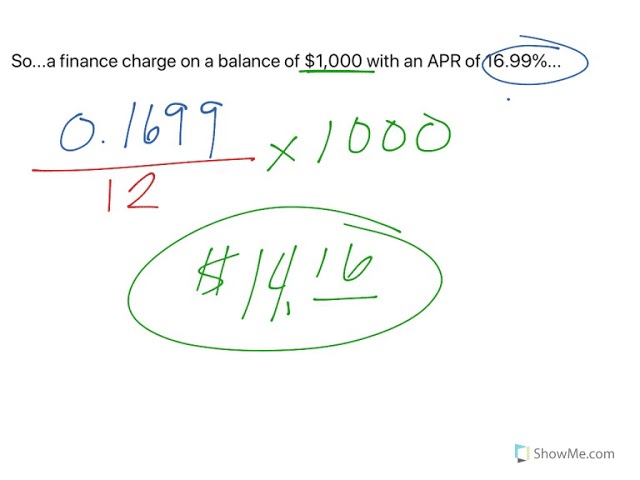

One common strategy is to make extra payments on your loan. This will reduce the amount of interest you pay over the life of the loan and can help you pay off the loan sooner. Another strategy is to refinance your loan. This can be done by taking out a new loan with a lower interest rate or by lengthening the term of the loan. This will lower your monthly payments, but you will end up paying more interest over the life of the loan.

Another option is to consolidate your loans. This can be done by combining multiple loans into one single loan with a lower interest rate. This can help you save money on interest and make it easier to manage your monthly payments. Another option is to use a debt management program. This program will work with your creditors to negotiate lower interest rates and monthly payments.

Whatever strategy you choose, it is important to make sure that you can afford the monthly payments and that you understand the terms of the loan before signing any paperwork.

The Benefits of Paying Off Loans

There are many benefits of loan payoff, including reducing stress, improving credit scores, and saving money on interest. Loan payoff can also help you become debt-free sooner, which can give you peace of mind and financial freedom.

If you are struggling to make your loan payments, or if you are behind on payments, loan payoff can be a great way to catch up and get back on track. Paying off loans can also help you avoid late fees, penalties, and damage to your credit score.

If you are able to pay off your loans early, you will save money on interest. The earlier you pay off your loans, the less interest you will have to pay. This can free up money in your budget that can be used for other purposes, such as investing or saving for retirement.

Paying off loans can be a great way to improve your credit score. When you pay off a loan, it shows that you are responsible with borrowed money and that you are working towards becoming debt-free. A higher credit score can give you access to lower interest rates and better terms on future loans.

If you are considering loan payoff, there are a few things to keep in mind. First, make sure that you can afford the monthly payments. Second, consider whether prepaying is the best use of your money. You may want to invest or save the money instead of using it to pay off debt. Third, remember that some lenders may charge prepayment penalties if you pay off your loan early. Weigh all of these factors before making a decision about whether loan payoff is right for you.