How to Get a Mortgage Loan with Bad Credit

Contents

It’s not impossible to get a mortgage loan with bad credit , but it will be difficult. Here are some tips to improve your chances.

Checkout this video:

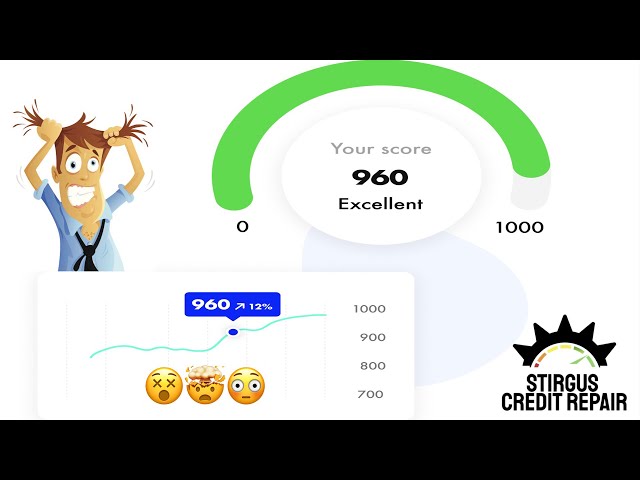

Know your credit score

Your credit score is one of the most important factors in getting approved for a mortgage loan. If you have bad credit, there are still a few things you can do to increase your chances of getting approved. First, you should know your credit score. This will give you an idea of where you stand and what you need to improve.

Get a free credit report

There are a few ways to get a free credit report. One way is to go through a credit reporting agency such as Experian, TransUnion, or Equifax. Another way is to go through the government-sponsored website AnnualCreditReport.com.

If you go through a credit reporting agency, you will likely have to give them your credit card information so that they can charge you for their services. If you go through AnnualCreditReport.com, you can get your report for free without having to give any personal information.

Once you have your credit report, check it for accuracy. If there are any errors, dispute them with the credit reporting agency.

Check for errors on your credit report

Bad credit can hurt your chances of getting approved for a mortgage loan, but checking for errors on your credit report can help improve your score and increase your chances of being approved.

According to the Fair Credit Reporting Act (FCRA), you are entitled to one free credit report from each of the three major credit bureaus — Experian, Equifax, and TransUnion — every 12 months. You can get your free credit reports by visiting AnnualCreditReport.com or by calling 1-877-322-8228.

When you get your credit report, check it for errors and dispute any incorrect information with the credit bureau. You should also keep an eye out for signs of identity theft, such as unexplained accounts or charges on your report.

If you find errors on your credit report, taking steps to fix them can improve your credit score and increase your chances of being approved for a mortgage loan.

Shop around for the best mortgage loan

The most important tip for getting a mortgage loan with bad credit is to shop around. Don’t just go with the first lender that approves you. Talk to multiple lenders and compare their offers. Make sure to compare APRs, interest rates, closing costs, and other fees. Also, ask each lender about their lending standards for people with bad credit.

Compare rates

Comparing mortgage rates among lenders is one of the smartest things you can do when shopping for a home loan. Lenders offer a variety of rates, terms, fees and in some cases, points. It pays to shop around and compare all of your options to get the best possible rate and terms.

Here are some tips on how to compare mortgage rates:

-Check with at least three different lenders. Compare both interest rates and fees.

-Ask each lender about their rate lock policy. This is important if interest rates are rising and you want to lock in a lower rate.

-Check to see if the lender offers any discounts for certain groups, such as veterans or teachers.

Compare fees

When you’re looking for a mortgage loan, it’s important to compare apples to apples. That means looking at the annual percentage rate (APR), not just the interest rate. The APR includes the interest rate, points and other associated fees, making it a more accurate measure of what you’ll pay over time. Also, compare loan programs and term lengths to find the one that best meets your needs.

Compare loan terms

When you’re ready to compare loans, look for the following features:

-A low interest rate

-A fixed interest rate if possible (which means the interest rate won’t change over time)

-Low fees and points

-A borrower-friendly term length (such as a 30-year mortgage)

-No prepayment penalties (which means you can pay off the loan early without being charged a fee)

Improve your credit score

Bad credit can make it difficult to get a mortgage loan, but it’s not impossible. There are a number of things you can do to improve your credit score, including paying down debts and making on-time payments. You can also work with a credit counseling agency to create a budget and plan to pay off your debt.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time. Payment history accounts for about 35% of your credit score, so this is a key factor in improving your score. If you have been missing payments or making late payments, start paying your bills on time now and continue to do so. This will gradually improve your credit score over time.

Reduce your debt

One of the best things you can do to improve your credit score is to reduce your debt. This can be done by paying off your debts, making regular payments on time, and consolidating your debts.

Paying off your debts will help improve your credit score by reducing the amount of debt that you have. This will also help improve your credit utilization ratio, which is the amount of debt you have compared to the amount of credit you have available.

Making regular payments on time will also help improve your credit score. This is because timely payments show lenders that you are responsible with your finances and are more likely to repay a loan on time.

consolidating your debts can also help improve your credit score. This is because it will reduce the number of accounts that you have open and make it easier to manage your debts. It will also lower the amount of interest that you are paying on your debts, which can save you money in the long run.

Dispute errors on your credit report

If you find errors on your credit report, you can dispute them with the credit bureau. According to the Federal Trade Commission, you should contact the credit bureau in writing and include the following:

-Your name, address and phone number

-A copy of your credit report with the disputed items circled

-An explanation of why you believe each item is incorrect

– Documentation to support your claim (such as a copy of a bill that shows the correct information)

The credit bureau must investigate and respond to your dispute within 30 days. If they find that an error has occurred, they will correct it and send you an updated report.