What Accounts Carry a Credit Balance?

Contents

Accounts that normally have a credit balance are assets, drawings, and expenses. The normal credit balance for an asset is a debit. This means that the total assets will be increased when this account is debited and decreased when this account is credited.

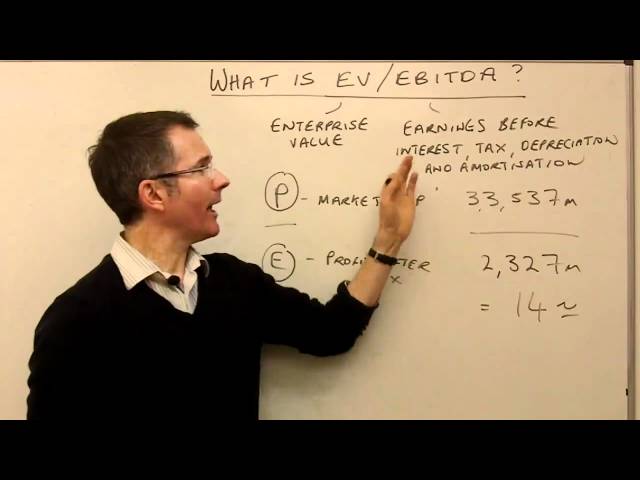

Checkout this video:

Accounts that Always Have a Credit Balance

Some types of accounts in accounting always have a credit balance. These include asset, liability, and equity accounts. The credit balance in these accounts indicates the amount of the account that is owed to the business. In asset and expense accounts, a credit balance indicates a negative amount (the business owes money to someone). In liability and equity accounts, a credit balance indicates a positive amount (the business is owed money).

Service Revenues

Service Revenues are accounts that always have a credit balance. This means that when revenue is earned, it will be entered as a credit into the account. The normal balance for Service Revenues is a credit.

Some examples of Service Revenues are:

-Sales

-Rent

-Interest

-Commissions

Interest Revenues

Interest revenues are monies received by a company for the use of its money. The amount of interest revenue is found by multiplying the rate of interest by the amount of time the money is used. In order for a company to receive interest revenue, it must first lend out its money or invest its money in an interest-bearing account. The company will receive periodic payments, which includes the borrowed amount plus the interest earned on that amount.

Sales Revenues

Revenues represent the amounts earned by a company from the sale of its products and services during a certain period of time. Company revenues are recognized when products or services are delivered or rendered, and are generally reported on a accrual basis. This means that if a product is sold today but won’t be delivered until tomorrow, the revenue is still recognized today.

Sales revenues are the most common type of revenue. They are generated when a company sells products or services to its customers. Other types of revenue include interest income, gains from investments, and royalties from intellectual property

Accounts that Occasionally Have a Credit Balance

The most common types of accounts that may have a credit balance are asset and expense accounts. This is because when payments are received (or when revenue is earned), the amount is first posted to these types of accounts.Other accounts that may have a credit balance are contra revenue accounts.

Accounts Receivable

Accounts receivable generally consists of money owed to a company by its customers for goods or services that have been delivered or used, but not yet paid for. In other words, it represents the credit sales of a company. Because it is money that the company is owed, it is considered an asset on the company’s balance sheet.

Accounts receivable is created when a company provides goods or services and records a sale on its balance sheet. The customer then becomes indebted to the company for the amount of the sale, and this debt is reflected as an account receivable. Once the customer pays off the debt, the account receivable is eliminated.

Unearned Revenues

Unearned revenues are revenues that have been collected by a company but not yet earned. A common type of unearned revenue is advance payments for products or services that have not yet been delivered. Unearned revenues are classified as liabilities on a company’s balance sheet because the company has a legal obligation to provide the products or services that were paid for in advance.

Other types of unearned revenue include:

-Prepaid rent

-Prepaid insurance

-Unused gift cards

Accounts that Rarely Have a Credit Balance

Accounts that normally have a credit balance are called contra accounts. The three most common contra accounts are Sales Returns and Allowances, Service Revenues, and Interest Receivable. Although these accounts occasionally will have a debit balance, it is quite rare.

Common Stock

Common Stock is an equity security that represents ownership in a corporation. Holders of common stock exercise control by electing a board of directors and voting on corporate policy. Common Stockholders are on the bottom of the priority ladder for ownership structure. In the event of liquidation, common shareholders have rights to a company’s assets only after bondholders, preferred shareholders and other debtholders have been paid in full. Voting rights are proportionate to the number of shares owned. For this reason, common stock is also known as “voting stock” or “ordinary shares”.

Paid-in Capital in Excess of Par

Paid-in capital in excess of par is an account that indicates the amount of money that shareholders have paid for their shares of stock above the stated par value of the stock. In other words, it’s the amount that shareholders have paid above the minimum price per share that the company can legally sell its stock.

This account is found on a company’s balance sheet under the heading “shareholders’ equity.” Shareholders’ equity is the portion of a company’s ownership that is held by its shareholders. It represents their claims on the company’s assets.

Paid-in capital in excess of par is important because it represents the amount of money that shareholders have invested in a company. This money can be used by a company to fund its operations, expansion, and other activities.

While most companies strive to maintain a healthy balance between paid-in capital and debt, there are some companies that choose to have more paid-in capital than debt. These companies are often referred to as “equity rich” or “asset light.” Equity rich companies usually have strong balance sheets and are less likely to default on their debt obligations.