How to Pay Yourself With a PPP Loan

Contents

If you’ve been approved for a Paycheck Protection Program loan, you may be wondering how you can use the funds to pay yourself. Here’s a quick guide on how to do just that.

Checkout this video:

What is a PPP Loan?

A PPP loan is a loan that is given to small businesses in order to help them keep their employees during the COVID-19 pandemic. The loan is forgiven if the business uses it to pay their employees’ salaries. The loan is also forgiven if the business closes or lays off employees.

What can PPP funds be used for?

The CARES Act allows small businesses and self-employed individuals to seek a loan through the Paycheck Protection Program (PPP) of up to 2.5 times their monthly payroll costs. These loans may be forgiven if borrowers maintain their payrolls during the crisis or rehire workers who have been laid off.

Funds from a PPP loan can be used for:

-Payroll costs, including benefits

-Interest on mortgages, rent, and utilities

-Worker protection costs related to the COVID-19 pandemic, such as drive-through window installation or plexiglass barriers

How to Pay Yourself With a PPP Loan

If you’re a small business owner, you may be wondering how to pay yourself with a PPP loan. The answer is simple: you can’t. The PPP loan is for businesses, not individuals. However, there are a few ways you can use the loan to benefit yourself and your business. Let’s take a look.

Step 1: Determine your eligibility

The first step in deciding how to pay yourself with a PPP loan is to determine your eligibility.

You may be eligible for a PPP loan if you are a small business owner, self-employed worker, or gig worker who was in operation on February 15, 2020 and had employees for whom you paid salaries and payroll taxes.

If you are a sole proprietor or independent contractor, you can apply for a PPP loan if you meet the criteria above and also had self-employment income in 2019.

If you are unsure of your eligibility, you can check the Small Business Administration’s (SBA) Eligibility Requirements here.

Once you have determined that you are eligible for a PPP loan, you can begin the process of applying for the loan through your lender.

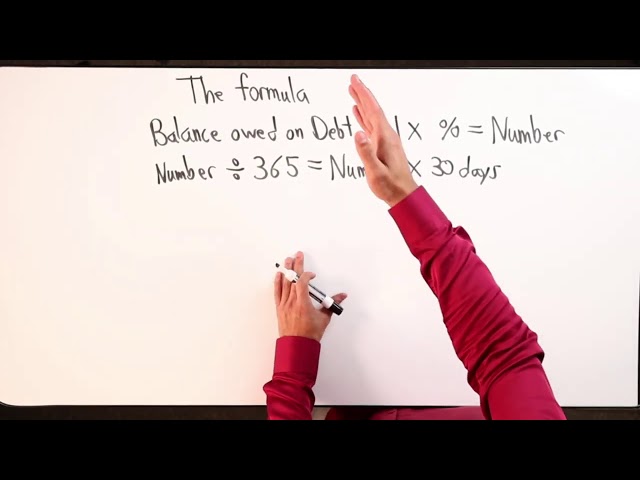

Step 2: Calculate your loan amount

You can apply for a PPP loan through any approved SBA 7(a) lender or through any participating federally insured depository institution, credit union, or Farm Credit System institution.

To calculate your loan amount, you will need to multiply your average monthly payroll costs by 2.5. For example, if your average monthly payroll costs are $10,000, you would be eligible for a loan amount of $25,000.

Keep in mind that the maximum loan amount is $10 million.

Step 3: Apply for the loan

Now that you’ve gathered all the required documents, it’s time to fill out the PPP loan application. This can be done online through the Small Business Administration website.

The PPP loan application is essentially a small business loan application. The form asks for basic information about your business, such as your business name, address, and EIN. You will also need to provide information about your average monthly payroll expenses.

Once you have completed the application, you will need to submit it to the lender of your choice. The lender will then review the application and make a decision on whether or not to approve the loan.

Step 4: Use the funds to pay yourself

If you’re self-employed, you can use the PPP loan to pay yourself a salary. The money can also be used to cover other business expenses, like rent, utilities, and payroll for your employees.

To pay yourself a salary with a PPP loan, calculate your average monthly net income from the last year. You can then use that number to figure out how much you can draw from the PPP loan each month. For example, if your average monthly net income was $5,000, you could draw up to $5,000 from the PPP loan each month to pay yourself a salary.

Keep in mind that the money you borrow from the PPP loan will need to be repaid with interest. You will also need to start making payments on the loan after two years.

What to Do if You’re Denied a PPP Loan

If you’re denied a Paycheck Protection Program loan, you’re not alone. Thousands of small business owners have been denied funding, and the process can be confusing and frustrating. But don’t give up hope. There are a few things you can do to appeal the decision or explore other funding options.

Step 1: Check your eligibility

If you didn’t get a PPP loan because you were deemed ineligible, there are a few things you can do:

1. Check your eligibility. The SBA has released more guidance on who is eligible for a PPP loan, so it’s worth checking to see if you now qualify.

2. Appeal the decision. If you still don’t think you should have been denied, you can appeal the decision.

3. Find another way to pay yourself. If you can’t get a PPP loan, there are other ways to pay yourself, like using your personal savings or taking out a personal loan.

Step 2: Appeal the decision

If you believe that you were wrongly denied a PPP loan, you can appeal the decision. According to the SBA, you should first reach out to the lender that denied your loan and ask for the specific reasons why your loan was not approved.

Once you have this information, you can begin to address the issues that the lender highlighted. For example, if the lender said that your business did not have enough revenue, you can provide documentation that proves otherwise.

If you are still unable to get approved for a loan after appealing the decision, you can reach out to your state’s small business association or the SBA directly for help.

Step 3: Consider alternative financing options

If you are not able to secure a PPP loan, there are other options to consider. The Small Business Administration (SBA) offers several programs that may be a good fit for your business. For example, the SBA’s Economic Injury Disaster Loan (EIDL) program provides low-interest loans of up to $2 million to small businesses and nonprofits that have been financially impacted by COVID-19.

Another option is to seek out a traditional small business loan from a bank or credit union. While these loans may not be specifically for businesses that have been impacted by the pandemic, they can still provide the funding you need to keep your business afloat.

Whatever option you decide to pursue, be sure to do your research and compare terms before signing on the dotted line. loans