How to Refinance Your Loan

Contents

Before you refinance your loan, it’s important to understand the process. This guide will show you how to refinance your loan step-by-step.

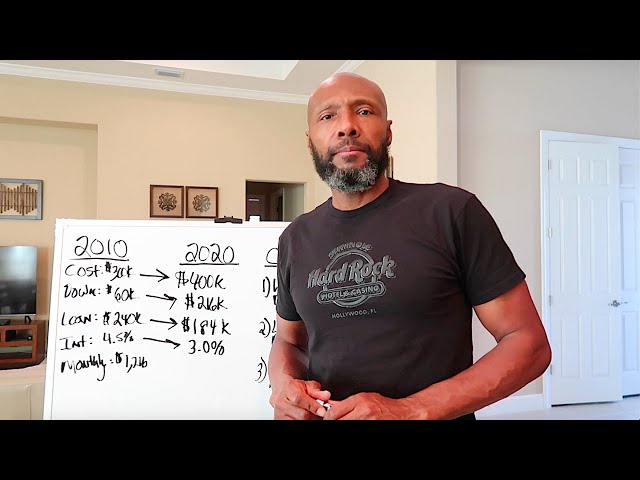

Checkout this video:

Introduction

When you refinance your loan, you’re essentially taking out a new loan to pay off your existing loan. This can be a good idea if you’re looking to save money on interest, lower your monthly payments, or pay off your loan faster.

Refinancing comes with some costs, so it’s important to do your homework before you decide whether or not it’s right for you. This guide will walk you through the process of refinancing your loan and help you compare options to find the best deal for you.

What is refinancing?

Refinancing is the process of taking out a new loan to pay off an existing loan. The new loan may have a different interest rate, monthly payment, and term length than the existing loan. Refinancing can be an excellent way to lower your monthly payments, reduce your overall interest costs, or change the term length of your loan.

Who can refinance their loans?

To be eligible for loan refinancing, you must:

-Have a good credit score

-Be employed or have a strong income

-Have little to no debt

-Be a U.S. citizen or permanent resident

-Not have any delinquent federal loans

When is the best time to refinance your loan?

The short answer is: whenever it makes financial sense.

A refinance rates can vary depending on the type of loan, the loan amount, your credit score, the market conditions, and many other factors.

To get a sense of what interest rates are available to you, shop around and compare offers from multiple lenders. Keep in mind that the best time to refinance your loan may not be when rates are at their lowest, but when you can get a lower rate that will save you money over the long term.

How to refinance your loan

If you’re considering refinancing your loan, there are a few things you should know first. Refinancing can be a great way to save money on your monthly payments, but it’s not always the best option. Here are a few things to consider before you refinance your loan:

· Is refinancing right for you?

You should only refinance your loan if it makes financial sense to do so. You’ll need to calculate the costs of refinancing, including any upfront fees, as well as the expected savings from lower monthly payments. You should also consider how long you plan to stay in your home. If you don’t plan on staying in your home for long, you may not save enough money on your monthly payments to offset the costs of refinancing.

· What are the terms of your new loan?

Be sure to compare the terms of your new loan with the terms of your current loan. You may be able to get a lower interest rate, but you may also end up with a longer term loan which could cost you more in the long run.

· How much will it cost to refinance?

There are typically costs associated with refinancing your loan, including appraisal fees, origination fees, and closing costs. These costs can add up, so be sure to factor them into your decision.

Conclusion

In conclusion, refinancing your loan can be a great way to save money, but it’s important to do your homework first and make sure you understand the process. Talk to your lender about their rates and terms, and compare offers from multiple lenders to get the best deal. Refinancing can be a great way to save money on your monthly payments, pay off your loan sooner, or get cash out for home improvements or other expenses.