What Do You Need to Take Out a Loan?

Contents

What do you need to take out a loan? It’s a common question, and one that our team at Loanry is here to help you answer. We’ve put together a list of the must-have items you’ll need in order to apply for a loan . Check it out and get started on your loan application today!

Checkout this video:

The Different Types of Loans

There are many different types of loans, from personal loans to business loans. Each type of loan has its own set of requirements, including things like credit score, annual income, and more. In this article, we’ll take a look at the different types of loans and what you need to qualify for them.

Secured Loans

A secured loan is a loan that uses an asset — such as a vehicle, home equity, or savings account — as collateral. The primary benefit of secured loans is that they usually come with lower interest rates than unsecured loans.

The biggest risk of secured loans is that you could lose your collateral if you can’t repay the loan. For example, if you take out a car loan and use your car as collateral, the lender can repossess your car if you don’t make your payments. That’s why it’s important to only take out a secured loan if you’re confident in your ability to repay it.

Unsecured Loans

An unsecured loan is a loan that is not backed by collateral. This means that if you default on the loan, the lender will not be able to seize any of your assets to repay the debt. Unsecured loans are often personal loans, credit card debts, and student loans. Because there is no collateral backing up the loan, unsecured loans tend to have higher interest rates than secured loans.

Applying for a Loan

Applying for a loan may seem like a daunting task, but it doesn’t have to be. There are a few things you’ll need to have in order to get started. You’ll need to have a good credit score, a down payment, and a steady income. You’ll also need to find a lender that you’re comfortable with.

Personal Loans

A personal loan is an unsecured loan that can be used for a variety of purposes, such as consolidating debt or financing a large purchase. Because personal loans are unsecured, they typically have higher interest rates and shorter loan terms than secured loans, such as mortgages or car loans.

To qualify for a personal loan, you’ll generally need good to excellent credit and a steady income. While some lenders may charge origination fees or prepayment penalties, others may offer promotional rates or discounts for autopay or paperless statements.

If you’re considering a personal loan, compare offers from multiple lenders to find the best rate and terms for your needs.

Business Loans

Whether you’re starting a business or expanding an existing one, you may need to borrow money. A business loan can be a great way to get the financing you need, but there are a few things you should know before you apply.

First, you’ll need to have a clear idea of how much money you need to borrow. This will help you determine the type of loan that’s right for your business. You should also have a clear purpose for the loan, such as purchasing inventory, equipment, or real estate.

Once you know how much you need to borrow and why, you can start shopping around for loans. There are many different types of loans available, so it’s important to compare offers to find the best rate and terms for your business.

Before you apply for a loan, be sure to check your credit score and history. Lenders will want to see that you have a history of making on-time payments, and a high credit score will give them confidence that you’ll repay your loan on time.

Once you’ve found a lender and been approved for a loan, be sure to read the fine print carefully before signing any paperwork. This way, you’ll understand all the terms and conditions of your loan agreement before being committed.

The Loan Process

Applying for a loan can seem like a daunting task, but it doesn’t have to be. Before you even start the process, you should know what you need in order to take out a loan. This includes things like a good credit score, a steady job, and a down payment. Once you have all of these things in order, you can begin the process of taking out a loan.

Applying for a Loan

If you’re in the market for a loan, you’ve probably already begun thinking about how to apply. The loan process can be daunting, but we’re here to help guide you through it step-by-step.

First things first, you need to decide what type of loan you’re looking for. There are many different types of loans available, each with its own set of requirements. Once you’ve decided on the type of loan you need, the next step is to start collecting the necessary documents. This will vary depending on the type of loan and lender, but generally speaking, you will need to provide proof of income, employment history, and residency. You will also need to have a good understanding of your credit history and score.

Once you have all of your documents collected, the next step is to fill out a loan application. This can usually be done online or in person at a financial institution. Once your application has been submitted, the lender will review it and make a decision based on your qualifications. If you are approved for a loan, the next step is to sign a contract and begin making payments.

The entire process can seem overwhelming at first, but if you take it one step at a time it will be much easier. Be sure to do your research and ask plenty of questions so that you can make the best decision for your needs.

Getting Approved for a Loan

When you apply for a loan, the lender will look at a variety of factors to determine if you are a good candidate for a loan and how much they are willing to lend you.

