Which of the Following Accounts Has a Normal Credit Balance?

Contents

If you’re trying to figure out which of your accounts has a normal credit balance, you’ve come to the right place. In this blog post, we’ll walk you through the process of determining which accounts should have a credit balance and which ones should have a debit balance. By the end, you’ll be able to confidently answer the question, “Which of the following accounts has a normal credit balance?”

Checkout this video:

Accounts with a normal credit balance

The normal credit balance for an account is its default balance type when it is created. This can be changed later if needed. The five types of accounts that usually have a normal credit balance are: asset, expense, equity, income, and liability.

Accounts Receivable

The answer is Accounts Receivable.

When a company provides a service or sells a product, it is common for the customer to not pay immediately. The company then records the amount of the sale as an Accounts Receivable. This means that the customer owes the company money.

At the end of each accounting period, the company will review its Accounts Receivables to see which customers still have not paid. This is important because the sooner the company can collect on its receivables, the better for its cash flow.

Inventory

The normal balance of inventory is a debit. This means that when a company debits inventory, the balance in the inventory account increases. The reason for this is that inventory is an asset, and assets have normal debit balances.

Prepaid expenses

Prepaid expenses are those which have been paid in advance and will be applied to future periods. For example, if you paid six months’ worth of rent at the beginning of the year, that would be a prepaid expense. Other common prepaid expenses include insurance premiums and property taxes.

Prepaid expenses are recorded as assets on a company’s balance sheet. The reason for this is that they represent future benefits that the company has already paid for. When the prepaid expense is used up, it is then recorded as an expense on the income statement.

Accounts with a normal credit balance include:

-Prepaid expenses

-Allowance for doubtful accounts

-Unearned revenue

Accounts with a normal debit balance

The following accounts typically have a normal debit balance: Accounts Receivable, Inventory, Service Revenue, and Salaries and Wages Expense.

Accounts payable

Accounts payable, also called trade payables, represent the amounts owed by a company for goods or services it has received from suppliers on credit. The standard accounting treatment for accounts payable is to classify them as current liabilities on the balance sheet. This is because the amounts are due to be paid within the next 12 months.

Salaries payable

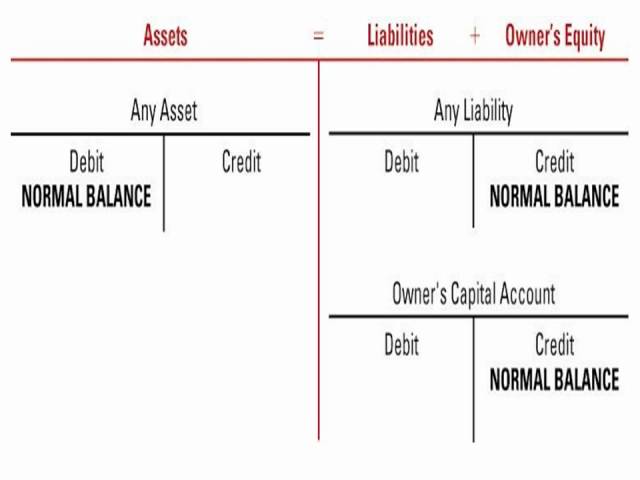

Accounts with a normal debit balance are those accounts in which we would normally expect to find a debit balance. The most common examples are asset, expense, and withdrawal accounts. Accounts with a normal credit balance are those accounts in which we would normally expect to find a credit balance. The most common examples are liability, equity, and revenue accounts.

Unearned revenue

Unearned revenue is reported on the balance sheet as a liability. This is because the revenue has not yet been earned, and therefore, the company is not yet entitled to keep the money. The cash has been received, but the company still owes a service to the customer. Once the service has been provided, the liability will be converted to revenue.