Direct Finance: What Is It and How Does It Work?

Contents

Direct finance is a type of financing that allows businesses to receive funding directly from investors. This can be a great option for businesses that may not be able to qualify for traditional bank loans. Keep reading to learn more about how direct finance works and how it can benefit your business.

Checkout this video:

What is Direct Finance?

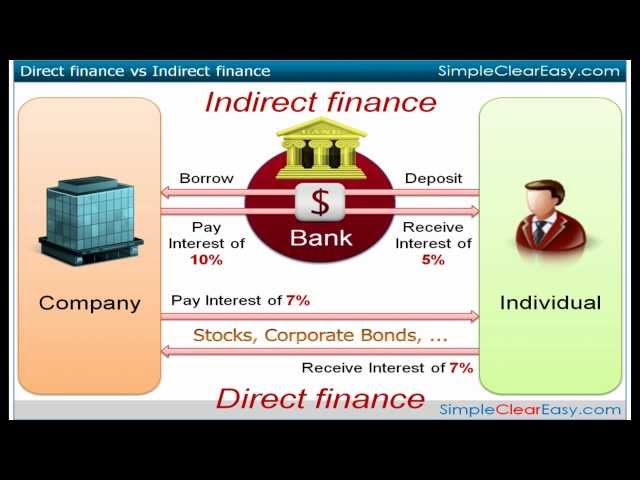

Direct finance is a type of financial transaction in which two parties exchange money without using a financial intermediary. This type of transaction is typically used for lending and borrowing money, but it can also be used for other types of financial transactions, such as investments and purchases.

Direct finance can be beneficial for both lenders and borrowers because it can save time and money by eliminating the need for a middleman. Additionally, direct finance can provide more flexibility than traditional financial transactions because the terms of the agreement can be customized to meet the needs of both parties.

However, direct finance can also be riskier than traditional transactions because there is no third party to provide protection if one of the parties defaults on the agreement. Additionally, direct finance can be challenging to set up if the parties do not have a good relationship with each other or if they do not have access to the same financial resources.

How does Direct Finance work?

Direct Finance is a form of financing that allows businesses to receive funding directly from investors, without having to go through a traditional financial institution. This can be a great option for businesses that may not be able to qualify for traditional financing, or for businesses that want to avoid the high interest rates and fees associated with traditional loans.

There are a few different ways that Direct Finance can work. One option is for businesses to set up an account on an online platform, where investors can browse different projects and choose which ones they want to invest in. Investors will typically receive some sort of return on their investment, either through interest payments or through equity in the business.

Another option is for businesses to work directly with individual investors. This can be done through personal connections or by using online platforms that connect businesses with potential investors. Again, investors will typically receive some sort of return on their investment, either through interest payments or through equity in the business.

Direct Finance can be a great way for businesses to raise capital, without having to go through traditional financial institutions. It can also be a great way for investors to get involved in early-stage businesses and potentially earn high returns on their investment.

The benefits of Direct Finance

Direct finance is a type of financing that allows businesses to receive funding directly from investors, without going through a financial institution. This can be a great option for businesses that are struggling to get traditional financing, or for businesses that want to avoid the high interest rates associated with traditional loans.

There are a few different ways that businesses can receive direct financing, such as through crowdfunding platforms, private equity firms, or angel investors. Each of these options has its own set of benefits and drawbacks, so it’s important to do your research before deciding which one is right for your business.

Crowdfunding platforms allow businesses to solicit funds from a large number of individuals, usually through an online campaign. This can be a great way to get funding from people who believe in your product or vision, but it can be difficult to reach your crowdfunding goals. Private equity firms typically invest larger sums of money in exchange for equity in the company. This can be a good option for businesses that are looking for long-term growth capital, but it can be difficult to find a private equity firm that is willing to invest in your business.

Angel investors are individuals who invest their own personal money into businesses they believe in. This can be a great option if you have a personal connection with the investor, but it can be difficult to find an angel investor who is willing to invest in your business.

Direct finance is a great option for businesses that are struggling to get traditional financing. There are a few different ways to receive direct financing, such as through crowdfunding platforms, private equity firms, or angel investors. Each of these options has its own set of benefits and drawbacks, so it’s important to do your research before deciding which one is right for your business.

The drawbacks of Direct Finance

Direct finance is a type of financial system where financial institutions lend money directly to businesses and individuals, without going through an intermediary. In theory, this should make the process more efficient and lead to lower borrowing costs. However, there are some drawbacks to direct finance that you should be aware of before you make any decisions.

First of all, because direct finance relies on a direct relationship between lenders and borrowers, it can be more difficult to get approved for a loan. Lenders may be more selective about who they lend to, and they may require collateral or a personal guarantee. This can make it harder for small businesses and startups to get the financing they need.

Second, direct finance can also lead to higher interest rates. Because there is no intermediary involved in the process, lenders may feel like they can charge higher interest rates to make up for the extra risk they are taking on. This can end up costing you more in the long run, even if you are able to get approved for a loan.

Finally, direct finance can create a conflict of interest between lenders and borrowers. Because lenders are dealing directly with borrowers, they may be tempted to put their own interests ahead of the borrowers’. For example, a lender might push a borrower to take out a larger loan than necessary or to accept terms that are not in the borrower’s best interest. You should be aware of this potential conflict of interest before you enter into any agreements with a lender.

