How to Request a Credit Limit Increase

Contents

You’ve been a good customer, made your payments on time, and now you want to request a credit limit increase. Here’s how.

Checkout this video:

Check your credit report

Checking your credit report is the first step you should take when you want to request a credit limit increase. This will give you an idea of where your credit stands and if there are any potential red flags that could prevent you from getting approved for a higher limit. You can check your credit report for free once a year from each of the major credit bureaus.

If you see any errors on your report, be sure to dispute them with the credit bureau before requesting a credit limit increase. Even one mistake could result in a lower credit score and make it harder to get approved for a higher limit.

Know your credit score

Your credit score is one factor that lenders look at when considering whether to give you a credit limit increase. If you don’t know your credit score, you can get a free copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once every 12 months at AnnualCreditReport.com.

Another way to check your credit score is to use a service like Credit Karma or Quizzle. These services will show you your credit score for free, along with other helpful information about your credit report.

Consider your credit utilization

Before you request a credit limit increase, it’s important to consider your credit utilization. This is the percentage of your credit limit that you’re using at any given time. For example, if your credit limit is $1,000 and you have a balance of $500, your credit utilization is 50%.

Credit utilization is an important factor in your credit score. In general, it’s best to keep your credit utilization below 30%. That means if you have a credit limit of $1,000, you should keep your balance below $300.

If your credit utilization is already close to 30%, a credit limit increase may not be the best option for you. That’s because a higher credit limit could lead to higher balances and higher credit utilization. Instead, you may want to focus on paying down your debt so you can lower your credit utilization.

Research your options

If you’re considering asking for a credit limit increase, research your options first. You’ll want to compare different offers and find the one that best suits your needs. Make sure you understand the terms and conditions before you agree to anything.

Some things to keep in mind when you’re researching your options:

-Check for any fees associated with the credit limit increase. Some companies charge a fee for this service, so be sure to factor that into your decision.

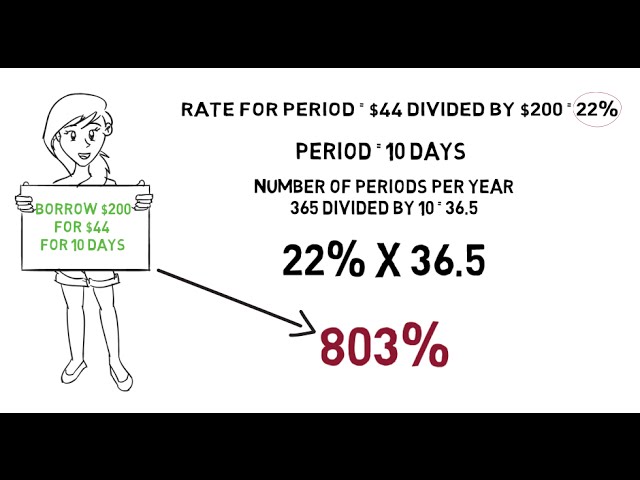

-Look at the interest rates associated with the credit limit increase. You’ll want to make sure you can comfortably make any additional purchases without accruing too much debt.

-Consider the impact on your credit score. A credit limit increase may have a positive or negative impact on your score, depending on how you use it. If you’re planning on using it to make a large purchase, for example, it could temporarily lower your score.

Once you’ve compared your options and decided which offer is best for you, follow the instructions on how to request a credit limit increase from that company.

Decide how much of an increase you need

Before you request a credit limit increase, it’s important to know how much of an increase you actually need. You don’t want to ask for too little and not get the full amount you’re hoping for, but you also don’t want to ask for more than you actually need and end up with a higher credit limit than you can reasonably keep track of.

A good rule of thumb is to calculate how much extra credit you would need in order to comfortably make your regular monthly payments and have room left over in case of an emergency. For example, if your total monthly payments are $500 and you typically keep $1,000 in your checking account as a buffer, you would need an extra $500 in available credit to feel comfortable.

Once you have a general idea of how much of an increase you need, take a look at your credit report to see where your credit stands. If your score is on the lower end, it might be worth taking some time to improve your score before requesting an increase. A higher score will usually result in a bigger credit limit increase.

Request the increase

If you would like to request a credit limit increase, you’ll need to contact your credit card issuer directly. You can usually do this by calling the customer service number on the back of your card or by logging in to your account online.

When you contact your credit card issuer, be prepared to provide them with information about your current financial situation and why you feel you need a higher credit limit. It’s also a good idea to have an idea of how much of an increase you’re hoping for.

If your credit card issuer agrees to give you a higher credit limit, they will likely do a hard inquiry on your credit report. This can temporarily lower your credit score by a few points. However, if you keep your balances low and make all of your payments on time, the impact on your score should be minimal.

If you’re denied, ask why

If you’re denied for a credit limit increase, the issuer should tell you why. It could be due to your credit history, income or something else in your financial profile. If you’re not satisfied with the answer, you can always try again later or ask another issuer for an increase.

There are a few things you can do to improve your chances of getting approved for a credit limit increase in the future:

-Pay your bills on time: Payment history is one of the most important factors in your credit score, so make sure you’re always paying on time.

-Keep your balances low: Try to keep your balances below 30% of your credit limit. This will help improve your credit utilization ratio, which is another important factor in your credit score.

-Maintain a good credit history: The longer you have an account open and in good standing, the better. This shows issuers that you’re a reliable borrower.