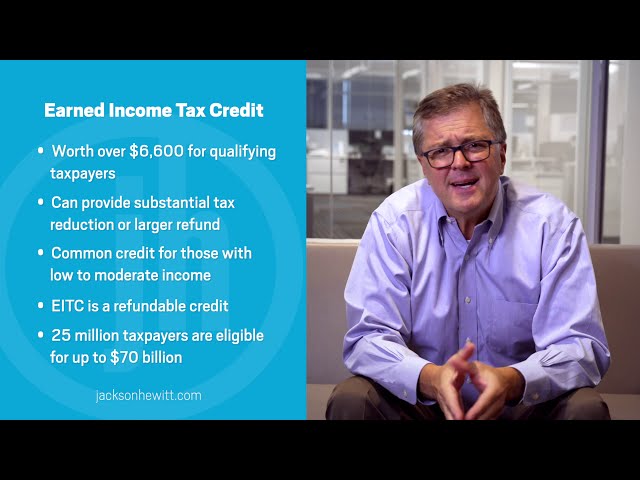

Some of the things lenders will look at include your credit score, your debt-to-income ratio, your employment history, your income, and your assets.

If you have a good credit score, a low debt-to-income ratio, a steady employment history, and a good income, you will have a better chance of getting approved for a loan.

If you have assets such as a house or a car, you may be able to use them as collateral for the loan, which will also increase your chances of getting approved.

Repaying a Loan

Most loans must be repaid. Depending on the type of loan, you may have to make payments on a regular schedule or pay off the entire amount of the loan at once.

If you have a loan with regular payments, you’ll make the same payment each month until the loan is paid off. The payment will usually be due on the same day each month.

You may be able to choose the day of the week or month when your payment is due. Or, you may be able to have your payment automatically deducted from your bank account each month.

If you have a loan with irregular payments, you’ll need to make a payment whenever it’s required by the terms of your loan agreement. You might make weekly payments, biweekly payments, or monthly payments.

Some loans, such as mortgage loans, allow you to make additional payments on top of your regular monthly payment. This can help you pay off your loan faster and save money on interest charges.

Tips for Borrowers

If you’re thinking about taking out a loan, you’re not alone. In 2018, Americans took out more than $584 billion in loans, according to the Federal Reserve. That’s a lot of money, and it can be helpful if you need to make a large purchase or consolidate debt. But before you sign on the dotted line, it’s important to understand the process and what you’ll need to qualify for a loan .

Shop Around for the Best Loan

When you’re looking for a loan, it’s important to shop around for the best deal. The terms of the loan—the (APR), length of the loan, and monthly payments—are important factors to consider when comparing loans.

You can use a loan calculator to compare different loans side-by-side. Make sure to look at the total cost of the loan, not just the monthly payments. A lower monthly payment might mean you’re paying more in interest over the life of the loan.

Also, beware of lenders who promise low rates but try to make up for it with high fees. Look for lenders who offer a “no points, no fees” loan. This means that you won’t have to pay any upfront costs to get the loan, and you won’t be charged any origination fees or prepayment penalties.

Read the Fine Print

Before you sign on the dotted line, be sure to carefully read the terms and conditions of your loan agreement. This document will outline the repayment schedule, interest rate, and fees associated with your loan. It’s important to understand all aspects of the agreement before making a commitment.

If you have any questions about the contents of the loan agreement, be sure to ask your lender for clarification. Once you have a clear understanding of the terms, you can make an informed decision about whether or not taking out a loan is right for you.

Be Wary of Scams

When you’re in the market for a loan, it’s important to be aware of the many different types of scams that exist. Here are a few tips to help you avoid falling victim to a scam:

-Do your research. If a lender doesn’t have a physical address or refuses to give you references, that should be a red flag.

-Beware of Guarantees. No one can guarantee that you will get a loan.

-Don’t Pay Upfront Fees. You should never have to pay an upfront fee to apply for a loan.

-Get it in Writing. A genuine lender will be happy to put the offer in writing so that you can review it carefully before making a decision.

-Talk to Someone You Trust. If you’re not sure about a lender, talk to someone you trust about your options before making a decision.