What Do Borrowers Use to Secure a Mortgage Loan?

There are a few things that borrowers need to secure a mortgage loan , including a good credit score, a down payment, and proof of income. However, one of the most important things that borrowers need is a property to use as collateral.

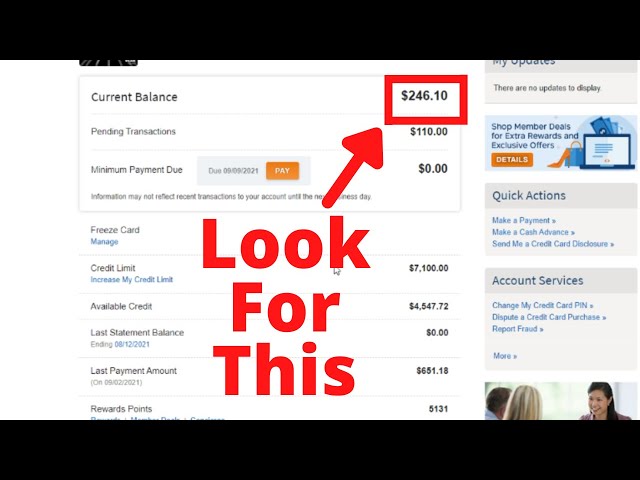

Checkout this video:

Mortgage Basics

In order to obtain a mortgage loan, borrowers are typically required to provide some form of collateral. This collateral can take the form of real estate, personal property, or even cash. The purpose of collateral is to secure the loan and protect the lender in case the borrower is unable to repay the loan.

What is a mortgage?

A mortgage is a loan that’s used to finance the purchase of a home. The loan is secured by the home itself, so if you default on your mortgage, your lender could foreclose on your home. Mortgages are available from many different lenders, including banks, credit unions, and online lenders.

What are the types of mortgage loans?

Federal housing administration (FHA) loans

An FHA loan is a mortgage that’s insured by the Federal Housing Administration (FHA). Borrowers with FHA loans pay for mortgage insurance (MIP) monthly, upfront MIP and an annual premium. FHA loans are available to all types of borrowers, not just first-time buyers. Borrowers with credit scores as low as 580 can qualify for an FHA loan with a down payment as low as 3.5%.

Veterans Affairs (VA) loans

A VA loan is a mortgage loan that’s backed by the Department of Veterans Affairs (VA) for those who have served or are presently serving in the U.S. military. While VA loans are available to active-duty service members and veterans, they also be used by some surviving spouses. Since there’s no mortgage insurance, the VA funding fee is generally the only major cost you pay for a VA loan.

United States Department of Agriculture (USDA) loans

A USDA loan is a zero-down mortgage for eligible rural and suburban home buyers offered by the United States Department of Agriculture’s Rural Development department.. Eligibility is based on income limits and property location, as well as credit score, debt-to-income ratio and other factors. If you qualify, you can get a USDA loan with no down payment.. Mortgage insurance is required, however, if your down payment is less than 20 percent of the purchase price.

Conventional fixed-rate mortgages

A “conventional” or “conforming” mortgage is simply a loan that meets guidelines established by government-sponsored enterprises Freddie Mac and Fannie Mae. A conventional fixed-rate mortgage has interest rates that don’t change over the life of your loan – so your payments will be consistent whether interest rates go up or down during that time.. You can also choose from various terms – such as 8 years, 10 years or 15 years.. A shorter term will have lower interest rates but higher monthly payments than a longer one; a 15-year term is typically cheaper than an 30-year term but your monthly payments will be almost double.. Conventional loans may also be portable – so if you sell your home before your loan term ends, you can take your mortgage with you to your new home.. Some government agencies such as the Veterans Administration and Federal Housing Administration insure certain types of conventional mortgages enabling borrowers to obtain mortgages with favorable terms even if they don’t meet standard guidelines.

Mortgage Loan Options

There are several ways to secure a mortgage loan, each with their own set of pros and cons. The most common methods are through the use of collateral, such as a home or other property, or through a co-signer. Borrowers should carefully consider all their options before choosing a method to secure their loan.

