How Long Until My Loan is Paid Off?

Contents

Have you ever wondered how long it will take to pay off your loan? Use this calculator to find out! Just enter in your loan information and you’ll get an estimate of how long it will take to pay off your loan.

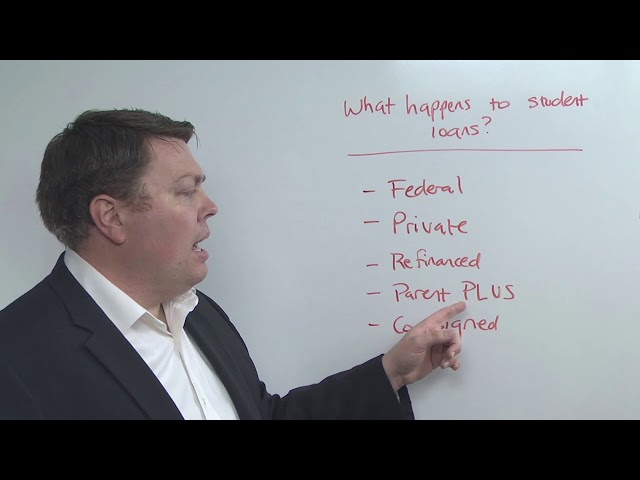

Checkout this video:

Introduction

Assuming that you make all of your payments on time, it will take _____ years to pay off your loan. To calculate this, we take into account the amount of money you borrowed, the APR, and the length of your loan term.

How long will it take to pay off my loan?

One of the questions you may have is “How long until my loan is paid off?” The answer to this question depends on a few factors such as the type of loan you have, the interest rate, and the payment term. In this article, we will discuss how to calculate the answer to this question so that you can know how long it will take to pay off your loan.

The minimum payment method

The minimum payment method is the easiest way to find out how long it will take to pay off your loan. This method simply requires you to make the minimum payments on your loan for a set period of time, and then calculate how long it will take to pay off the loan based on those payments.

For example, if you have a $10,000 loan with a 5% interest rate and you make the minimum payments of $250 per month, it will take you 60 months (or 5 years) to pay off the loan.

While this method is easy, it’s not always accurate. If you only make the minimum payments on your loan, it’s likely that you’ll still owe money when the loan Term expires. In addition, the minimum payment method doesn’t account for any changes in interest rates over time.

The snowball method

The snowball method is a debt reduction strategy where you pay off debts in order of smallest to largest, gaining momentum as you knock out each balance. Once the first debt is paid off, you roll the money you were putting toward it into paying off the next debt on your list.

Say you have three debts: a $2,000 credit card balance with a 15% interest rate, a $5,000 car loan at 5%, and a $10,000 student loan at 6%. According to the snowball method, you would focus on paying off the credit card first.

Let’s say you can afford $250 per month in extra payments. You’d put all $250 toward your credit card until it’s paid off. Once that happens, you’d move on to your car loan. Now that your credit card is gone, you can redirect its $250 payment to your car loan, giving you $500 to work with each month. After your car is paid off, you could put the entire $750 toward your student loan and pay it off in less than two years.

The avalanche method

The avalanche method is a debt reduction strategy in which you pay off your debts from the highest interest rate to the lowest.

The logic behind this method is that you’ll save more money in the long run by paying off your high-interest debt first. Once your high-interest debt is paid off, you can then focus on paying off your low-interest debt.

This method can be used for both secured and unsecured debts. To use this method, simply list out all of your debts from the highest interest rate to the lowest. Then, make the minimum payment on all of your debts except for the one with the highest interest rate. Once you’ve paid off that debt, move on to the next one on your list and so forth.

Conclusion

This calculator can help you create a repayment plan that fits your budget.

If you have any questions about your specific loan, please contact your lender.