What Credit Score Do You Need for an Apple Card?

Contents

What Credit Score Do You Need for an Apple Card?

If you’re thinking about applying for the Apple Card, you might be wondering what credit score you need to qualify. Here’s what you need to know.

Checkout this video:

Understanding Apple Card’s Credit Score Requirements

If you’re thinking of applying for an Apple Card, you may be wondering what credit score you need to qualify. The good news is that Apple doesn’t publicly reveal what credit score is needed to be approved for their card. However, there are some things we can look at to give us a better idea.

What is the minimum credit score needed for an Apple Card?

The minimum credit score needed for an Apple Card is 700. However, if you have a credit score below 700, you may still be able to get approved for the card if you have a strong financial history.

What are the other requirements for an Apple Card?

Aside from having a strong credit score, there are a few other requirements you’ll need to meet before you can qualify for an Apple Card. For starters, you must be at least 18 years old and a U.S. citizen or legal resident with a valid physical U.S. address. You’ll also need to have an iPhone 6 or later running iOS 12.4 or later, and iCloud Keychain turned on. Finally, you’ll need to be approved by Goldman Sachs, the issuing bank for Apple Card.

How to Improve Your Credit Score

If you’re thinking about applying for an Apple Card, you might be wondering what credit score you need. While there’s no official number, most experts say you’ll need a score of at least 700 to get approved. Here are a few tips on how to improve your credit score so you can get theApple Card you’ve been wanting.

Check your credit report for errors

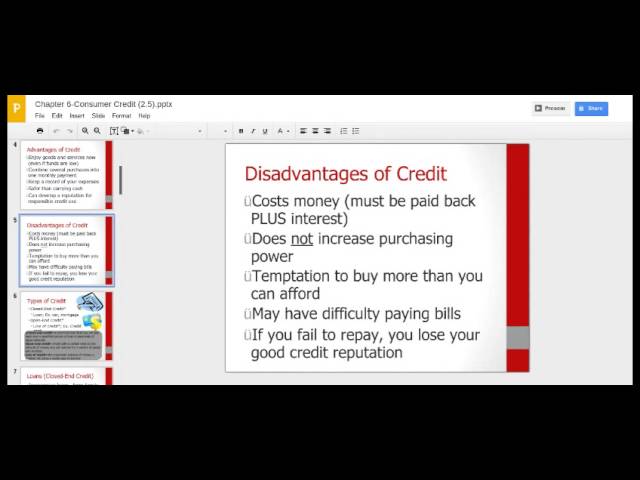

Your credit score is important because it is one factor that lenders will look at when considering whether or not to give you a loan. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

You can get your free credit report from AnnualCreditReport.com. You’re entitled to one free report from each of the three major credit bureaus every year. Check your report for errors and dispute any errors you find.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time. Payment history accounts for 35% of your FICO® Score, so even if you have a low credit score, you can still improve your chances of getting approved for a loan or credit card by paying your bills on time.

Another way to improve your payment history is to set up automatic payments with your creditors. This way, you will never forget to make a payment and you can be sure that your payments will always be on time.

If you have missed any payments in the past, it is important to catch up as soon as possible. Creditors are more likely to forgive late payments if you have otherwise been a good customer. You can also contact your creditors and explain your situation. Many creditors are willing to work with customers who are trying to improve their credit score.

Use a credit monitoring service

Credit monitoring services can help you keep tabs on your credit report and score. They usually cost a monthly fee, but some come with free trials. Typically, these services will send you alerts if there are any changes to your credit report or score. They can also help you spot errors or potential fraud.

Alternatives to Apple Card

If you’re planning on applying for an Apple Card, you might be wondering what credit score you need. Unfortunately, Apple doesn’t release this information publicly. However, we’ve gathered some insights from experts to give you an idea of what you need. Let’s take a look.

Compare credit cards

If you’re looking for an alternative to the Apple Card, there are plenty of other options available. Here’s a quick look at some of the best alternatives to the Apple Card, based on your credit score.

If you have excellent credit (740 or higher):

-Chase Sapphire Reserve: This card offers 3x points on travel and dining, 1x points on everything else, and a $300 annual travel credit. It also comes with a $450 annual fee.

-Citi Prestige: This card offers 5x points on airfare and dining, 3x points on hotels and cruises, and 1x points on everything else. It also comes with a $495 annual fee.

-Capital One Venture Rewards: This card offers 2x miles on every purchase, plus a $100 annual travel credit. It has no annual fee for the first year, then $95 after that.

If you have good credit (660-739):

-Chase Sapphire Preferred: This card offers 2x points on travel and dining, 1x points on everything else. It has a $95 annual fee.

– Capital One VentureOne Rewards: This card offers 1.25 miles per dollar spent on all purchases, with no foreign transaction fees. It has no annual fee.

Consider a secured credit card

If you’re looking for an Apple Card alternative, you might want to consider a secured credit card. A secured credit card is a good option for people with bad credit or no credit history. With a secured card, you deposit money into a savings account, and that deposit acts as your credit limit.

For example, if you deposit $500 into a savings account, your credit limit on the secured card will be $500. This deposit lowers the risk for the issuer, which makes it more likely that you’ll be approved for the card.

Secured cards can help you build or rebuild your credit history by reports to the major credit bureaus. And as you use the card responsibly and make on-time payments, your credit score will improve.

Once your credit score improves, you can qualify for a regular unsecured credit card with better terms and no annual fee.

Get a co-signer

If you don’t have the credit score needed for the Apple Card, you could try applying with a co-signer. A co-signer is somebody who agrees to take on responsibility for your debt if you can’t pay it back. This could be a parent, spouse, or other close friend or relative.

If you have a co-signer with good credit, you may be able to get approved for the Apple Card. Keep in mind that this will put your co-signer’s credit at risk if you can’t make your payments. So make sure you can afford the monthly payments before you apply.

You can also try using a secured credit card as a way to build up your credit so you can eventually qualify for the Apple Card. A secured card requires a cash deposit, which acts as collateral in case you can’t pay your bill. This deposit is usually equal to your credit limit. So if you have a $500 deposit, your credit limit will also be $500.

But unlike unsecured cards, most secured cards come with annual fees and high interest rates. So once you’ve built up your credit andyou no longer need it, be sure to cancel the card and get your deposit back.