What Loan Type Provides Interest Subsidy?

Contents

When it comes to taking out a loan, there are many different options to choose from. One type of loan that you may be considering is a subsidized loan. But what exactly is a subsidized loan? And what are the benefits of taking out this type of loan? Read on to find out.

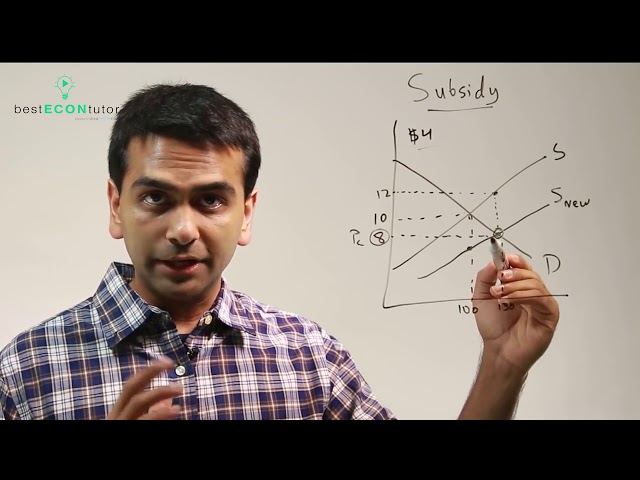

Checkout this video:

Introduction

When you are considering taking out a loan, it is important to understand the different types of loans available and how they can impact your finances. One type of loan that you may come across is an interest subsidy loan.

An interest subsidy loan is a type of loan that comes with an interest subsidy. This means that the government or another entity will pay part of the interest on the loan for you. This can make your monthly payments lower and help you to save money on your overall loan costs.

Interest subsidy loans are typically available for specific purposes, such as studying or buying a home. In some cases, you may need to meet certain requirements to be eligible for an interest subsidy loan, such as having a low income or being a first-time home buyer.

If you are considering taking out a loan, it is worth investigating whether an interest subsidy loan could be suitable for you.

What is an Interest Subsidy?

An interest subsidy is a reduction in the interest rate that is charged on a loan. The subsidy may be provided by the government or by a private organization. Interest subsidies are often used to encourage people to borrow money to buy a home, start a business, or attend college.

Who is Eligible for an Interest Subsidy?

There are two types of interest subsidies available, and the type for which you may be eligible depends on the type of loan you have.

For Direct Loans, the interest subsidy is available for the life of the loan, as long as you are enrolled at least half-time.

For FFEL Loans, the interest subsidy is available during in-school and grace periods, as well as during periods of deferment or forbearance.

What Types of Loans Provide an Interest Subsidy?

While all loans come with some degree of risk, there are a few types of loans that offer an interest subsidy to help offset this risk. The most common type of loan with an interest subsidy is the Stafford Loan, which is available to both undergraduate and graduate students. Other types of loans that may offer an interest subsidy include the Perkins Loan, the Direct PLUS Loan, and the Direct Consolidation Loan.

How to Get an Interest Subsidy

There are many ways to get an interest subsidy. The most common way is to take out a loan. You can get an interest subsidy on your loan if you:

-Pay all or part of your loan in advance

-Make regular payments on time

-Have a good credit history

Conclusion

Both Stafford and Perkins Loans are federal student loans that offer interest subsidy. The main difference between the two programs is that Perkins Loans are need-based, while Stafford Loans are not. Interest subsidy means that the federal government pays the interest on your loan while you are in school and during certain other periods. This can save you a lot of money over the life of your loan.