How to Cancel a Bank of America Credit Card

Contents

If you need to cancel your Bank of America credit card, you can do so by calling customer service or visiting their website. Be sure to have your account information handy so that you can cancel your card quickly and easily.

Checkout this video:

Cancelling Your Bank of America Credit Card

So, you’ve decided that you want to cancel your Bank of America credit card. Whether you’re fed up with high interest rates, poor customer service, or you just don’t use it anymore, we’ll show you how to cancel your card and close your account.

Call the Customer Service Number

The best way to cancel your Bank of America credit card is to call the customer service number. You can find this number on your statement or on the back of your credit card. When you call, be prepared to provide your name, address, and credit card number. You may also be asked for your Social Security number and date of birth. Be sure to have this information handy before you call.

Once you have reached a customer service representative, tell them that you would like to cancel your credit card. The representative will then ask you for your reason for cancelling. Be polite and honest with your answer. The representative may try to offer you alternatives or discounts, but politely decline these offers. Once you have confirmed that you would like to cancel your credit card, the representative will process the cancellation and provide you with a confirmation number. Be sure to write down this number and keep it in a safe place.

Speak to a Customer Service Representative

If you decide that you would like to cancel your Bank of America credit card, you will need to contact customer service in order to do so. Customer service can be reached by phone at 1-800-732-9194. You may also be able to cancel your credit card online, although this option may not be available for all cards.

When you call customer service, you will need to have some information handy, including your account number and any PIN or security code associated with your account. You will also need to tell the customer service representative why you are cancelling your credit card. Once your cancellation is processed, you will receive a confirmation number that you can use for future reference.

Request to Cancel Your Credit Card

We’re sorry to see you go. To cancel your credit card, please call the number on the back of your card or on your statement. You’ll need to provide the following information:

-Your name

-Your account number

-The date you would like the cancellation to take effect

Please note that you may have to pay any outstanding balance on your credit card before your cancellation can take effect.

Considerations Before Cancelling

Before you cancel your Bank of America credit card, it’s important to understand the implications. Cancelling a credit card can affect your credit score, so you need to weigh the pros and cons before making a decision. In this article, we’ll go over everything you need to know before cancelling your Bank of America credit card.

Review the Terms and Conditions

Before cancelling your Bank of America credit card, be sure to review the terms and conditions of your account. There may be fees associated with cancelling your credit card, and you will want to be sure that you are aware of them before taking any action. You should also review any outstanding balances or transactions on your account to ensure that you will not be responsible for them after your credit card is cancelled.

Once you have reviewed the terms and conditions of your account, you can decide whether or not cancelling your credit card is the best option for you. If you are certain that you would like to cancel your credit card, there are a few different ways that you can do so.

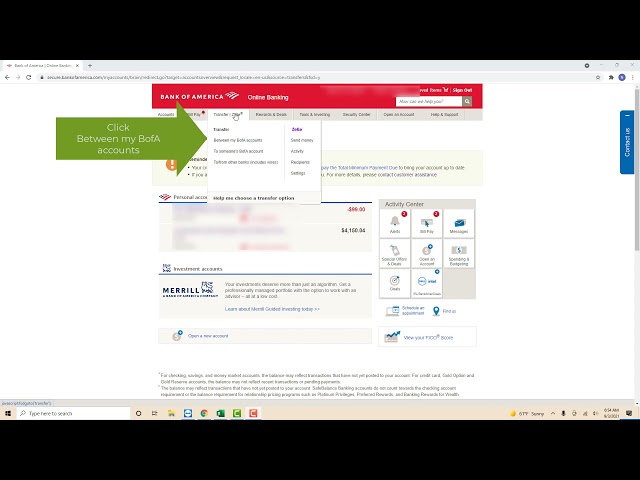

If you have a Bank of America online account, you can log in and cancel your credit card through the website. You will need to provide some information about your account and reason for cancellation, but this process is generally straightforward.

If you do not have a Bank of America online account, or if you prefer to speak with someone in person, you can call customer service at 1-800-732-9194 to cancel your credit card. Once again, you will need to provide some information about your account and reason for cancellation. Customer service representatives are available 24 hours a day, 7 days a week to assist you.

You can also visit a Bank of America branch in person to cancel your credit card. Be sure to bring along any information that may be required, such as your credit card number or account number. Once again, customer service representatives will be able to assist you with cancelling your credit card.

Consider Downgrading to a Different Card

Cancelling a credit card can result in a decrease in your credit score, especially if the card was opened for a long time. If you’re set on cancelling, you may want to consider downgrading to a different card first. Bank of America offers several different credit cards, so you may be able to find one that better suits your needs.

Downgrading to a different card has several benefits:

-You’ll keep the same account history, which can help maintain your credit score

-You may be able to keep the same interest rate and credit limit

-You’ll still have access to important account features, like online banking and mobile alerts

If you’re interested in downgrading your Bank of America credit card, you can call customer service at 1-800-732-9194.

Understand the Implications of Cancelling

Cancelling a credit card can have an impact on your credit score. It can also affect your ability to get approved for new lines of credit in the future. If you’re considering cancelling a Bank of America credit card, it’s important to understand the implications first.

Here are a few things to keep in mind:

-Your credit score could drop.

-You could be charged a cancellation fee.

-It could hurt your chances of getting approved for new lines of credit in the future.

If you’re still considering cancelling your Bank of America credit card, follow these steps:

1. Call customer service.

2. Tell them you’d like to cancel your account.

3. Ask if there are any fees associated with cancellation.

4. Find out if there’s anything you need to do to close the account, such as paying off any outstanding balance.

5. Get confirmation that the account has been closed and request a final statement be sent to you for your records.