How to Fix Your Credit in 5 Steps or Less

Contents

Do you have bad credit? Find out how to fix your credit in 5 steps or less with this helpful guide.

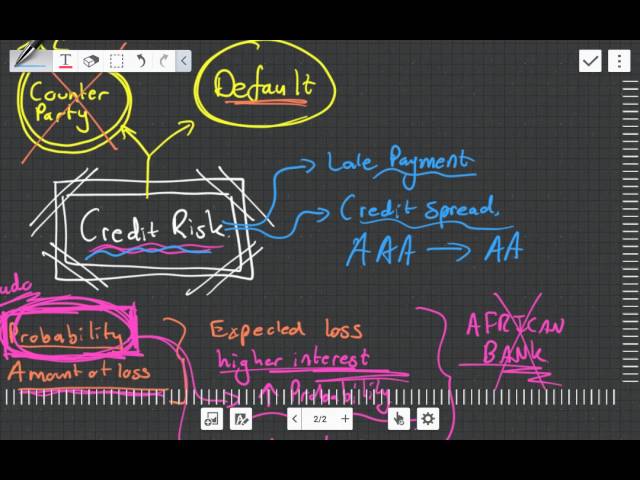

Checkout this video:

Get a credit report

The first step to take is to get a credit report. You can do this by contacting one of the three credit reporting bureaus: Experian, Equifax or TransUnion. You can also request a free credit report from each bureau once every 12 months by visiting AnnualCreditReport.com. Review your credit report carefully to identify any errors or outdated information that might be dragging down your score. If you spot any errors, dispute them with the credit bureau in question.

Check for errors

The first step is to check your credit report for errors. You’re entitled to a free copy of your credit report from each of the three major credit bureaus every 12 months. You can get them at www.annualcreditreport.com. Go through each report carefully and dispute any errors you find with the credit bureau.

If you find errors on your credit report, it’s likely that they’re negatively impacting your credit score. By fixing these errors, you can improve your score and put yourself in a better position to get approved for loans and lines of credit in the future.

dispute any errors you find

The first step is to order a free copy of your credit report from each of the three credit bureaus —Experian, TransUnion and Equifax—and dispute any errors you find. You can do this online or by mailing a letter. Include a copy of your report with the error highlighted, along with a statement explaining why you believe the information is wrong and what evidence you have to support your claim.

If the credit bureau agrees that there was an error, they will notify the lender and ask them to correct the information. The credit bureau will also send you a free copy of your updated report. If you don’t agree with the outcome, you can file a complaint with the Consumer Financial Protection Bureau.

correct any negative information

The first step is to order copies of your credit report from the three major credit bureaus—Equifax, Experian and TransUnion. (You can get them for free once a year at AnnualCreditReport.com.) Look for any inaccurate or outdated information, such as old addresses, misspellings of your name, closed accounts that are still listed as open and negative entries that should have been removed after seven years.

Next, dispute any errors with the credit bureau in writing. Include documentation to support your case and ask that the item be removed or corrected.

If the credit bureau agrees that an error has been made, they will update your report and notify the other two bureaus. If they don’t agree, you can file a statement of complaint with the Federal Trade Commission (FTC), providing documentation to support your case.

You should also contact the company that provided the accurate information to the credit bureau and ask them to update your file. You may need to provide documentation to support your case.

improve your credit score

You can improve your credit score by following these simple steps:

1. Check your credit report for errors and dispute any errors you find.

2. Pay your bills on time, every time.

3. Keep your credit balances low.

4. Use a mix of credit products.

5. Monitor your credit report regularly.