What is a Pace Loan?

Contents

A Pace Loan is a type of home improvement loan that is obtained through your local government. This type of loan is available to homeowners who want to make energy efficient improvements to their homes.

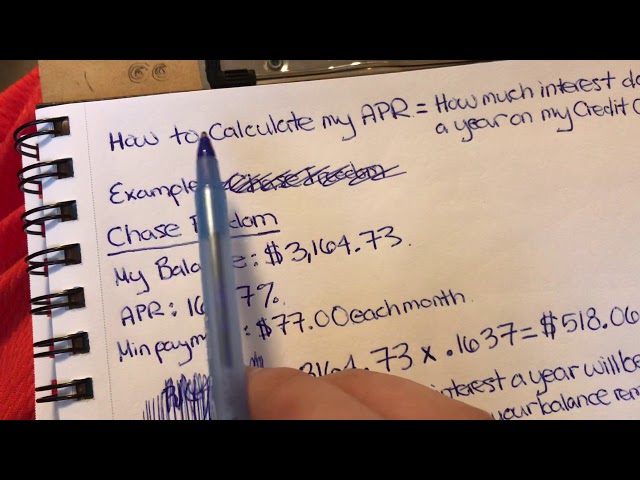

Checkout this video:

What is a Pace Loan?

A Pace Loan is a type of home loan that allows homeowners to finance improvements to their property. The loan is attached to the property, not the borrower, and is repaid through the homeowner’s property taxes.

Pace Loans are available in many states and are an attractive financing option for homeowners because they usually have low interest rates and long repayment terms. Pace Loans can be used to finance a wide variety of home improvements, including energy-efficiency upgrades, solar panels, and new windows.

If you’re considering making improvements to your home, a Pace Loan might be a good option for you.

How Does a Pace Loan Work?

PACE stands for Property Assessed Clean Energy. A PACE loan is a type of financing that allows homeowners to borrow money for energy efficiency or renewable energy upgrades to their home. The loan is then repaid as an assessment on the property tax bill over a period of years, typically 5-20 years.

PACE programs are available in many states and local jurisdictions across the country. PACE financing can be used for a variety of different types of projects, including solar panel installations, roofing repairs, HVAC upgrades, and more.

To apply for a PACE loan, you will need to find a participating lender in your area and complete an application process. Once approved, the loan funds will be disbursed to you and you can begin making energy efficiency improvements to your home.

Who is Eligible for a Pace Loan?

PACE loans are available to both residential and commercial property owners. In order to be eligible, your property must:

-Be located in a participating municipality

-Have a valid certificate of occupancy

-Be used as your primary residence or primary place of business

-Not be subject to any tax liens or other encumbrances

If you’re not sure whether your property is eligible, you can check with your municipality or the PACE program administrator in your area.

What are the Benefits of a Pace Loan?

A pace loan is a type of home improvement loan that allows you to finance energy-efficient improvements to your home. The loan is attached to your property, not to you as the borrower, which means that it stays with the property even if you sell it.

Pace loans are available in many states and localities across the country. Some of the benefits of a pace loan include:

-You can finance up to 100% of the eligible project costs

-The loan terms are usually much longer than a traditional home improvement loan, which means lower monthly payments

-The interest on the loan may be tax-deductible

-You may be able to get a lower interest rate than a traditional home improvement loan

How to Apply for a Pace Loan

The PACE program is a new financing option for energy efficiency and renewable energy upgrades to your home. The program is available in select states and municipalities, and is designed to help property owners afford the upfront costs of energy upgrades by allowing them to finance the project through their property taxes.

To apply for a PACE loan, you will first need to find a participating PACE provider in your area. Once you have found a provider, you will need to fill out an application and provide documentation of the improvements you wish to make to your home. Once your application is approved, you will enter into a contract with the PACE provider, which will be placed on your property tax bill. You will then make payments on the loan through your property taxes over the course of several years.