What is CVV in Credit Card?

Contents

If you’ve ever used a credit card online, you may have been asked for your CVV or Card Verification Value. But what is CVV and why is it important? In this blog post, we’ll explain everything you need to know about CVV and how it helps keep your credit card information safe.

Checkout this video:

CVV stands for card verification value

CVV stands for card verification value. It is a three or four digit code that is used to verify that you are the owner of the credit card. The code is typically printed on the back of the card, next to the signature strip.

CVV is a security feature for credit or debit card transactions

CVV is an anti-fraud security feature for credit or debit card transactions, providing greater assurance that the person placing the order actually possesses the card. When you make a purchase online, by phone, or in person, you may be asked to provide your card’s CVV.

There are two different types of CVV numbers:

-CVV1 is encoded on the magnetic stripe of Visa, MasterCard and Discover cards and is three or four digits long.

-CVV2 is printed on the front of Visa, MasterCard and Discover cards and is three digits long.

For American Express cards, the CVV is a four-digit number printed on the front of the card above the card number.

CVV is typically a three-digit code

CVV stands for “Card Verification Value”. It is the three or four digit code found on the back of credit cards, typically to the right of the signature strip. On American Express cards, the CVV is a four digit code found on the front of the card, to the right of your card number.

The CVV is used as a security measure to ensure that you are in physical possession of your credit card when making purchases over the internet or by phone. When you provide your CVV, the merchant verifies that the card is on hand and can be used for the transaction. For this reason, it is very important to keep your CVV safe and never store it with your credit card information.

CVV is not your PIN number

The CVV number is the three digit number on the back of your credit card, or four digits if you have an American Express card. This is also sometimes referred to as the CVC or security code. The CVV number is used to help verify that you actually have your physical credit card in front of you when making a purchase. It helps reduce fraudulent purchases made with stolen credit card numbers.

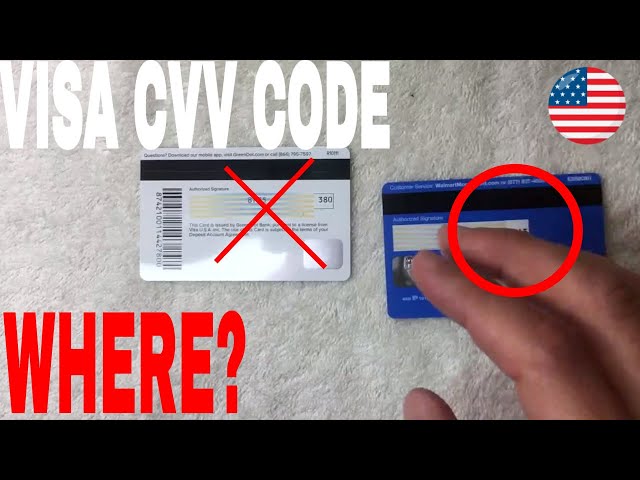

How to find your CVV

The CVV on a credit card is the three-digit number on the back of your card, to the right of your card’s number. It’s the last three digits of the number printed on the signature strip on the back of your card. If your card doesn’t have a signature strip, it will have a four-digit number printed on the front, to the right of the credit card number.

On Visa, Mastercard, and Discover cards, the CVV is the three-digit code on the back of your card, to the right of your card’s signature strip.

On Visa, Mastercard, and Discover cards, the CVV is the three-digit code on the back of your card, to the right of your card’s signature strip.

On American Express (AMEX) cards, the CVV is the four-digit code on the front of your card, to the right of your card number.

On American Express cards, the CVV is the four-digit code on the front of your card, to the right of your card number.

On American Express (AMEX) cards, the CVV is a four-digit code on the front of your card, to the right of your card number. On Visa, Mastercard and Discover credit cards, the CVV is the three-digit number on the back of your card, to the right of your signature.

To find your CVV, look for the following on your credit or debit card:

On American Express cards, the CVV is the four-digit code on the front of your card, to the right of your card number.

On Visa, Mastercard and Discover credit cards, the CVV is the three-digit number on the back of your card, to the right of your signature.

How to use your CVV

CVV is an anti-fraud security feature to help verify that you are in possession of your credit card. For Visa, Mastercard, and Discover cards, the CVV is the last 3 digits of the number on the back of your card. For an American Express card, it is the 4 digits on the front of the card. When you’re making a purchase online, you’ll be asked to enter your CVV.

When you’re shopping online, you’ll typically be asked to provide your CVV when you’re entering your card information.

The CVV, or card verification value, is a number that is unique to your credit or debit card. It helps to verify that you are in possession of the physical card, and it makes online shopping more secure by ensuring that the person entering the CVV is actually the cardholder.

You can usually find the CVV on the back of your credit or debit card — it will be a three- or four-digit number printed on the signature strip. For American Express cards, the CVV is a four-digit number printed on the front of the card above the account number.

When you’re shopping online, you’ll typically be asked to provide your CVV when you’re entering your card information. The process is similar to shopping in a brick-and-mortar store — if you’re paying with a credit or debit card, you’ll need to present the physical card and sign for your purchase. With online shopping, however, you’ll enter your card information (including the CVV) into a form on the website.

While the CVV adds an extra layer of security to online transactions, it’s important to keep in mind that it is not a foolproof method — if someone has your credit or debit card number and expiration date, they may still be able to make unauthorized purchases with your card. For this reason, it’s important to keep an eye on your account activity and report any suspicious charges as soon as possible.

Some websites may also ask for your CVV when you’re setting up an account or profile.

The CVV is a security code that’s used to help verify that you’re the owner of the credit card and that the order is legitimate. It’s usually a three- or four-digit number that’s printed on your credit card.

Some websites may also ask for your CVV when you’re setting up an account or profile. This helps make sure that you’re the rightful owner of the card and that the purchase is legitimate. If you’re ever asked for your CVV and you’re not sure why, don’t hesitate to contact the customer service department for the website or company involved.

What to do if you think your CVV has been compromised

If you think your CVV has been compromised, the first thing you should do is contact your bank or credit card issuer. They will be able to cancel your card and issue you a new one. They may also be able to offer you a new CVV. In the meantime, you should not use your card for any purchases.

If you think your CVV has been compromised, contact your card issuer immediately.

If you think your CVV has been compromised, contact your card issuer immediately. Your issuer can help you resolve the issue and, if necessary, reissue your card with a new CVV.

If you used your CVV to make an online purchase, you may also want to check with the merchant to see if there are any steps they recommend you take. For example, they may be able to process your purchase without requiring the CVV.