What Is EV In Finance?

Contents

- Introduction to EV in finance

- How is EV used in finance?

- What are the benefits of EV in finance?

- What are the limitations of EV in finance?

- How can EV be improved in finance?

- How has EV changed over time in finance?

- What is the future of EV in finance?

- Case study: The use of EV in finance

- FAQs about EV in finance

- Additional resources on EV in finance

When it comes to finance, the term “EV” refers to enterprise value. This is a measure of a company’s worth, and it takes into account both the equity and debt held by the business.

In order to calculate EV, you need to add up the market value of all of the company’s outstanding shares, plus any cash on hand. From there, you subtract any outstanding debt. The result is the enterprise value of the company.

Why is EV important?

Checkout this video:

Introduction to EV in finance

In finance, EV is short for enterprise value. Enterprise value is a measure of a company’s value that takes into account both its equity and its debt.

Why is EV important? Because it gives you a more comprehensive picture of a company’s worth than simply looking at its market capitalization (or “market cap”) does.

To calculate EV, you start with a company’s market cap, which is the price of its stock multiplied by the number of shares outstanding. Then, you add or subtract the company’s net debt (total debt minus cash and equivalents). The result is the company’s enterprise value.

Here’s how it works:

If Company A has a market cap of $1 billion and $500 million in net debt, its EV is $1.5 billion.

If Company B also has a market cap of $1 billion but no net debt, its EV is also $1 billion.

EV can be used to compare companies of different sizes and levels of indebtedness. It can also be useful in valuation analysis, as it provides a more complete picture of a company’s financial situation.

How is EV used in finance?

EV, or enterprise value, is a financial metric that attempts to measure the total value of a company. This figure includes both the equity value and the debt of a firm, which makes it a more holistic metric than other measures like market capitalization.

analysts and investors use EV to compare companies of different sizes, or to compare companies within the same industry. A company with a higher EV relative to its peers is usually considered to be more expensive, and a company with a lower EV is usually considered to be less expensive.

There are several ways to calculate EV, but the most common method is to add together a company’s market capitalization, its debt, and any cash that it has on hand. This sum is then divided by the number of shares outstanding.

The formula for EV can be written as:

EV = market cap + debt – cash / shares outstanding

or, alternatively:

EV = equity value + debt – cash

What are the benefits of EV in finance?

Electric vehicles (EVs) are increasingly becoming a popular choice for businesses and individuals alike. Not only are they more environmentally-friendly, but they also offer a number of financial benefits.

For businesses, EVs can help to reduce running costs and improve environmental performance. For individuals, EVs can offer significant savings on fuel and maintenance costs.

EVs also have the potential to generate income through the sale of renewable energy certificates (RECs). RECs are certificates that represent the environmental benefits of generating electricity from renewable sources. They can be sold to businesses or individuals who want to offset their carbon emissions.

In addition, EVs tend to hold their value better than traditional gasoline-powered vehicles. This is because they have fewer moving parts, which means there is less wear and tear. As a result, EVs can often be sold for a higher price than their gasoline-powered counterparts when they come to trade them in.

What are the limitations of EV in finance?

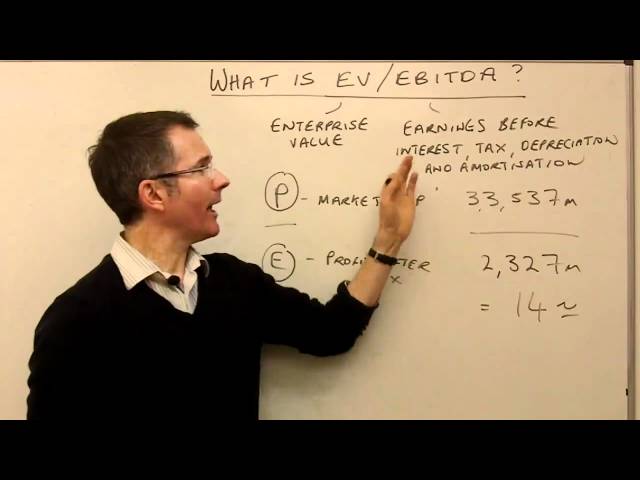

Price to Earnings (P/E) is the most common way to value stocks, but it has its limitations. One way to overcome these limitations is to use EV/EBITDA.

