What is a Predatory Loan?

Contents

There’s a lot of talk these days about “predatory loans .” But what exactly is a predatory loan? In short, it’s a loan that’s designed to take advantage of the borrower. The lender may charge high fees, offer unrealistic terms, or otherwise try to trap the borrower in a cycle of debt.

If you’re thinking about taking out a loan, make sure you understand the terms and conditions. And be on the lookout for any red flags that could indicate a predatory

Checkout this video:

What is a predatory loan?

A predatory loan is a loan that is taken out with unfair terms and conditions that put the borrower at a disadvantage. Usually, these loans have high interest rates, fees, and other terms that make it difficult for the borrower to repay the loan. Predatory loans can be taken out by anyone, but they are often targeted at people who are desperate for money or have bad credit. If you’re thinking about taking out a loan, make sure you understand the terms and conditions before you sign anything.

What are the characteristics of a predatory loan?

Predatory loans are typically characterized by the following features:

-Loan terms that are unfair to the borrower

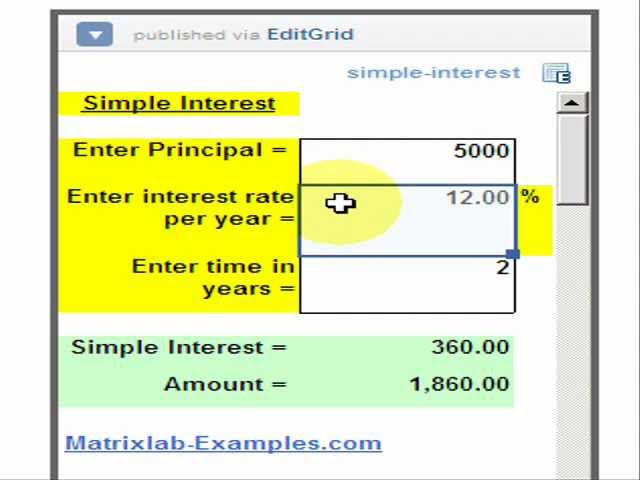

– High interest rates

– Hidden fees and charges

– Pressure to sign the loan contract without reading or understanding it

– Loans that are not suitable for the borrower’s needs

What are the consequences of taking out a predatory loan?

Predatory loans are typically characterized by high interest rates, fees, and terms that are designed to trap the borrower in a cycle of debt. Predatory loans can have a devastating effect on the financial well-being of borrowers, leaving them struggling to make ends meet and often leading to foreclosure.

If you’re considering taking out a loan, be sure to shop around and compare offers from multiple lenders. Be sure to read the fine print and ask questions so that you understand the terms of the loan and can be sure that you’re getting a fair deal.

How can you avoid getting a predatory loan?

A predatory loan is a loan that has unfair terms and conditions that exploit the borrower. This type of loan often has high fees, a high interest rate, and strict repayment terms. Some predatory lenders also require the borrower to purchase unnecessary products, such as credit insurance. Borrowers should be aware of these types of loans and how to avoid them.

How can you spot a predatory loan?

There are many ways to spot a predatory loan, but some of the most common signs include:

-Loan terms that are much worse than what you qualified for based on your income and credit score. For example, a lender may offer you a loan with an interest rate that is much higher than what you would normally qualify for.

-Fees that are much higher than what is typical for the type of loan you’re getting. For example, a lender may charge you an origination fee that is much higher than what is typical.

-Loan terms that are designed to be difficult to understand. For example, a lender may use jargon or complex legal language in the loan agreement.

-A requirement that you buy insurance from the lender or use the lender’s services in order to get the loan. For example, a lender may require you to buy insurance from them in order to get the loan.

-Loan terms that are designed to trap you in debt. For example, a lender may include a “prepayment penalty” clause in the loan agreement which would make it very expensive for you to pay off the loan early.

What should you do if you’re offered a predatory loan?

If you’re offered a loan with terms that you don’t understand, or that seem too good to be true, beware! You may be the target of a predatory lender.

Here are some things to watch out for if you’re thinking of taking out a loan:

-Unreasonable fees:Lenders may charge high origination fees, prepayment penalties, or other hidden fees.

-Predatory terms:Lenders may structure loans with terms that are designed to fail, such as balloon payments or interest-only payments.

-Unfair practices:Lenders may pressure you to buy unnecessary products, such as credit insurance.

If you’re offered a loan with any of these features, it’s important to understand what you’re getting into before you sign anything. Make sure you shop around and compare offers from different lenders before you make a decision.

What are some alternatives to predatory loans?

A predatory loan is a loan with unfair or abusive loan terms. It is typically offered to borrowers with poor credit who are desperate for money. These loans often have high fees, high interest rates, and unfair terms. They can trap borrowers in a cycle of debt. If you’re considering a predatory loan, there are some alternatives you can look into.

What are some alternative lenders?

There are a few different types of lenders you could consider when you need a loan, including:

-Banks: National and regional banks offer a variety of loans, including personal loans, mortgages, auto loans, and lines of credit.

-Credit unions: These cooperative financial institutions offer many of the same products as banks but may have more favorable terms for members, such as lower interest rates.

-Online lenders: A growing number of online lenders offer personal loans with competitive rates and quick approval times.

-Peer-to-peer (P2P) lenders: P2P platforms connect borrowers with individual investors or groups of investors who are willing to fund their loan. These loans usually come with lower interest rates than traditional bank loans.

What are some other options for getting a loan?

There are a few different types of loans that you can get that are not predatory. Some of these include:

-Credit unions: Many credit unions offer small, short-term loans with reasonable interest rates and terms. You may need to become a member of the credit union in order to get a loan, but this is usually not difficult or expensive.

-Peer-to-peer lending: With this type of loan, you borrow from another person or group of people rather than from a bank. The interest rates on peer-to-peer loans can be high, but they are still usually lower than the interest rates on predatory loans.

-Federal student loans: If you are a student, you may be able to get a federal student loan. These loans have fixed interest rates and usually have good terms.

There are also some government programs that can help you with your finances if you are struggling. For example, the Low Income Home Energy Assistance Program provides money to help low income households pay their heating bills. You can find out more about this and other programs at www.benefits.gov.