How to Get a Home Equity Loan with Bad Credit

It’s not as difficult as you might think to get a home equity loan with bad credit . In fact, there are many lenders who specialize in helping people with poor credit get the financing they need.

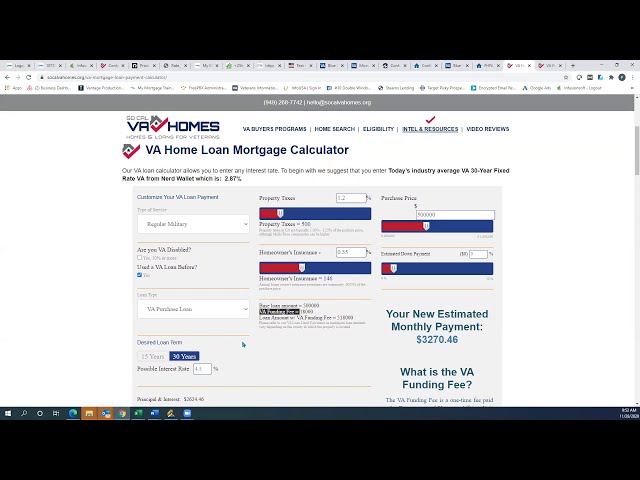

Checkout this video:

Home Equity Loans

A home equity loan is a loan that is secured by your home. This means that if you default on the loan, the lender can foreclose on your home. Home equity loans are a great way to get a lower interest rate than you would with a unsecured loan, but they are still risky. If you have bad credit, you may not be able to get a home equity loan.

What is a home equity loan?

A home equity loan is a loan that uses your home as collateral. You can borrow a fixed amount, secured by the equity in your home, and receive the money in one lump sum. Home equity loans are sometimes called “second mortgages” because they are a second loan on your home after your first mortgage.

The interest rate on a home equity loan is usually fixed, which means that it will not change over the life of the loan. Home equity loans are typically 10 to 15 years, although some lenders offer terms as long as 30 years.

You can use a home equity loan for anything you want, but it is most commonly used to finance major expenses such as home repairs or renovations, medical bills, or college education.

If you have bad credit, you may still be able to qualify for a home equity loan if you have equity in your home and can find a lender who is willing to work with you.

How does a home equity loan work?

A home equity loan is a loan that uses the value of your home as collateral. This type of loan is also known as a second mortgage, because it functions in a similar way to your primary mortgage. When you take out a home equity loan, you borrow against the value of your home, and you use your home as collateral for the loan. If you default on the loan, the lender can foreclose on your home and sell it to recoup the money that you owe.

How to get a home equity loan with bad credit

It is possible to get a home equity loan with bad credit. In fact, this is one of the most common questions we get from people who are considering a home equity loan. While your credit score is important, it’s not the only factor that we consider when you apply for a home equity loan.

If you have bad credit, the process for getting a home equity loan is similar to the process for getting any other type of loan. The first step is to contact a lender and submit an application. The lender will then look at your financial situation and credit history to determine if you are eligible for a loan.

If you are approved for a home equity loan with bad credit, the interest rate you pay will be higher than if you had good credit. However, it is still possible to get a competitive interest rate by shopping around and comparing offers from different lenders.

Mortgage Refinancing

Home equity loans are a type of second mortgage that let you access the equity in your home. Equity is the difference between your home’s appraised value and the outstanding balance on your mortgage. Home equity loans are a popular way to finance home improvements, pay for college, or consolidate debt. If you have bad credit, you may wonder if you can get a home equity loan.

What is mortgage refinancing?

Mortgage refinancing is taking out a new loan to pay off an existing mortgage. Homeowners usually refinance when they have equity in their home, which is the difference between the amount owed on the mortgage and the value of the property. A home equity loan is a type of mortgage refinancing where a borrower takes out a new loan that is larger than the existing loan and keeps the difference as cash. The extra cash can be used for any purpose, such as home improvements or debt consolidation.

How does mortgage refinancing work?

Homeowners with a mortgage may be able to refinance their loan in order to lower their monthly payments, change the length of their loan, or to get cash out of their equity. In order to qualify for refinancing, lenders will look at your employment history, credit score, and debt-to-income ratio. If you have equity in your home, you may be able to get a home equity loan or a home equity line of credit (HELOC) in addition to your mortgage.

How to get a mortgage refinancing with bad credit

Bad credit can make refinancing a home equity loan more difficult. But it’s still possible to do, as long as you find the right lender and are willing to pay a higher interest rate.

Here are some tips on how to get a mortgage refinancing with bad credit:

-Check your credit score and report for errors. You can get your credit score for free from many sources, such as Credit Karma or NerdWallet. Once you know your score, check your credit report for errors that could be dragging it down. You can get a free copy of your credit report from each of the major credit reporting bureaus every 12 months at AnnualCreditReport.com.

-Look for lenders that offer bad-credit home equity loans. Just because you have bad credit doesn’t mean you can’t get a home equity loan. There are lenders out there that specialize in loans for people with bad credit scores.

-Be prepared to pay a higher interest rate. Because you have bad credit, you’ll likely pay a higher interest rate on your home equity loan than someone with good credit would pay. But if you shop around, you may be able to find a lender that offers competitive rates.

Before you start shopping for a home equity loan, make sure you know how much equity you have in your home and what your monthly payments would be if you took out a loan. This will help you narrow down your options and choose the best loan for your needs.

Home Equity Line of Credit

A home equity loan is a loan that is secured by your home. This means that if you default on the loan, the lender can foreclose on your home. Home equity loans are a great way to get a lump sum of cash to use for major expenses. However, if you have bad credit, you may be wondering if you can still get a home equity loan. Let’s discuss how to get a home equity loan with bad credit.

What is a home equity line of credit?

A home equity line of credit, also known as a HELOC, is a type of home equity loan that works like a credit card. You can use it for individual purchases as needed up to your available credit limit. It’s a revolving form of credit, which means you have the flexibility to borrow the amount you need and make payments over time.

How does a home equity line of credit work?

A home equity line of credit, also called a HELOC, is a revolving line of credit backed by your home’s equity. Homeowners often use home equity lines of credit for large expenses such as home improvements, debt consolidation or tuition payments.

A home equity line of credit works much like a credit card. You’re approved for a certain amount of credit and you can use the money as you need it up to your limit. You’ll only pay interest on the money you borrow and you can make payments as frequently or as infrequently as you want up to the maximum repayment period.

Once you’re approved, you’ll typically have access to the funds within a few days and you can use them for any purpose. Some lenders may require that you close on your loan before disbursing the funds, but others will allow you to access the funds through an online portal or by writing checks against the account.

How to get a home equity line of credit with bad credit

It may be possible to get a home equity line of credit (HELOC) even if you have bad credit. Lenders typically look at your credit score, debt-to-income ratio and income when considering you for a HELOC. If you have poor credit, there are a few things you can do to improve your chances of getting approved:

-Work on improving your credit score. This can take time, but it will make it easier to get approved for a HELOC.

-Reduce your outstanding debt. The less debt you have, the more likely you are to be approved for a HELOC.

-Increase your income. If you can show that you have a steady income, this will improve your chances of being approved for a HELOC.