What Credit Card Can I Get with No Credit?

Contents

If you’re looking to get a credit card but don’t have any credit history, you might be wondering “what credit card can I get with no credit?” The good news is, there are a few options out there for you! In this blog post, we’ll go over a few of the best credit cards for people with no credit history, so you can start building your credit today.

Checkout this video:

Understanding Credit

Many people think that they need to have perfect credit in order to get a credit card. However, this is not the case. There are credit cards available for people with no credit. This can be a great way to build up your credit. Let’s take a look at some of the options.

What is credit?

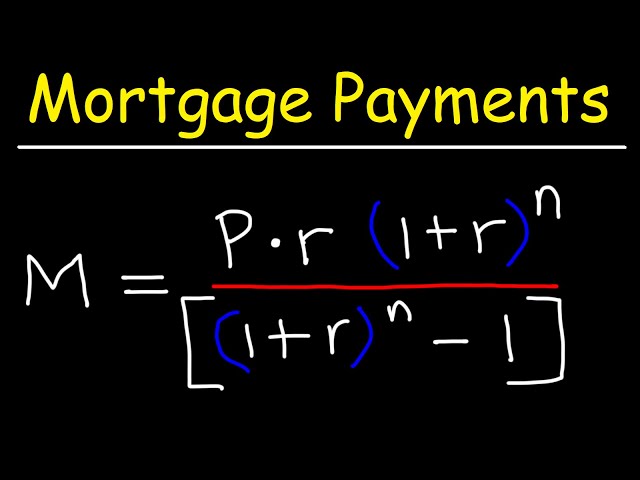

There are many types of credit, but the most common is called revolving credit. This is a loan that allows you to borrow money up to a certain limit and then pay it back over time. Your monthly payment will depend on how much you borrowed, the interest rate, and the length of time you have to pay it back.

Other types of credit include:

-Installment loans: These are loans that you receive in one lump sum and then pay back over a set period of time, usually in equal monthly payments.

-Mortgages: A mortgage is a type of installment loan that is used to purchase property.

-Auto loans: Like installment loans, auto loans are used to finance the purchase of a vehicle.

-Student loans: Student loans are a type of installment loan that is used to finance education costs.

How is credit scored?

There are a few things that go into your credit score, but the two biggest are your payment history (35%) and how much of your credit you’re using, also called your credit utilization (30%). A smaller factor is the average length of your credit history (15%), with new accounts having less impact than older ones. The last 10% is a mix of the types of credit you have and recent inquiries on your report.

To get a good credit score, you’ll need to do two things: use credit responsibly and keep an eye on your credit report. You can get started by learning more about what goes into a credit score and what you can do to build yours.

Types of Credit Cards

There are a few types of credit cards that you can get with no credit. The most common are secured credit cards and retail store credit cards. With a secured credit card, you will need to put down a deposit that will be your credit limit. With a retail store credit card, you can only use the card at that particular store. There are also a few credit cards that are specifically for people with no credit.

Secured Credit Cards

A secured credit card is a credit card that requires you to deposit money with the issuer as collateral. The deposit is usually equal to your credit limit, which means you’re essentially borrowing your own money.

For people with limited or no credit history, a secured credit card can be an effective way to start building credit. Using a secured card responsibly by making on-time payments and keeping your balance low relative to the credit limit will help you improve your credit scores over time.

Most major issuers offer at least one secured card option—Discover, Mastercard, and Visa all have secured cards that are available to people with bad or limited credit. There are also a number of smaller issuers that focus on offering credit products to people with bad or limited credit histories.

Unsecured Credit Cards

Unsecured credit cards are the most common type of credit card. An unsecured card does not require any deposit or collateral, which makes them easier to get approved for. With an unsecured card, you will receive a credit limit based on your credit score and financial history.

There are a few different types of unsecured credit cards:

-Standard unsecured cards: These are the most common type of unsecured credit card. Standard unsecured cards have no annual fee and usually have a lower interest rate than other types of unsecured cards.

-Rewards unsecured cards: Rewards unsecured cards earn you points, cash back, or miles for every purchase you make. These cards usually come with an annual fee, but the rewards can be worth it if you use the card frequently.

-Secured Credit Cards: A secured credit card is a type of unsecured credit card that requires a deposit to secure your line of credit. The deposit is usually equal to your credit limit. Secured cards are typically easier to get approved for than other types of unsecured cards and can help build your credit history if used responsibly.

Applying for a Credit Card

Most people think that you need to have good credit in order to be approved for a credit card. However, there are actually a few credit cards that are designed for people with no credit. These credit cards can help you build your credit so that you can get approved for cards with better terms in the future.

