How to Get a Home Renovation Loan

Contents

Thinking about a home renovation? Here’s what you need to know about getting a home renovation loan to make your project happen.

Checkout this video:

Determine the scope of the project.

The first step is to determine the scope of the project. This will give you an idea of how much money you will need to borrow and what type of loan would be best suited for your needs. If you are planning on making major structural changes, such as adding an addition to your home, you will likely need a construction loan. These loans are typically short-term loans that will need to be paid off once the construction is completed.

If you are planning on making smaller, cosmetic changes, such as updating your kitchen or bathroom, you may be able to finance your project with a personal loan or a home equity line of credit (HELOC). These loans tend to have lower interest rates than credit cards, so they can be a good option if you are looking to save money on your renovation.

Once you have determined the scope of the project, you can start shopping around for loans. Be sure to compare interest rates, fees, and terms before choosing a lender. It is also important to read the fine print carefully so that you understand all of the terms and conditions of the loan.

Research home equity loans and lines of credit.

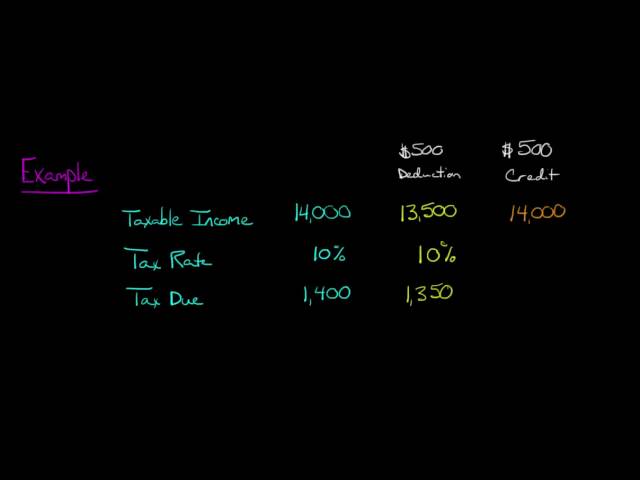

Once you’ve decided that a home equity loan or line of credit is right for your renovation project, it’s time to start shopping around for the best deal. Keep in mind that the interest rate on your loan will be based, in part, on your credit score, so it’s important to get your credit in order before you start applying for loans.

Before you apply for a home equity loan or line of credit, research the following:

-Your personal credit score and history

-The value of your home

-The amount of equity you have in your home

-The interest rates available for home equity loans and lines of credit

-The fees associated with home equity loans and lines of credit

Once you have this information, you’ll be able to compare offers from different lenders and choose the loan that’s right for you.

Research personal loans.

There are numerous personal loan companies that will give you a loan for home renovations. Each company has different eligibility requirements and interest rates. It’s important to compare multiple options before deciding on a loan.

Some things to keep in mind when shopping for a personal loan include:

-The interest rate

-The monthly payment

-The term of the loan (how long you have to pay it back)

-Whether there are any origination or prepayment fees

-The total cost of the loan

Compare and contrast loan options.

There are several loan options available for finance a home renovation. The best loan option for you depends on a variety of factors, including the cost of your renovation, the value of your home, and your credit score.

Compare and contrast loan options:

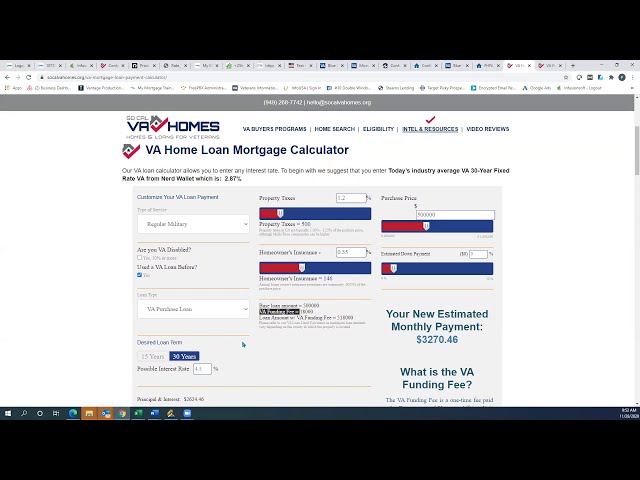

-Federal Housing Administration (FHA) 203(k) Loan: The FHA 203(k) loan is a government-backed loan that can be used to finance up to 110% of the costs of a home renovation. This includes both the cost of the property itself and the cost of any renovations or repairs. The minimum down payment for an FHA 203(k) loan is 3.5%.

-Home Equity Line of Credit (HELOC): A HELOC is a line of credit that can be used for home renovations as well as other purposes. The amount of the line of credit is based on the equity in your home, and you can borrow against it as needed. HELOCs typically have lower interest rates than other types of loans, but they also require monthly payments.

-Personal Loan: Personal loans can be used for a variety of purposes, including home renovations. Personal loans typically have fixed interest rates and terms, which makes them a good option if you need to borrow a specific amount of money for your renovation. However, personal loans typically have higher interest rates than other types of loans.

Choose the best loan for your needs.

There are a few different types of home renovation loans available, each with their own pros and cons. You’ll need to decide which loan type is best for your needs before you can apply.

The two most common types of home renovation loans are home equity loans and personal loans. Home equity loans are best for those who have equity in their home to use as collateral, while personal loans are better for those without equity or who have bad credit.

Home equity loans can be either fixed-rate or variable-rate, and they usually have lower interest rates than personal loans. However, home equity loans also require you to put your home up as collateral, which means that if you default on the loan, you could lose your home. Personal loans don’t require collateral, but they usually have higher interest rates than home equity loans.

Before you decide which loan to apply for, compare offers from multiple lenders to see who is offering the best terms. You should also consider the fees associated with each loan before making a decision.

Start the loan application process.

If you’re planning a home renovation, you may be wondering how to get a loan to finance your project. There are several different types of loans that can be used for renovations, and the best option for you will depend on the scope of the work you’re planning, the value of your home, and your credit history.

To get started, you’ll need to gather some basic information about your financial situation, such as your annual income, your current debts, and the value of your home. You’ll also need to have a clear idea of what you want to do with the renovation loan; this will help lenders determine whether they’re willing to finance your project.

Once you have this information gathered, you can begin shopping around for loans. Talk to your bank or credit union first; they may offer special rates for customers who are looking to finance home renovations. You can also check with online lenders or look into government-backed programs like the FHA 203(k) loan program.

Once you’ve found a few potential lenders, compare rates and terms to find the best deal. Be sure to ask about fees and closing costs so that you can get a true comparison of the offers. Once you’ve found the right loan, fill out an application and provide any required documentation. Once everything is approved, you’ll be ready to start planning your home renovation!

Complete the loan application process.

The first step in getting a home renovation loan is to complete a loan application. You will need to provide basic information about yourself, your home, and your current financial situation.

Once you have completed the loan application, you will need to submit it to the lender for approval. The lender will then review your application and decide whether or not you qualify for the loan.

If you are approved for the loan, the next step is to complete the loan agreement. This document outlines the terms of the loan and should be read carefully before you sign it.

Once you have signed the loan agreement, the lender will disburse the funds to you. You can then use these funds to pay for your home renovations.