Who is Direct Finance for?

Direct Finance is a type of online lending that offers loans and lines of credit to consumers and businesses. The company works with a network of lenders to provide financing for a variety of needs, including working capital, business expansion, and more.

Direct Finance is a good option for businesses that need financing but may not qualify for traditional bank loans. The company offers competitive rates and terms, and there is no collateral required. Direct Finance is also a good option for businesses that need funding fast – the application process is quick and easy, and funding can be received as soon as 24 hours after approval.

How to get started with Direct Finance

Direct finance is a type of financing that allows businesses to receive funding from investors without going through a financial institution. This type of financing can be beneficial for businesses because it can provide them with the capital they need quickly and without having to go through a lengthy and complicated application process. Additionally, businesses that receive direct financing may be able to negotiate better terms with their investors than they would if they went through a financial institution.

If you’re interested in pursuing direct finance for your business, there are a few things you should keep in mind. First, you’ll need to identify potential investors who might be interested in providing funding for your business. You can do this by networking with people in your industry or by searching online for direct finance opportunities. Once you’ve found a few potential investors, you’ll need to put together a pitch that outlines why your business is a good investment opportunity. This pitch should include information about your business model, your target market, and your growth plans. Once you’ve created your pitch, you’ll need to reach out to investors and set up meetings so that you can present your proposal. If an investor is interested in providing funding for your business, you’ll then need to negotiate the terms of the deal. These terms will include the amount of money being invested, the equity stake the investor will receive, and the repayment schedule.

The future of Direct Finance

We are on the cusp of a new era in finance, one that promises to be more inclusive, efficient, and empowering than ever before. Direct finance is a key part of this new landscape, and it holds the potential to completely upend the way we think about financial services.

So what exactly is direct finance? In a nutshell, it is a form of peer-to-peer lending that enables individuals and businesses to access capital directly from investors, without going through traditional financial institutions.

This model has a number of advantages over the traditional banking system. For one, it bypasses the need for intermediaries, which can save time and money. It also gives borrowers more control over the terms of their loans, and presents a more flexible and responsive way of accessing capital.

Finally, direct finance democratizes access to capital by making it available to a wider range of borrowers. This is particularly important for small businesses and entrepreneurs, who often find it difficult to secure funding through traditional channels.

Looking ahead, direct finance is poised to become an increasingly important part of the global financial system. As more people and businesses embrace this model, we can expect to see a wave of innovation that will further increase its efficiency and reach.

FAQs about Direct Finance

What is Direct Finance?

Direct finance is a form of lending that allows businesses to access funding without going through a traditional financial institution such as a bank. Instead, businesses can apply for loans directly from investors. This can be done through online platforms that match businesses with investors, or by approaching investors directly.

How does Direct Finance work?

Businesses that use Direct Finance will typically create a profile on an online lending platform. This profile will include information about the business, the amount of money that is being requested, and the terms of the loan. Once the profile is created, it will be made available to potential investors. If an investor is interested in providing funding, they will reach out to the business to discuss the loan agreement. Once an agreement is reached, the funds will be transferred to the business.

What are the benefits of Direct Finance?

Direct finance can be a good option for businesses that may not qualify for traditional bank loans. It can also be a quicker and easier way to access funding than going through a bank.

What are the risks of Direct Finance?

As with any loan, there is always the risk that the business will not be able to make the payments and will default on the loan. This could result in damage to the business’s credit score and difficulty securing future funding.

Case studies of Direct Finance

Direct finance is a type of financing that allows companies to receive funding directly from investors, without going through traditional financial institutions.

There are a few different ways that companies can raise capital through direct finance, including:

-Crowdfunding: Companies can post projects or campaigns on crowdfunding platforms, and individuals can choose to invest in them.

-Peer-to-peer lending: Companies can borrow money from individuals through online platforms.

-Invoice financing: Companies can sell their invoices to investors in order to get immediate funding.

There are many benefits of direct finance, including the ability to raise large sums of money, the flexibility of terms, and the speed at which funding can be received. However, it is important to note that not all companies will be eligible for this type of financing, and it is not always the best option for every business.

Further reading on Direct Finance

There is a lot of confusion surrounding the term “direct finance.” Here’s a quick rundown of what it is and how it works.

Direct finance is a type of financing that allows businesses to get funding directly from investors, without going through a middleman. This can be done through online platforms, such as equity crowdfunding, or by directly approaching investors.

There are a few key advantages to direct finance. First, it can be faster and easier than traditional methods of raising capital, such as going through a bank or venture capital firm. Second, it gives businesses more control over their funding, as they are not beholden to the terms set by third-party lenders. Finally, it can be less expensive, as businesses only have to pay the fees associated with the platform they are using to raise funds (if any).

Of course, there are also some drawbacks to direct finance. One is that it can be difficult to find investors who are willing to invest in your business. Another is that you may have to give up equity in your company in order to raise funds. And finally, there is always the risk that your business will fail and you will not be able to repay your investors.

If you’re considering using direct finance to raise capital for your business, it’s important to weigh the pros and cons carefully before making a decision.