How to apply for a credit card

When you apply for a credit card, the credit card issuer will check your credit history and credit score to decide whether or not to approve your application. If you have no credit history or a low credit score, you may still be able to get a credit card, but you may have to pay a higher interest rate or put down a deposit.

If you’re not sure which credit card to apply for, start by checking out our list of recommended cards for people with no credit. Once you’ve found a few cards that look good to you, compare the terms and conditions to see which one is the best fit.

When you’re ready to apply, make sure you have all the required information on hand. Most issuers will require your name, address, date of birth, Social Security number, and income. You may also need to provide additional information such as your employment history or rental history.

Once you’ve gathered all the necessary information, fill out the application form and submit it online or by mail. The issuer will then review your application and let you know if you’ve been approved. If you’re approved, you’ll receive your new credit card in the mail within a few weeks.

What to look for in a credit card

When you start looking for a credit card, you’ll quickly find there are many different cards to choose from. But how do you know which card is right for you?

Here are a few things to look for when choosing a credit card:

-Annual fee: Some cards come with an annual fee, while others don’t. If the card has an annual fee, make sure the benefits of the card outweigh the cost of the fee.

-Rewards: Credit cards offer various rewards programs, such as cash back or points that can be redeemed for travel or merchandise. If you decide you want a rewards card, look for one that offers rewards that fit your lifestyle.

-Interest rate: This is the rate you’ll be charged if you carry a balance on your card from month to month. If you plan to pay off your balance in full each month, look for a card with a lower interest rate. But if you think you may carry a balance from time to time, look for a card with a 0% intro APR on purchases and balance transfers.

-Credit limit: This is the maximum amount of money you can charge to your credit card in a given billing period. If you think you may need a higher credit limit, look for a card that offers automatic credit line increases after you make your first five monthly payments on time.

-Other features: Some cards offer additional features, such as rental car insurance or extended warranty protection. If these are features that would be important to you, look for a card that offers them.

Using a Credit Card

A credit card can be a great way to build credit, if used responsibly. If you have no credit, you may be wondering what credit card you can get. The answer depends on a few factors, but we’ll go over a few options that might be available to you.

How to use a credit card

A credit card can be a useful tool if used correctly. You can use it to build your credit, make purchases and even get rewards. But if you don’t use it wisely, a credit card can quickly become a burden.

Here are some tips on how to use a credit card:

– Use it for everyday purchases: You can use your credit card for gas, groceries and other everyday expenses. This can help you build your credit history.

– Make payments on time: It’s important to make your payments on time.Missed or late payments can damage your credit score.

– Keep your balance low: It’s best to keep your balance below 30% of your credit limit. This shows creditors that you’re using your credit wisely and helps improve your credit score.

– Pay in full each month: If you can, pay off your balance in full each month. This will help you avoid interest charges and keep your debt under control.

If you follow these tips, using a credit card can be a great way to improve your financial situation.

What to do if you can’t pay your credit card bill

If you can’t pay your credit card bill, don’t panic. There are a few things you can do to keep your account in good standing and avoid damaging your credit score.

First, call your credit card issuer and explain the situation. They may be able to work with you to set up a payment plan or offer other options.

Second, if you’re unable to make a full payment, try to at least make the minimum payment. This will help keep your account in good standing and avoid late fees.

Third, consider using a balance transfer credit card to pay off your debt. This can help you save money on interest and get your debt under control.

Finally, if you’re struggling to make payments, reach out to a non-profit credit counseling agency for help. They can assist you in creating a budget and negotiating with creditors.

Building Credit

It can be difficult to get approved for a credit card when you have no credit history. However, there are a few credit cards that are designed for people with no credit. These cards can help you build your credit so that you can get approved for other cards in the future. Let’s take a look at some of the best credit cards for people with no credit.

How to build credit

One of the best ways to build credit is to use a credit card responsibly. That means making on-time payments and keeping your balances low relative to your credit limit. You can get a credit card even if you have no credit history by becoming an authorized user on someone else’s credit card. You can also get a secured credit card, which requires you to put down a cash deposit that becomes your line of credit. Using either of these types of cards responsibly will help you build credit so you can qualify for products with better terms in the future.

What to avoid when trying to build credit

In order to build credit, there are a few things you should avoid doing. First, you should never miss a payment. This will damage your credit score and make it harder for you to get approved for loans and credit cards in the future. Second, you should avoid using too much of your available credit. This is called your “credit utilization” and it makes up 30% of your FICO score. So, if you have a credit card with a $1,000 limit, try to keep your balance below $300. Finally, you should avoid opening too many new accounts at once. This can also hurt your credit score because it shows that you’re seeking out new debt. If you’re not careful, you could end up in a cycle of debt that’s hard to break out of.