EV/EBITDA is a ratio that measures the value of a company’s stock against its earnings before interest, taxes, depreciation, and amortization. The ratio is used by investors to compare companies with different capital structures and can be used to value companies in different industries.

EV/EBITDA has its limitations, but it is a useful tool for analyzing companies.

How can EV be improved in finance?

There is no one-size-fits-all answer to this question, as the best way to improve EV in finance will vary depending on the specific circumstances and goals of the organization. However, some ways to improve EV in finance include increasing transparency and communication, improving data collection and analysis, and developing better incentives for employees.

How has EV changed over time in finance?

EV, or enterprise value, is a measure of a company’s valuation that considers both its equity and debt. Enterprise value is often used in takeover bids, investment analysis, and valuation.

Historically, enterprise value was calculated as the sum of a company’s equity market capitalization and its debt. However, this method didn’t take into account the value of a company’s cash or other assets, which can be important in takeover bids or investments. As a result, EV has been redefined to include these other factors.

Today, enterprise value is typically calculated as the market capitalization plus debt, minority interest, and preferred shares minus total cash and cash equivalents. This method gives a more accurate picture of a company’s true value.

Enterprise value can be positive or negative depending on a company’s financial situation. A company with negative EV is considered to be undervalued by the market, while a company with positive EV is considered to be overvalued.

EV is an important metric for financial analysis and valuation because it provides a more holistic view of a company’s worth than market capitalization alone.

What is the future of EV in finance?

The future of EV in finance is shrouded in potential but fraught with uncertainty. While the transition to a low-carbon economy is well underway, it is still unclear what role electric vehicles (EVs) will play in this shift. A number of factors – from government policy to consumer preferences – will ultimately determine the success of EVs in the marketplace.

That being said, there are a number of reasons to be optimistic about the future of EVs in finance. First, the cost of batteries and other key components continue to decline, making EVs more affordable for consumers. Second, a growing number of countries are adopting policies that support the adoption of EVs, including tax incentives and regulations that favor low-emitting vehicles. And third, as awareness of the environmental benefits of EVs grows, it is likely that more consumers will make the switch from traditional gasoline-powered vehicles.

With all this in mind, it’s clear that the future of EVs in finance is full of potential – though exactly how this potential will be realized remains to be seen.

Case study: The use of EV in finance

In finance, enterprise value (EV) is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. Enterprise value includes both equity market capitalization and debt, as well as any minority interest in the company. It therefore provides a more accurate picture of a company’s true worth.

In practice, EV is often used as a metric for valuation purposes, either in absolute terms or relative to other companies in the same sector. For example, a company with an EV/EBITDA ratio of 10 would be considered cheap relative to its peers if the median ratio for the sector was 20.

There are a number of ways to calculate EV, but the most common approach is to add together a company’s market capitalization, debt and minority interest, and then subtract out cash and cash equivalents. This provides a more accurate picture of a company’s true worth than simply looking at market cap alone.

The use of EV in finance has come under scrutiny in recent years, with some critics arguing that it gives too much weight to debt levels and can be manipulated by companies through share repurchases and other means. However, it remains a popular metric among investors and analysts due to its comprehensiveness and ability to provide valuable insights into a company’s financial health.

FAQs about EV in finance

What is EV in finance?

EV, or enterprise value, is a measure of a company’s total value. This includes both the market value of its equity and the debt that is outstanding. EV can be used to compare companies of different sizes and can be a helpful tool in evaluating potential investments.

What are some advantages of using EV?

EV can give you a more complete picture of a company’s worth. It can also be helpful in comparing companies of different sizes, as it takes into account both equity and debt. This metric can also be useful in evaluations potential investments.

What are some disadvantages of using EV?

EV does not consider the cash that a company has on hand, which can be an important factor in its overall value. Additionally, EV can be difficult to calculate if a company has complex financing arrangements.

Additional resources on EV in finance

In finance, EV (enterprise value) is a measure of a company’s total value. This includes both equity value and debt, as well as any other financial claims against the company. Enterprise value is often used as a more comprehensive alternative to equity market capitalization.

EV can be calculated using the following formula:

EV = market value of equity + market value of debt + minority interest + preferred shares – cash and investments

For more information on enterprise value in finance, please see the following resources:

-Investopedia: https://www.investopedia.com/terms/e/enterprisevalue.asp

-The Balance: https://www.thebalance.com/what-is-enterprise-value-357306