When Does Experian Update Credit Scores?

Contents

Wondering when Experian updates credit scores? Here’s what you need to know about the credit reporting agency’s schedule.

Checkout this video:

What is Experian?

Experian is one of the three major credit bureaus in the United States. The other two are Equifax and TransUnion. Experian collects and maintains information on consumers that is used by lenders to make credit decisions.

Experian updates credit scores on a regular basis, typically once every 30 days. However, some lenders may request that Experian update their score more frequently, such as once a week or even daily.

It’s important to keep in mind that your Experian credit score is just one factor that lenders will consider when making a credit decision. Other factors, such as your income and employment history, may also be considered.

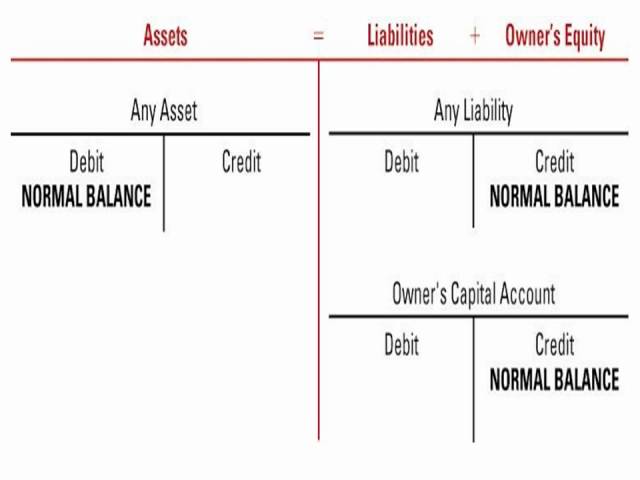

What is a credit score?

Your credit score is a numeric summary of your credit report, and it’s quite important. Lenders use credit scores to help them decide whether to give you a loan and how much interest to charge. A high credit score means you’re a low-risk borrower, which could translate into a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

How often does Experian update credit scores?

Your Experian credit score is updated every 30 days. This means that if there are any changes to your credit report, your score will reflect those changes within a month.

It’s important to remember that your Experian credit score is just one of many factors that lenders take into consideration when you apply for a loan or credit card. Other factors include your income, employment history and debt-to-income ratio.

What factors affect credit scores?

There are a number of factors that can affect credit scores, including:

-The type of credit accounts you have (e.g. mortgages, credit cards, etc.)

-The age of your credit accounts

-The amount of debt you owe

-Your payment history

-The number of inquiries on your credit report

Experian updates credit scores on a regular basis, but the frequency with which they update can vary depending on the individual’s situation.

How can I check my Experian credit score?

There are a few ways that you can check your Experian credit score for free. You can sign up for a free trial of Experian CreditWorksSM, which will give you access to your Experian credit report and FICO® Score 8. You can also use experian.com’s Free Credit Report Card, which will give you your Experian credit score along with the scores from the other two major credit bureaus, TransUnion and Equifax.

How can I improve my Experian credit score?

There are a number of things you can do to improve your Experian credit score. Some methods are more effective than others, and some may take longer to show results.

Here are a few things you can do to improve your Experian credit score:

-Pay your bills on time: Perhaps the most important factor in your Experian credit score is your payment history. Make sure you pay all of your bills on time, every time.

-Keep balances low on credit cards and other “revolving credit”: Another important factor in your Experian credit score is how much of your available credit you are using. This is also called your “credit utilization ratio.” It’s best to keep your balances well below 30% of your available credit, and lower is even better.

-Have a mix of different types of credit: Another factor that goes into your Experian credit score is the mix of different types of accounts you have. It’s good to have a mix of revolving (credit cards) and installment (loans) accounts.

-Apply for new credit only when needed: When you apply for newcredit, it can temporarily lower your Experian credit score. So only apply for newcredit when you really need it.

Conclusion

Experian is a credit reporting agency that calculates your credit score. This score is used by lenders to determine your creditworthiness. Experian updates your credit score periodically, typically once every 30 days. However, there are some instances where your score may be updated more frequently.