FHA Loans

Federal Housing Administration (FHA) loans are a type of mortgage that is insured by the FHA and backed by the U.S. Department of Housing and Urban Development (HUD). They are a popular choice for first-time homebuyers with low credit scores or those who have minimal down payment funds.

FHA loans are available in all 50 states and territories like Puerto Rico, Guam, and U.S. Virgin Islands. However, there is a limit to how much you can borrow, depending on where you live. In general, the maximum loan amount is capped at $331,760 for most counties across the country. However, there are a few areas with higher limits:

-Alaska, Hawaii, Guam, and the U.S. Virgin Islands have a maximum loan amount of $726,525

-There are 262 counties with a higher maximum loan amount of $1,028,350

VA Loans

The Veterans Administration (VA) guarantees a portion of each veteran’s loan, making it easier for lenders to offer favorable terms. In order to qualify, you or your spouse must have served active duty during wartime or peacetime, or you must be the surviving spouse of a service member who died in the line of duty. You also need to meet certain requirements regarding length of service and character of discharge.

If you qualify for a VA loan, you can usually get favorable terms, including no down payment and no private mortgage insurance (PMI). VA loans are available for both purchase and refinance transactions.

Conventional Loans

A conventional loan is any mortgage that is not insured or guaranteed by the federal government. This type of loan is available from a bank or other financial institution and they are usually sold through mortgage brokers. These loans can be used to purchase a primary residence, secondary residence or investment property.

There are two types of conventional loans: conforming and non-conforming. Conforming loans follow guidelines set by Fannie Mae and Freddie Mac, two government-sponsored enterprises (GSEs) that purchase mortgage loans from lenders. These guidelines include maximum loan amounts as well as income, employment and credit requirements. Non-conforming loans do not meet the guidelines set by the GSEs and are also known as jumbo loans.

Jumbo Loans

Jumbo Loans, also called non-conforming loans, are mortgages that exceed the loan limit in specific geographic areas. Jumbo loans are available in both fixed-rate and adjustable-rate mortgage (ARM) formats. They can be used to purchase either a primary residence or a second home.

With a fixed-rate jumbo loan, the interest rate stays the same for the entire term of the loan, which means your monthly payment will stay the same, too. An ARM jumbo loan has a lower interest rate than a fixed-rate loan during an initial period (usually five or seven years), but after that period, the interest rate can increase annually for the rest of the term of the loan.

If you’re considering a jumbo loan, you’ll need to have strong credit and income in order to qualify. Lenders will also require you to have a larger down payment than they would for a conforming loan – typically 20% or more. And, you may be required to pay private mortgage insurance (PMI) if your down payment is less than 20%.

Mortgage Loan Process

In order to qualify for a mortgage loan, borrowers are typically required to have a down payment of 20% of the purchase price of the home. In some cases, borrowers may be able to put down less, but they would then have to pay for private mortgage insurance (PMI), which would add to their monthly payment.

Pre-Qualification

When shopping for a mortgage loan, you will likely hear the term “pre-qualification.” This is when a lender provides you with an estimate of how much of a loan you may qualify for, based on a review of your financial history. This is generally done without taking a formal application, and it is not binding on either party.

Applying for a Loan

The first step in the mortgage loan process is applying for a loan. You’ll need to provide basic information about yourself and your finances, as well as details about the type of loan you’re interested in.

You can apply for a mortgage loan online, over the phone, or in person at a bank or other financial institution. The process typically takes a few days, and you’ll usually be required to pay a fee for the application.

Once you’ve applied for a loan, the lender will review your information and decide whether or not to approve your loan. If you’re approved, you’ll be asked to sign a loan agreement and will then be able to start the process of getting your new home.

Loan Approval

The mortgage loan process varies slightly from one lender to the next, but there are some common steps that all borrowers can expect.

Most lenders will require that you complete a loan application and provide documentation of your income, debts and assets. Once you have been approved for a loan, the lender will order a home appraisal to determine the value of the property you are purchasing.

Once the appraisal has been completed, the lender will issue a loan commitment letter outlining the terms of your loan. At this point, you will work with a real estate agent to finalize the details of your purchase contract.

Once your purchase contract has been signed, you will need to provide the lender with additional documentation, such as a home inspection report and proof of insurance. The lender will then arrange for a closing date, at which point you will sign the final paperwork and officially take ownership of your new home!

