What Credit Score Is Used For Mortgage?

Contents

What credit score is used for a mortgage? This is a common question we receive at Credit Sesame. Here’s what you need to know about your credit score and how it can affect your mortgage approval.

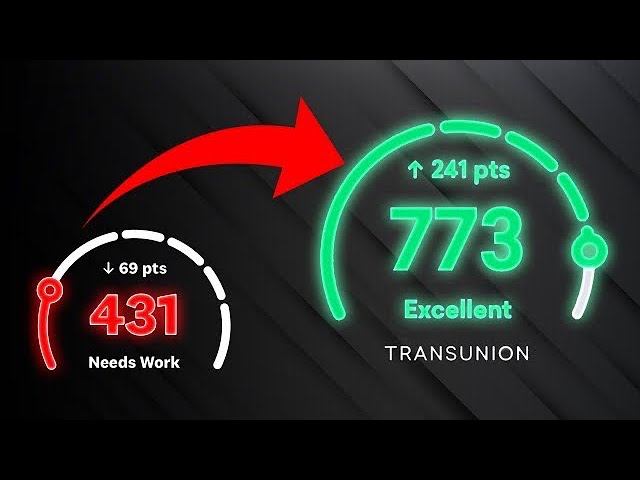

Checkout this video:

The Mortgage Process

The credit score used for a conventional mortgage is the middle score of the three credit scores reported by the credit bureaus. For example, if your scores are 640, 660, and 680, the lender will use 660 as your score. If you have two scores, the lender will use the lower of the two scores.

Applying for a mortgage

When you apply for a mortgage, the lender will pull your credit report and score from the credit bureaus. The lender will also contact your employers to verify employment and may run a background check. Once the application process is complete, the underwriter will determine whether or not you are approved for the loan.

Getting pre-approved for a mortgage

The first step in the homebuying process is to get pre-approved for a mortgage. To do this, you’ll need to provide your lender with some basic information about your financial situation, including your income, debts, and assets. Your lender will use this information to determine how much of a loan you qualify for and what interest rate you’ll be offered.

It’s important to note that being pre-approved for a mortgage doesn’t guarantee that you will actually receive the loan. Once you find a home and make an offer, the lender will still need to verify your income and employment, as well as assess the property before approving the loan. However, getting pre-approved is a useful first step in the process and can give you an edge over other buyers who haven’t gone through this process.

Credit Score Requirements

The credit score needed for a mortgage loan is different for every lender. There are many factors that go into approving a loan, and each lender has their own standards. However, there are a few things that are generally looked at when determining if a borrower is eligible for a loan. One of the most important is the credit score.

FICO Score

The FICO score is the credit score most lenders use to determine your credit risk. A FICO score of 750 or higher is considered excellent; a score of 700 to 749 is good; a score of 650 to 699 is fair; and a score below 650 is poor.

A FICO score between 620 and 639 is considered subprime, which means you may have difficulty obtaining a loan at all, or you may have to pay higher interest rates if you are approved for a loan. If your FICO score is below 620, you will likely have to pay very high interest rates or you may not be approved for a loan at all.

There are other credit scoring models in addition to the FICO score, but the FICO score is the most widely used model by lenders.

VantageScore

VantageScore is a scoring system created jointly by the three major credit bureaus – Experian, Equifax, and TransUnion. It’s used by many lenders as an alternative to the FICO score, which is still the most widely used credit score.

The VantageScore ranges from 300 to 850, just like the FICO score. However, the specific criteria for each score can vary depending on which credit bureau’s information is being used. For example, Experian considers a score of 660 to be good, while TransUnion considers a score of 700 to be good.

Generally speaking, you need a score of at least 620 to qualify for a conventional mortgage, and a score of at least 740 to get the best interest rates. However, it’s important to remember that these are just general guidelines – each lender has their own standards, so it’s always best to shop around and compare offers before you decide on a mortgage.

Other Factors That Affect Mortgage Approval

Your credit score is one of the first things that lenders will look at when you apply for a mortgage. A high credit score will give you a better chance of being approved for a loan with a lower interest rate. However, your credit score is not the only factor that can affect your mortgage approval.

Debt-to-income ratio

Along with your credit score, your debt-to-income (DTI) ratio is an important part of your overall financial health. Lenders use your DTI ratio to calculate whether you can afford to take on a loan.

The DTI ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income. For example, if you have $500 in monthly debt payments and your monthly income is $2,000, your DTI ratio would be 25%.

Most lenders want to see a DTI ratio of 36% or less. If your DTI ratio is too high, you may have trouble qualifying for a loan or you may be offered a loan with less favorable terms.

There are two main ways to reduce your DTI ratio: increase your income or reduce your debt payments. You may be able to increase your income by getting a higher paying job or working more hours. To reduce your debt payments, you can try to negotiate lower interest rates with your creditors or make extra payments on your debts each month.

Loan-to-value ratio

The loan-to-value ratio (LTV) is a measure of the loan amount relative to the value of the property. It is usually expressed as a percentage and is used by lenders to assess risk. A high LTV ratio indicates that the loan amount is high in relation to the value of the property, which could mean that the borrower has a higher risk of defaulting on the loan. A low LTV ratio indicates that the loan amount is low in relation to the value of the property, which could mean that the borrower has a lower risk of defaulting on the loan.

Employment history

Employment history is one of the most important factors that lenders look at when considering a mortgage application. Lenders want to see a consistent work history, preferably with the same employer. They’ll also look at the types of jobs you’ve had and your income level.

Residency history

An important factor that is often overlooked is your residency history. Lenders like to see that you have a steady residence history, and they will often look at your credit report to see where you have lived for the past seven years. If you have moved around a lot, it may be difficult to get approved for a mortgage.

How to Improve Your Credit Score

Your credit score is one of the most important factors that lenders look at when you apply for a mortgage. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on your mortgage. A low credit score could lead to a higher interest rate and could mean you won’t qualify for a loan at all. Here are some tips on how to improve your credit score.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay all your bills on time. This includes not only credit card bills and other types of loan payments, but also utility bills, cell phone bills, and any other kind of recurring bill. By paying all your bills on time, you’ll show creditors that you’re a reliable borrower who is less likely to default on a loan.

Keep your credit utilization low

Credit utilization is one of the most important factors in your credit score, and one of the easiest to improve. Your credit utilization ratio is the amount of your available credit you are using at any given time, and you should always aim to keep it below 30%. If you have a credit card with a $1,000 limit, for example, your goal should be to never charge more than $300 at once. When your balance gets close to your limit, it starts to hurt your score. So make sure you are always paying attention to how much of your available credit you are using.

Avoid opening new credit accounts

Opening new credit accounts can have a negative impact on your credit score for several reasons. First, it can add to your overall debt burden, which can increase your debt-to-income ratio and lower your score. Second, it can shorten your average credit history, which can also lower your score. Finally, each new account represents a potential source of fraud or identity theft, which could lead to negative marks on your report.

Conclusion

After reading this guide, you now know what credit score is used for a mortgage. You also know how to improve your credit score so that you can get the best mortgage terms possible. Work on building your credit score and get yourself into a good financial position before shopping for a mortgage.