What is a Credit Card?

Contents

- What is a credit card?

- How do credit cards work?

- What are the benefits of using a credit card?

- What are the drawbacks of using a credit card?

- How can I use a credit card responsibly?

- What are some common credit card terms?

- How can I choose the right credit card for me?

- What should I do if I have credit card debt?

- How can I avoid credit card fraud?

- Where can I get more information about credit cards?

A credit card is a plastic card that gives the cardholder a line of credit with which to make purchases or withdraw cash.

Credit Card?’ style=”display:none”>Checkout this video:

What is a credit card?

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy items or withdraw cash up to a certain limit in exchange for a fee. When a purchase is made, the credit card user agrees to pay the card issuer at a later date.

How do credit cards work?

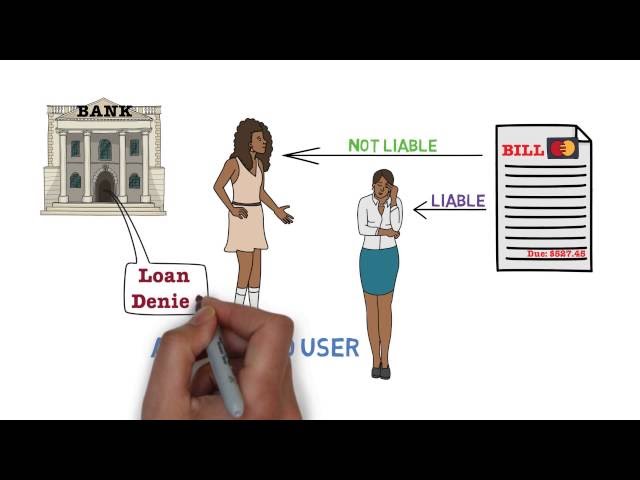

A credit card is a plastic card that gives the cardholder a pre-approved loan for purchase of goods and services. The issuer of the card provides a revolving line of credit to the consumer from which the user can make purchases. When the user makes a purchase, the credit card company pays the vendor for the purchase. The cardholder then repays the credit card company according to the terms of the agreement, which generally requires monthly payments of principal and interest.

What are the benefits of using a credit card?

There are a number of benefits to using a credit card, including the following:

1. You can build your credit history by using a credit card responsibly.

2. You can earn rewards, such as cash back or points, when you use your credit card for purchases.

3. You can take advantage of perks, such as extended warranties or travel insurance, that come with some credit cards.

4. You can use a credit card to make purchases online or over the phone without having to carry cash or checks.

5. You can get a grace period on your payments, which means you don’t have to pay interest on your purchases if you pay your balance in full each month.

What are the drawbacks of using a credit card?

While credit cards offer a lot of flexibility and can be a great tool for managing your finances, there are also some potential drawbacks to using them. If you’re not careful, it’s easy to get into debt with credit cards. Interest rates on credit cards are usually much higher than rates on other types of loans, so it can be difficult to pay off your balance if you carry a high balance from month to month. Additionally, if you miss a payment or make a late payment, you may be charged additional fees by your credit card issuer.

How can I use a credit card responsibly?

There are a few key things to remember if you want to use your credit card responsibly:

1. only spend what you can afford to pay back

2. make sure you make your payments on time

3. keep your balance low

4. don’t max out your credit limit

5. beware of interest and fees

What are some common credit card terms?

There are a lot of common credit card terms that you should know in order to understand your credit card agreement. Here are some of the most important ones:

Annual Percentage Rate (APR): This is the yearly interest rate that you will be charged on your outstanding balance if you don’t pay it off in full each month.

Balance: This is the amount of money you owe on your credit card.

Credit Limit: This is the maximum amount of money that you can charge to your credit card.

Fees: These are charges that are not related to the purchase of goods or services, such as an annual fee, Balance Transfer Fee or Cash Advance Fee.

Minimum Payment: This is the minimum amount of money that you must pay each month in order to keep your account in good standing. If you only make the Minimum Payment, it will take longer to pay off your balance and you will end up paying more in interest.

How can I choose the right credit card for me?

There are literally thousands of credit card offers available, so how do you know which one is right for you? The answer is simple: It depends on your individual needs and financial situation. You should consider factors such as your credit history, annual income, budget and spending habits before you decide which credit card is best for you.

If you have excellent credit, you may be able to qualify for a card with a low interest rate and a generous rewards program. On the other hand, if you have bad credit, you may need to apply for a secured credit card in order to get approved.

Once you know what type of card you need, you can start comparing features and benefits to find the best deal. Be sure to read the fine print carefully so that you understand all of the terms and conditions before you apply.

What should I do if I have credit card debt?

If you have credit card debt, you’re not alone. In fact, according to a report by the Federal Reserve, the average American household has over $7,000 in credit card debt.

There are a few things you can do to reduce your credit card debt. One option is to transfer your balance to a lower interest rate credit card. This can help you save money on interest and pay off your debt faster. Another option is to negotiate with your credit card company for a lower interest rate. This can be difficult, but it’s worth a try if you’re struggling to make your payments.

If you’re having trouble making your payments, you should contact your credit card company and ask about their hardship programs. Many companies have programs that can help you lower your payments or postpone them for a period of time. These programs can be very helpful if you’re facing a financial hardship.

Whatever you do, don’t ignore your debt or try to hide from it. This will only make things worse in the long run. If you’re having trouble dealing with your debt, there are plenty of resources available to help you get through this tough time.

How can I avoid credit card fraud?

Credit card fraud is a serious problem that can cost cardholders thousands of dollars. There are a few simple steps you can take to avoid becoming a victim:

-Check your credit card statements carefully and report any suspicious activity to your bank or credit card issuer immediately.

-Never give your credit card number to anyone who calls you on the telephone, even if they claim to be from your bank or credit card issuer. If you have any doubts, hang up and call the customer service number on the back of your card.

-Be cautious when using your credit card online. Only enter your credit card number into websites that are secure (look for https:// in the address bar) and trustworthy.

-Keep your credit cards in a safe place at home and never carry more cards than you need. When you are out shopping, keep an eye on your purse or wallet and don’t let it out of your sight.

Where can I get more information about credit cards?

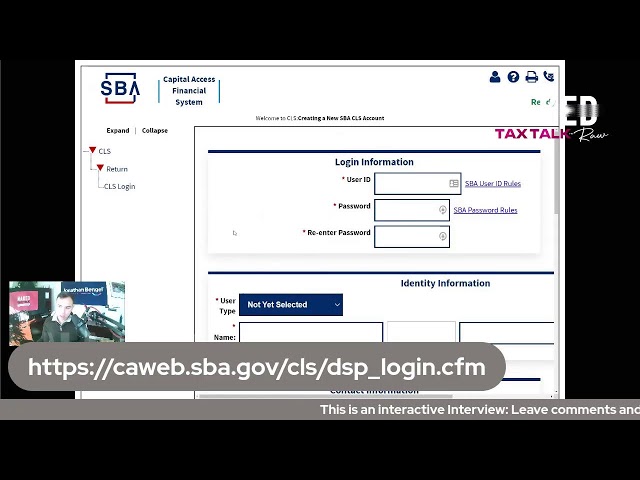

If you have additional questions about credit cards, please contact the Consumer Financial Protection Bureau (CFPB). The CFPB is a U.S. government agency that makes sure banks, lenders, and other financial companies treat consumers fairly.

You can submit a complaint about a credit card company to the CFPB online or by calling (855) 411-2372.