How to Get a Car Loan from the Bank

Contents

It can be difficult to get a car loan from the bank , but it is possible. Here are a few tips on how to get a car loan from the bank.

Checkout this video:

Introduction

When you head to the bank to get a loan for a car, there are a few things you’ll need to bring with you. The first is proof of income, which can come in the form of a pay stub or tax return. You’ll also need some collateral, which is typically in the form of a vehicle title or another asset. Finally, you’ll need to have a good credit score to qualify for the best rates.

If you don’t have these things, don’t worry – there are still options available to you. However, it’s important to be aware that you may not qualify for the best interest rates and terms if you don’t have all of the necessary documentation. In this article, we’ll go over what you need to get a car loan from the bank so that you can be prepared when it’s time to apply.

How to Get a Car Loan from the Bank

In order to get a car loan from the bank, you will need to meet with a loan officer and fill out an application. You will also need to provide the bank with proof of income, employment, and residency. The bank will then run a credit check and if you are approved, you will be given a loan.

Applying for a Car Loan from the Bank

When you go to the bank to apply for a car loan, you will need to bring some documentation with you. The first thing the bank will need is proof of income. This can be in the form of a pay stub from your job or an offer letter from a new employer. The bank will also need to see your credit history. You can get a free copy of your credit report from each of the three credit reporting agencies once per year. Finally, you will need to provide the bank with an estimate of the car’s value. The best way to do this is to get a quote from a dealer or use an online resource like Kelley Blue Book.

The Application Process

To get a car loan from the bank, you will need to fill out an application and provide some supporting documentation. The requirements vary from bank to bank, but you will typically need to provide proof of income, proof of residency, and proof of insurance. You may also need to provide a down payment.

Once you have submitted your application, the bank will review it and determine whether or not you are approved for the loan. If you are approved, the bank will provide you with a loan agreement that outlines the terms of the loan, including the interest rate, monthly payments, and repayment schedule.

It is important to read the loan agreement carefully before signing it. Once you have signed the agreement, you are committed to repay the loan according to the terms specified. If you have any questions about the loan agreement, be sure to ask them before you sign it.

The Loan Agreement

The loan agreement is the document that outlines the loan terms and conditions. It is important to read and understand the loan agreement before signing it. The loan agreement will include information such as the loan amount, interest rate, repayment schedule, and any fees or charges associated with the loan.

It is important to note that the terms and conditions of the loan agreement may vary from lender to lender. Be sure to compare different lenders before signing a loan agreement.

Repaying the Loan

Once you’ve taken out the loan and bought your car, you’ll need to start making repayments. These are usually made monthly, and you’ll be given a repayment schedule when you take out the loan. It’s important to stick to this schedule, as missing repayments can damage your credit rating and make it harder to get credit in the future.

If you think you might struggle to make a repayment, contact your lender as soon as possible. They may be able to offer assistance or give you more time to make the payment.

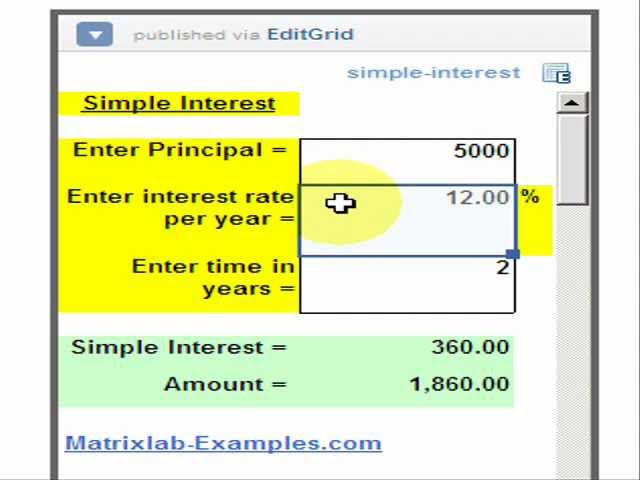

When you make a repayment, part of the money will go towards interest charges and the rest will reduce the amount of money you owe. The amount of interest you pay will depend on the interest rate on your loan, as well as the amount of money you borrowed and the length of time you took to repay it.

Conclusion

If you follow the steps above, you should have no trouble getting a car loan from the bank. Remember to shop around for the best interest rate and terms, and to read the fine print carefully before signing any loan documents.