What is the Expansion of the Child Tax Credit?

Contents

The expansion of the Child Tax Credit has been a hot topic recently. Here, we’ll discuss what it is and how it may affect you and your family.

Checkout this video:

Introduction

The Child Tax Credit is a tax credit that is available to parents or guardians who have dependent children under the age of 17. The credit can be worth up to $2,000 per child and can be used to offset any taxes that the parent or guardian owes.

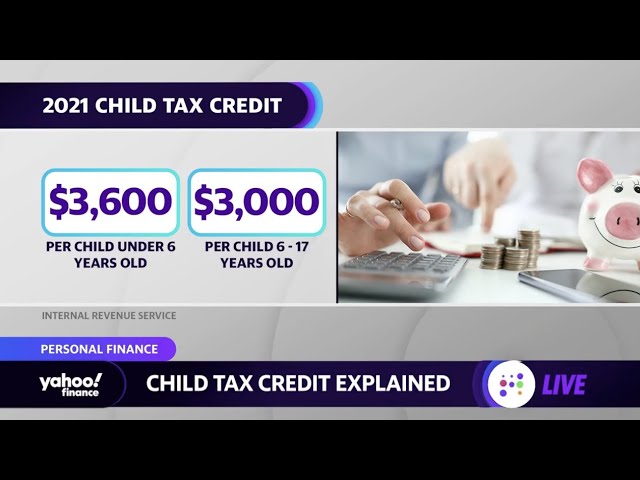

In recent years, there has been talk of expanding the Child Tax Credit, potentially making it worth up to $3,000 per child. The expansion proposal has been met with some opposition, however, as critics argue that it would disproportionately benefit higher-income families.

Nonetheless, the expansion of the Child Tax Credit remains a possibility, and it could provide a valuable financial boost to families with young children.

The Child Tax Credit

The Child Tax Credit is a credit that can be claimed by taxpayers who have dependent children under the age of 17. The amount of the credit is based on the number of children and the income of the taxpayer. In addition, the credit may be refundable, meaning that if the credit exceeds the taxpayer’s tax liability, the taxpayer may receive a refund for the difference.

In 2018, the Child Tax Credit was expanded by the Tax Cuts and Jobs Act. The maximum credit amount was increased from $1,000 to $2,000 per child, and the income thresholds at which the credit begins to phase out were raised significantly. As a result of these changes, more taxpayers are eligible for the credit and those who do qualify can receive a larger credit.

The Expansion of the Child Tax Credit

The expansion of the child tax credit is a tax credit that is available for taxpayers who have children. This tax credit is available for taxpayers who have children under the age of 17. The tax credit is worth up to $2,000 per child. The credit is refundable, which means that taxpayers can receive a refund if they have paid more in taxes than they owe. The expansion of the child tax credit is part of the tax reform law that was passed in December of 2017.

The New Law

In December of 2017, Congress passed the Tax Cuts and Jobs Act, which temporarily increased the Child Tax Credit (CTC) from $1,000 to $2,000 per qualifying child under age 17. The credit is now set to return to $1,000 in 2025 absent any further Congressional action. In addition, the new law created a “non-refundable” credit worth up to $1,400 of the CTC for each qualifying child. This change essentially makes the CTC refundable for all children in poverty and close to refundable for most other children.

The new law also increased the income thresholds at which the credit begins to phase out. The credit phases out completely for single filers with incomes above $200,000 and for joint filers with incomes above $400,000. Prior to tax reform, the CTC began phasing out at incomes of $75,000 for single filers and $110,000 for joint filers. Finally, the new law allows parents to claim the CTC for children ages 17 and 18 – something that was not possible under prior law.

How the Expansion Affects Families

The expansion of the Child Tax Credit has the potential to significantly reduce child poverty in the United States. The changes enacted by the Tax Cuts and Jobs Act of 2017 increased the credit from $1,000 to $2,000 per child under the age of 17. The credit is now also refundable against payroll taxes, meaning that families who do not earn enough income to owe federal income tax can still receive the full value of the credit. In addition, the credit is now available to families with incomes up to $200,000 (or $400,000 if married filing jointly).

According to estimates from the Congressional Budget Office, the expansion of the Child Tax Credit will result in about 5 million fewer children living in poverty in 2018. Families are likely to see the biggest benefits if they have more than one child and if they earn close to or below the median income for their family size. However, all families with children stand to benefit from the expansion of this important tax credit.

Conclusion

In conclusion, the expansion of the child tax credit has been a positive development for families across the United States. The expansion has made the credit more accessible and easier to claim, and has increased the overall amount of the credit. This has all helped to make raising a family a little bit easier, and has put more money back into the pockets of working parents.