How to Take Over a Car Loan

Contents

If you’re taking over a car loan , there are a few things you need to know. Here’s a quick guide on how to take over a car loan from somebody else.

Checkout this video:

Research the Vehicle’s History

It’s important to know about the vehicle you want to take over a loan for. You should research the vehicle’s history to make sure it doesn’t have any hidden problems. You can find this information by checking the vehicle’s VIN (vehicle identification number).

Obtain a vehicle history report

If you’re taking over an auto loan from another person, it’s important to obtain a vehicle history report. This report can tell you a lot about the car, including its previous owners, accidents it has been in, and any outstanding recalls. You can order a vehicle history report online from a number of different companies, such as Carfax or Autocheck.

Research the vehicle online

You can find out a lot about a vehicle’s history online, using sites like Carfax.com or Autocheck.com. These services will tell you if the vehicle has been in any accidents, and whether it has been recalled for any safety issues. It’s worth paying for a report from one of these services, so that you know what you’re getting into before you sign any paperwork.

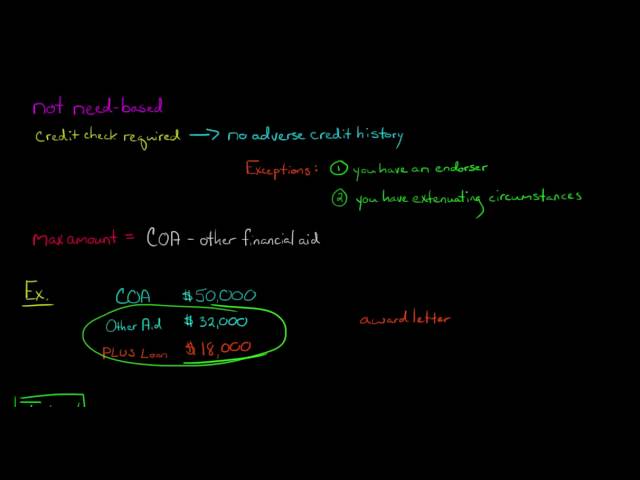

Research the Loan

When you agree to take over a car loan from somebody, you are assuming their debt and their monthly payments. You will need to make sure that you can afford the monthly payments before you agree to take over the loan. You will also need to research the loan to make sure that there are no hidden fees or anything else that could end up costing you more money.

Call the lender

If you are taking over a car loan, you will need to contact the lender to let them know of the change in ownership and to find out what, if any, information or documentation they will need from you. You will also want to ask about the process for transferring the loan and any associated fees.

Review the loan agreement

The first step in taking over a car loan is to review the loan agreement. This document will list the remaining balance on the loan, the interest rate, the monthly payment amount, and the due date of each payment. It will also list any special conditions on the loan, such as a requirement to maintain full coverage auto insurance.

Once you have reviewed the loan agreement, you will need to contact the lender to let them know that you would like to take over the payments. Be sure to have your financial information ready so that you can demonstrate your ability to make the monthly payments. The lender may require that you submit a new application and go through a credit check before they approve your request.

If you are approved, you will need to sign a new loan agreement and make arrangements for the transfer of ownership of the vehicle. Once everything is finalized, you will be responsible for making timely monthly payments on the car loan until it is paid off in full.

Prepare to Take Over the Loan

If you are taking over a car loan from someone, there are a few things you need to do to prepare for it. First, you will need to get a copy of the loan agreement so that you can review the terms and conditions. You will also need to contact the lender to let them know that you are taking over the loan and to find out what their requirements are. Once you have all of the information, you will be ready to take over the loan.

Get insurance for the vehicle

If you’re taking over someone else’s car loan, you’ll need to have your own insurance for the vehicle. The previous owner’s insurance won’t cover you once the loan is in your name. You can shop around for car insurance rates from different companies to find the best deal. Make sure to get quotes for the same coverage levels so you can compare apples to apples.

Get a new title in your name

The process of taking over a car loan is not as complicated as it may seem at first. If you have good credit and can show proof of income, you should be able to take over the payments on a loan without much trouble. Here are the basic steps to take when assuming someone else’s car loan.

1. Get a new title in your name – The first step is to get a new title for the car in your name. This will require going to the DMV and filling out some paperwork. Make sure you have all of the necessary documents, such as the bill of sale and proof of insurance.

2. Make sure the car is paid off – Once you have assumed the loan, you will be responsible for making all of the payments. Make sure the previous owner has paid off the loan before you take over so that you don’t end up having to pay more than what is owed.

3. Start making payments – The last step is to start making payments on the loan. You will need to make sure you make them on time and in full each month in order to keep your credit score high and avoid any penalties or fees.

Arrange to make payments to the lender

If you’re taking over a car loan, you’ll need to make arrangements to make payments to the lender. You may be able to do this directly with the lender or through the dealership.

If you’re taking over the loan through the dealership, they may be able to help you set up automatic payments. This can help you avoid missing a payment and incurring late fees.

You’ll also need to provide the lender with your contact information so they can send you billing statements and other important information about your loan.

Take Over the Loan

If you’re interested in taking over someone’s car loan, there are a few things you need to know. You’ll need to have good credit, enough income to make the payments, and you’ll need to be approved by the lender. Once you have all of that, you can take over the loan and start making the payments.

Make the first payment to the lender

The first step in taking over a car loan is to make the first payment to the lender. This will allow the lender to release the lien on the vehicle and transfer ownership to you. The lender may require that you provide proof of insurance for the vehicle before they will release the lien.

Once you have made the first payment, you will need to obtain a copy of the loan agreement from the lender. This agreement will outline the terms of the loan, including the interest rate, monthly payment amount, and term of the loan. Make sure that you understand all of the terms of the loan before you agree to take over responsibility for it.

You will also need to provide proof of income and residency in order to take over a car loan. The lender will want to see that you have a steady income and are able to make the monthly payments on time.

Get the vehicle registration in your name

The first step to taking over a car loan is to get the vehicle registration in your name. You will need to contact the DMV and get a new title in your name. This can usually be done by mail or in person. You will need to provide proof of insurance and the title to the car. The DMV will then issue you a new registration and license plate.

Enjoy your new vehicle!

You may be taking over the loan because the original owner can no longer afford the payments, or because you simply got a great deal on the car. Either way, there are a few things you need to do to make sure the process is smooth and that you are protected in case something goes wrong.

1. Get a copy of the loan documents from the seller. This will give you all the information you need about the remaining balance, interest rate, and terms of the loan.

2. Contact the lender to let them know that you are taking over the loan. They may require some additional information from you, but this is generally a simple process.

3. Make sure that you make your payments on time! If you default on the loan, you could end up losing the car and damaging your credit score.