What Are Credit Cards Used For?

Contents

A credit card can be a useful tool if you know how to use it correctly. Read on to learn about what credit cards are most commonly used for.

Credit Cards Used For?’ style=”display:none”>Checkout this video:

Introduction

Credit cards are a type of loan that allows you to borrow money up to a certain limit in order to purchase items or withdraw cash. You will need to repay the loan, plus interest and any fees, over time.

There are many different types of credit cards available, each with its own set of benefits and drawbacks. It’s important to compare different cards before choosing one to ensure that you get the best deal for your needs.

Some credit cards offer rewards programs, such as cash back or points that can be redeemed for travel or merchandise. Others come with introductory offers of 0% APR for a certain period of time, which can be helpful if you need to make a large purchase or consolidate debt. Some cards also offer perks such as extended warranty protection or purchase protection.

Be sure to read the terms and conditions carefully before applying for any credit card, so that you are aware of all the fees and requirements involved.

What Are Credit Cards?

Credit cards are a type of short-term loan that allows you to purchase items or withdraw cash up to a certain limit. You will need to repay the amount you have borrowed plus interest and any fees that may be charged by the card issuer.

How Do Credit Cards Work?

There are many different types of credit cards available, but they all work in basically the same way. You can use a credit card to make purchases or withdraw cash from an ATM, and the credit card company will pay the vendor or bank on your behalf. You will then be billed for the amount of money you have spent, plus interest and any other fees that may apply.

If you make your payments on time and in full each month, you will avoid paying interest and will only be responsible for the amount you have spent. However, if you only make a partial payment or miss a payment altogether, you will be charged interest on the outstanding balance. Credit cards can be a great way to build your credit history and improve your credit score, but they can also be a financial trap if you are not careful.

What Are the Different Types of Credit Cards?

There are many different types of credit cards available on the market. If you are thinking about getting a credit card, it is important to understand the different types of cards that are available and what they are best used for. Here is a brief overview of some of the most popular types of credit cards:

-Secured Credit Cards: A secured credit card is a good option for people who have no credit history or poor credit. With a secured card, you must make a security deposit that acts as your collateral in case you default on your payments. Your credit limit will be equal to your deposit amount.

-Unsecured Credit Cards: An unsecured credit card does not require a security deposit. These cards are best for people with good to excellent credit who can qualify for low interest rates and generous credit limits.

-Balance Transfer Cards: Balance transfer cards offer 0% APR for a promotional period, usually 12-18 months. This can be an excellent way to consolidate high-interest debt onto one low-interest account. Just be sure to pay off your balance before the promotional period ends, or you will be stuck with retroactive interest charges.

-Rewards Cards: Rewards cards earn points, cash back, or miles that can be redeemed for travel, merchandise, or gift cards. If you plan to use your credit card frequently, it makes sense to choose a rewards card that aligns with your spending habits. For example, if you travel often, look for a card that offers bonus points on travel purchases.

What Are Credit Cards Used For?

A credit card is a plastic card that gives the cardholder a line of credit to use for purchases, cash advances, or balance transfers. There is no set limit on how much you can spend, but you will need to make at least the minimum payment each month. Credit cards can be used for a variety of purposes, including building credit, making large purchases, or earning rewards.

Building Credit

Credit cards are often used to build credit. This is because when you use a credit card, you are borrowing money from the issuer. You will then need to pay that money back, with interest. If you make your payments on time and in full, this will help to improve your credit score.

Making Purchases

Credit cards can be used for a variety of purposes, the most common of which is making purchases. When you use a credit card to buy something, you are essentially borrowing money from the credit card issuer to pay for the purchase. You will then need to repay that debt, plus interest and fees, if any.

Other common uses for credit cards include cash advances, balance transfers, and paying bills. Cash advances allow you to withdraw cash from your credit limit; balance transfers let you transfer debt from another account to your credit card; and paying bills allows you to make payments on utilities, rent, and other expenses directly from your credit card.

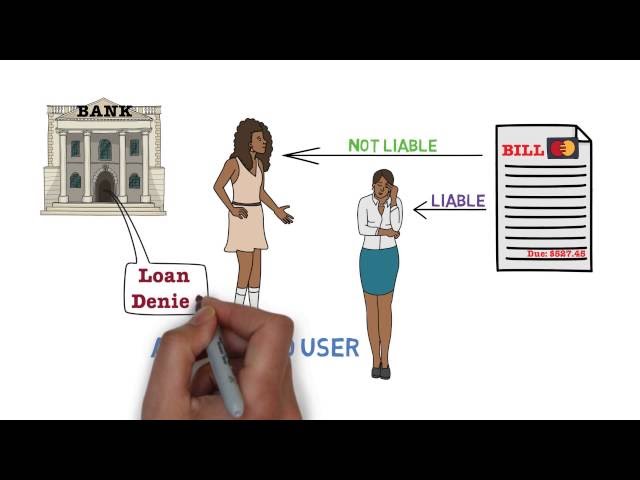

There are also a few less common uses for credit cards. Some cards offer rewards or bonuses that can be redeemed for cash back, travel, or merchandise. And some cards allow you to add an authorized user to your account, which can help build their credit history.

Earning Rewards

Credit cards are often used to earn rewards, such as cash back or points that can be redeemed for travel. Rewards programs will vary from card to card, so it’s important to choose a card that offers rewards that are valuable to you. For example, if you travel often, you may want to consider a card that offers points that can be redeemed for airfare or hotels. If you don’t travel often, a card with a cash back program may be more valuable to you.

Conclusion

Credit cards are a very popular way to pay for purchases and can be used in most situations. There are different types of credit cards, each with their own advantages and disadvantages. It’s important to choose the right credit card for your needs and to use it wisely.