How Long Does a Hard Inquiry Stay on Your Credit?

A hard inquiry on your credit report generally stays there for two years. But, it won’t affect your score for longer than 12 months.

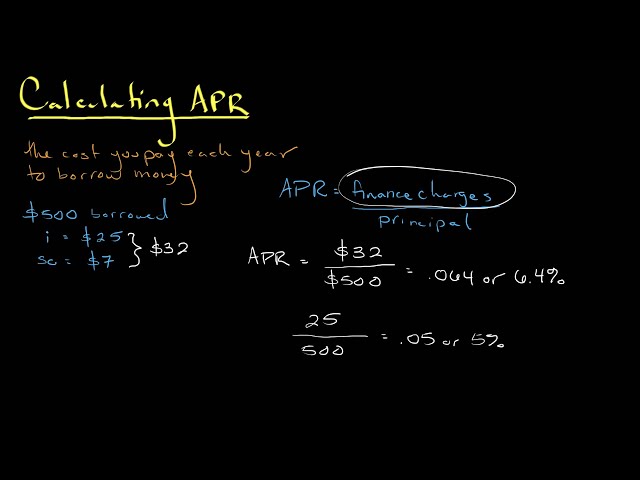

Checkout this video:

Hard inquiries

A hard inquiry is when a lending institution checks your credit report before approving you for a loan or extending you credit. A hard inquiry typically stays on your credit report for two years, although some lenders only consider inquiries from the past year.

What is a hard inquiry?

A hard inquiry is a type of credit check that occurs when you apply for a new line of credit. Hard inquiries can stay on your credit report for up to two years, but their impact on your credit score will generally diminish over time.

A hard inquiry is generally generated when you apply for a new credit card, loan or other type of borrowing, and it can show up on your credit report even if you’re not approved for the new account. When lenders review your credit report as part of a loan application, they’ll see all hard inquiries that have been made in the last two years.

Hard inquiries are one factor that can contribute to a lower credit score, but they’re not the only factor. If you have a strong history of repaying your debts on time, you may still be able to get approved for a loan even with one or more hard inquiries on your report.

If you’re concerned about the impact of hard inquiries on your credit score, you can take steps to remove them from your report. One option is to dispute the inquiries with the credit bureau that is reporting them. You can also try to negotiate with the lender to have the inquiry removed if you’re approved for the loan.

How long do hard inquiries stay on your credit report?

Hard inquiries can stay on your credit report for up to 2 years. Each time you apply for credit, a lender or creditor will order a copy of your credit report and give you a score based on the information included in your report.

A hard inquiry is generated when you give permission to a lender or creditor to check your credit with the intention of applying for credit. Hard inquiries are also known as “hard pulls” because they usually result in a small ding on your credit score.

While hard inquiries can stay on your report for up to 2 years, they typically only affect your score for the first 12 months. And, if you have multiple hard inquiries within a short period of time, they may only count as one inquiry.

How many hard inquiries can you have in a year?

The number of hard inquiries you can have in a year depends on the credit scoring model being used. For example, FICO® scores range from 300 to 850, and a hard inquiry can cause your score to drop by up to five points. However, the effect of a hard inquiry on your credit score will generally fade after about 12 months.

Soft inquiries

What is a soft inquiry?

A soft inquiry is a check of your credit that doesn’t ding your score. Soft inquiries can happen when you check your own credit, when a business checks your credit to preapprove you for a credit card offer, or when a business checks your credit as part of a background check. Because soft inquiries don’t affect your score, you don’t have to worry about them.

How long do soft inquiries stay on your credit report?

Unlike hard inquiries, soft inquiries have no effect on your credit score. They’re simply a record of when someone has accessed your report — and you can see them all yourself.

We pull your TransUnion credit report every time you log in to Credit Karma. When you do, we’ll show you a list of all the soft inquiries made on your report in the last two years. You can also see soft inquiries by going directly to your TransUnion credit report.

A soft inquiry won’t stay on your credit report forever. In fact, soft inquiries only appear on your report for about two years. After that, they’ll fall off naturally.

How many soft inquiries can you have in a year?

While there is no definite answer, a common rule of thumb is that you can have about one soft inquiry for every hard inquiry. So, if you have four hard inquiries on your report, you can have up to four soft inquiries.

Of course, this is just a general guideline, and the number of inquiries on your report will ultimately depend on the scoring model used by the lender. For example, some scoring models may place more emphasis on hard inquiries than others. Additionally, the number of inquiries on your report can also be influenced by other factors, such as your credit history and payment history.

In any case, it’s always best to keep the number of inquiries on your report as low as possible. If you’re shopping around for a loan or credit card and you’re worried about the impact of multiple inquiries, you can always ask the lender if they offer pre-approval. With pre-approval, you can submit one application and receive multiple offers from lenders without having to worry about multiple inquires negatively impacting your score.

Impact of hard and soft inquiries

When you check your credit report, you might notice two types of inquiries: hard and soft. Soft inquiries won’t impact your credit score, but hard inquiries can. So, how long do hard inquiries stay on your credit report? And what can you do to remove them?

How do hard inquiries impact your credit score?

A hard inquiry is an inquiry from a lender with whom you have applied for credit. Hard inquiries can negatively impact your credit score, although the impact is typically small and fades over time.

In general, a hard inquiry will lower your credit score by a few points. The exact amount depends on your credit history and the scoring model being used. If you have a good credit history and a high credit score, a hard inquiry may not have much of an effect. If you have a lower credit score or a thin credit history, a hard inquiry could have a greater impact.

Hard inquiries stay on your credit report for two years, but their impact on your score diminishes over time. The most recent inquiries are given more weight than older ones. After 12 months, hard inquiries will no longer impact your score at all.

If you’re shopping for a loan or other type of credit, it’s best to do it within a short period of time so that all the hard inquiries are grouped together and have less of an effect on your score.

How do soft inquiries impact your credit score?

There are two types of inquiries that can show up on your credit report: hard and soft. Hard inquiries are generally made by lenders when you’re applying for a loan or credit card, and these can slightly impact your credit score. Soft inquiries are generally made by employers or landlords who are checking your credit as a background check, and these have no impact on your score.

If you’re worried about the impact of hard inquiries on your credit score, you can take steps to limit the number of these that show up on your report. For example, you can shop around for loans before settling on one, so that all of the lender’s inquiries will be bunched together into a single inquiry. Additionally, you can limit the number of credit applications you submit in a short period of time, as multiple inquiries from a single lender in a short period of time will only count as a single inquiry.

Can you remove hard inquiries from your credit report?

Unfortunately, you can’t remove hard inquiries from your credit report. They’ll stay on your report for two years, and then they’ll fall off. Hard inquiries only impact your credit scores for one year, however—and they have no effect after that.

What’s the difference between a soft inquiry and a hard inquiry?

A soft inquiry won’t impact your credit score—and you won’t even see it on your credit report. That’s because soft inquiries are typically made when you check your own credit score or when a business checks your credit to pre-approve you for an offer. Hard inquiries will show up on your credit report and may impact your credit score slightly.

Can you remove soft inquiries from your credit report?

As you can see, hard inquiries can stay on your credit report for up to two years. But, they typically only impact your score for the first 12 months. So, if you have a hard inquiry on your credit report from more than 12 months ago, it’s unlikely that it will impact your score.

What about soft inquiries? Soft inquiries are not included in your FICO® Score and don’t have an impact on your credit scores. However, since soft inquiries don’t have an impact on your credit scores, there is no need to try and remove them from your credit report.