How to Get a Property Loan

Are you looking for a loan to finance your property purchase? If so, you’ll need to know how to get a property loan.

In this blog post, we’ll share some tips on how to get a loan for your property purchase. We’ll cover the different types of loans available, how to qualify for a loan, and what you need to do to get started.

Follow these tips and you’ll be on your way to getting the loan you need to finance your

Checkout this video:

Introduction

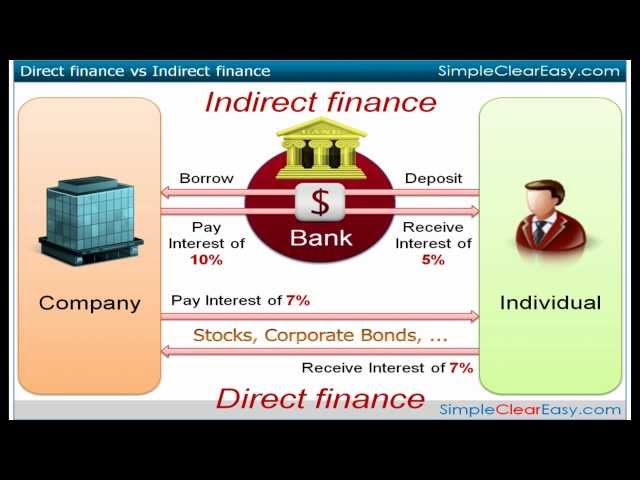

When you’re ready to get a loan for your property, there are a few things you need to know. The first is that there are two types of loans available: home equity loans and mortgage loans. Home equity loans are based on the value of your home, and can be used for anything from home improvements to debt consolidation. Mortgage loans are based on the value of the property you’re buying, and can be used for anything from buying a new home to refinancing an existing loan.

The second thing you need to know is that there are two types of interest rates: fixed and variable. Fixed interest rates means that your interest rate will stay the same for the life of the loan, while variable interest rates means that your interest rate can change over time.

Now that you know the basics, here’s a step-by-step guide to getting a property loan:

1. Find out how much you can afford to borrow. This will depend on your income and debts, as well as the type of loan you’re looking for.

2. Shop around for the best interest rate. Interest rates can vary greatly between lenders, so it’s important to compare rates before you decide on a loan.

3. Get pre-approved for a loan. This means that a lender has agreed to lend you a certain amount of money at a certain interest rate. Pre-approval gives you more negotiating power when it comes time to buy a property.

4. Find the right property. Once you’ve found a property you’re interested in, make an offer and hope that it’s accepted! If your offer is accepted, congrats – you’re on your way to owning your own home!

How to Get a Property Loan

If you’re looking to get a loan for a property, there are a few things you’ll need to do. First, you’ll need to find a lender. There are a few different types of lenders you can choose from, each with their own pros and cons. You’ll also need to decide how much you’re looking to borrow, and what type of loan you want. Keep reading to learn more about how to get a property loan.

The Application Process

The first step in getting a property loan is to fill out a loan application. The loan application will ask for information about your income, employment history, debts, and other financial obligations. You will also be asked to provide information about the property you want to purchase.

After you have submitted your loan application, the lender will evaluate your financial situation and decide whether or not to approve your loan. If you are approved for a loan, the lender will give you a loan offer. The loan offer will include the interest rate, monthly payment amount, and other terms of the loan.

You can choose to accept or reject the loan offer. If you accept the loan offer, you will be required to sign a contract and provide collateral for the loan. Collateral is something of value that can be used to repay the debt if you default on the loan. Common examples of collateral include houses, cars, or savings accounts.

Once you have signed a contract and provided collateral for the loan, the lender will give you the money you need to purchase the property. You will then make monthly payments to the lender until the debt is paid off.

The Mortgage Process

The mortgage process can be confusing and time-consuming, but it doesn’t have to be. In this article, we’ll give you an overview of the steps you need to take to get a property loan.

1. Get pre-approved: The first step is to get pre-approved for a loan. This will give you an idea of how much money you can borrow and what interest rate you can expect to pay.

2. Find a property: Once you know how much money you can borrow, you can start looking for a property. Keep in mind that the amount you can borrow may be different from the amount you’re actually approved for, so don’t get too far ahead of yourself.

3. Get a loan estimate: Once you’ve found a property, your lender will give you a loan estimate. This document will outline the terms of your loan, including the interest rate, monthly payments, and closing costs.

4. Apply for the loan: Once you’ve reviewed and accepted the terms of your loan estimate, it’s time to apply for the actual loan. Your lender will require some basic information about you and your financial situation.

5. Get a loan commitment: If your application is approved, your lender will issue a loan commitment. This document outlines the final terms of your loan and is legally binding.

6. Close on the loan: The last step in the process is to close on the loan and officially become the owner of the property. This involves signing a lot of paperwork and paying any remaining closing costs or fees.

Conclusion

In conclusion, getting a property loan is not as difficult as you might think. With the right preparation and research, you can get the loan you need to finance your dream home. Just remember to shop around for the best rates and terms, and to keep your financial information in order. With a little effort, you can make your homeownership dreams come true.