Closing on a Loan

The process of closing on a loan is started by the borrower completing a loan application. After the application is complete, the lender will then review the application and supporting documentation to determine if the borrower meets their guidelines for approval.

Once the lender has determined that the borrower meets their guidelines, an appraisal will be ordered on the property to determine its current market value. The appraisal is used by the lender to determine if the value of the property is sufficient to secure their investment in the event that they need to foreclose on the loan.

Once the appraisal has been completed, and if it comes back satisfactory, a loan estimate will be generated and given to the borrower. The loan estimate outlines all of the terms and conditions of the loan including interest rate, monthly payments, and closing costs. The borrower will then review and accept these terms before moving forward with closing on the loan.

Closing on a loan typically takes place at a title company or attorney’s office. During closing, all of the documents related to the loan will be signed by both parties and notarized. The borrower will also be required to pay any outstanding closing costs at this time. Once all of the documents have been signed and notarized, they will be sent to the lender for final approval before being recorded with your local county recorder’s office.

Once everything has been recorded, you will then be able to take possession of your new property!

Mortgage Loan Tips

If you’re planning on taking out a mortgage loan, it’s important to know what type of collateral you’ll need to secure the loan. In most cases, borrowers use their home as collateral. This means that if you default on your loan, the lender can take your home.

Get Pre-Approved

You’ve probably heard that you need to get pre-approved for a mortgage loan before you start shopping for a home. Mortgage pre-approval is different from getting pre-qualified for a loan, and it’s important to understand the difference.

Pre-qualification is based on information that you provide to the lender, such as your employment history, income, debts and estimated credit score. The lender then gives you a ballpark idea of how much they would be willing to lend you. Pre-approval is based on a more in-depth analysis of your financial information. The lender does a thorough review of your employment history, income, debts and credit score. They will also verify your bank statements and tax returns. Once you are pre-approved for a loan, the lender will give you a letter that indicates how much they are willing to lend you and what interest rate you can expect to pay.

Getting pre-approved for a mortgage loan can give you an advantage when shopping for a home because it lets sellers know that you are serious about buying their home and that you have the financial resources to do so.

Compare Loan Options

When you’re ready to compare loan options, start by looking at loan programs offered by the same type of lender. For example, if you’re a veteran, you may want to look only at VA loans. If you have strong credit and income but not much money for a down payment, you might look only at FHA loans.

compare mortgage loan options, including their pros and cons:

-Fixed-rate loans: These loans have the same interest rate for the entire term of the loan, typically 15 or 30 years. The main benefit is that your monthly payments will never go up or down.

-Adjustable-rate mortgages (ARMs): These loans have an interest rate that changes over time, typically every year or two. The most common ARM is a 5/1 ARM, which has a fixed interest rate for five years followed by an adjustable rate for the remaining 25 years of the loan term. The main benefit of an ARM is that it usually starts with a lower interest rate than a fixed-rate mortgage.

The bottom line is that you should compare loan options from multiple lenders before deciding which one is right for you.

Understand Mortgage Terms

Fixed Rate Mortgage – Interest rate remains the same for the term of the loan. Typically 30 year and 15 year terms are available. The payments stay the same, but since the interest rate is locked in, if current interest rates rise, you are protected from having to make a higher payment. If interest rates decrease, you would benefit by being able to refinance at a lower rate, assuming your credit score has improved.

Adjustable Rate Mortgage – Interest rate fluctuates based on a specific market index over the initial term of the loan (usually 1 to 7 years). The advantage of an ARM is that initial interest rates are usually lower than fixed rates. The disadvantage is that as interest rates increase, your payments will go up as well. Some people choose an ARM because they plan on selling their homes before the interest rates adjust upward, others use them as a stepping stone to get into a home they otherwise couldn’t afford now with plans of refinancing into a fixed rate mortgage later when their incomes have increased or interest rates have decreased.

Points – A point is equal to 1 percent of your loan amount and can be used to buy down your interest rate. The more points you pay, the lower your interest rate will be. One Phoenix real estate agent noted that “a cut in half in your interest rate could easily make up for any discount paid on the sales price of the home.”