How Much Would a $500 Payday Loan Cost?

Contents

How Much Would a $500 Payday Loan Cost? We break it down for you here in this helpful blog post.

Checkout this video:

How Payday Loans Work

A payday loan is a type of short-term borrowing where a lender will extend high interest credit based on a borrower’s income and credit profile. A payday loan’s principal is typically a portion of a borrower’s next paycheck. These loans charge high interest rates for short-term immediate credit. How much would a $500 payday loan cost?

How much can you borrow?

The amount that you can borrow from a payday lender depends on a few factors. Each state has its own laws that govern how much money payday lenders can give to consumers. In some states, the maximum loan amount is $500, while in others it may be as high as $1,000. The amount that you can borrow also depends on your income and whether you have any outstanding payday loans.

Most payday lenders will not give you more than one loan at a time. This is to prevent borrowers from getting into too much debt. If you need to take out another loan to cover the costs of the first one, you will have to pay off the first loan before you can take out the second one.

The interest rate on a payday loan is typically much higher than the interest rate on a personal loan from a bank or credit union. The exact amount of interest will vary depending on the lender and the amount of money you borrow. However, the typical interest rate for a two-week payday loan is about 15%. This means that if you borrowed $500, you would have to pay back $575 two weeks later.

What are the fees and interest?

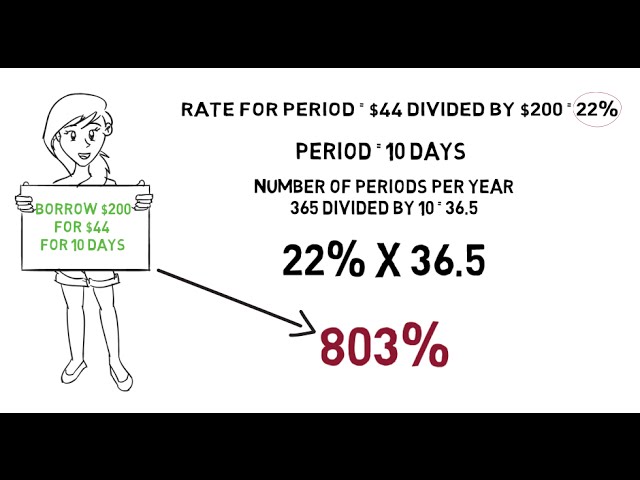

The fees and interest associated with a payday loan can vary depending on the state where you live and the lender you borrow from. In general, however, most payday loans will have a flat fee for every $100 borrowed and an annual percentage rate (APR) that ranges from 300% to 700%.

For example, if you were to borrow $500 from a payday lender in California, you would be charged a flat fee of $75 and an APR of 460%. This means that your total loan cost would be $575, and you would need to repay the loan in full within two weeks (plus any additional fees or interest that may accrue).

If you’re unable to repay the loan in full within the original timeframe, you may be able to extend your loan by paying additional fees. However, it’s important to note that extending your loan will likely result in even more fees and interest charges, which can make it even more difficult to repay the debt.

How do you repay the loan?

Generally, you will have until your next payday to repay the loan plus interest and fees. Some lenders may allow you to roll over the loan for another term (usually two weeks) for an additional fee. Others may renew the loan automatically, and extend the repayment date, usually adding fees each time they do so.

The Cost of a $500 Payday Loan

If you need a $500 payday loan, you will likely have to pay a fee of around $75. This means that the total cost of the loan will be $575. The interest rate on a $500 payday loan is usually around 15%, which means you will be paying $75 in interest.

The fees

The fees associated with a $500 payday loan can vary depending on the lender and the state you live in. Typically, the fees range from $15 to $30 for every $100 borrowed. This means that you would owe $75 to $150 in fees if you borrowed $500. In some states, lenders are allowed to charge more.

It’s important to remember that the fees are only part of the cost of a payday loan. You also have to pay interest on the loan, which can be very high. The annual percentage rate (APR) on a typical payday loan is 400% or more. That means you would pay $4 in interest for every $100 you borrow, or $40 for a $500 loan.

The interest

The interest on a $500 payday loan would be $62.50 if you took out the loan for one week. That works out to an annual percentage rate (APR) of 658%. If you took out the same loan for two weeks, the interest would be $125, or an APR of 329%.

The repayment schedule

The repayment schedule for a $500 payday loan would typically be as follows:

-Loan amount: $500

-Interest rate: 15%

-Number of payments: 8

-Amount of each payment: $75

-Total interest charged: $120

-Total amount repaid: $620

How to Avoid the Cost of a Payday Loan

Save up in advance

Saving up in advance is the best way to avoid the high cost of a payday loan. If you know you will need extra money for an upcoming expense, start setting aside money each week until you have enough to cover the cost. This will help you avoid having to turn to a payday loan when unexpected expenses arise.

Get a personal loan

A personal loan is a fixed-rate loan that you can use for a variety of purposes, including consolidating debt, paying for unexpected expenses or making a major purchase. Personal loans typically have fixed interest rates, meaning your monthly payments stay the same throughout the life of the loan, and they typically range from $1,000 to $100,000.

Use a credit card

If you’re struggling to make ends meet, you may be considering a payday loan. But before you take out a high-interest loan, consider using a credit card instead. Although credit cards can have high interest rates, they are typically much lower than the rates on payday loans. And, if you use a credit card for your payday loan and pay it off quickly, you can avoid most of the interest charges altogether.

Alternatives to Payday Loans

There are a number of other options to consider before taking out a payday loan. Some people use credit cards to cover unexpected expenses, while others may borrow from friends or family. You could also consider a personal loan from a bank or credit union. Each option has its own pros and cons, so be sure to weigh all your options before making a decision.

Personal loans

Personal loans are a type of unsecured loan, which means there’s no collateral required to qualify. Unsecured loans are available from traditional lenders, such as banks and credit unions, as well as online lenders.

personal loan terms are typically three to five years, and the maximum amount you can borrow is $100,000. The interest rate you’ll pay depends on your credit score and other factors, but it will likely be lower than the APR on a payday loan. A personal loan also gives you more time to repay the debt than a payday loan – typically two to five years – so you can make smaller monthly payments.

Credit cards

If you’re considering a payday loan, there are several alternatives you may want to consider, including using a credit card.

With a credit card, you can withdraw cash from an ATM or financial institution, or you can use the cash advance feature to get cash from your credit card issuer. However, there are some important things to keep in mind if you’re thinking about using a credit card for a cash advance.

First, there will likely be fees associated with taking a cash advance on your credit card. These fees can vary depending on your card issuer, but they are typically around 3% of the amount withdrawn. Additionally, interest will accrue on the outstanding balance from the date of the cash advance transaction until the balance is paid in full. This interest is typically at a higher rate than the interest rate charged on purchases made with your credit card.

Because of these fees and rates, it’s important to only use a credit card for a cash advance if you’re confident that you’ll be able to repay the debt quickly. If not, you could end up owing a lot of money in fees and interest charges.

Home equity loans

If you own a home, a home equity loan or line of credit can be lower cost alternatives to payday loans. Home equity lines of credit have variable interest rates, and require you to make monthly payments. A home equity loan gives you the entire amount at once, and you’ll pay it back over several years at a fixed interest rate. You can typically borrow as little as $5,000 or as much as $100,000 with a home equity loan.