How to Calculate Interest Payments on a Loan

Contents

Interest payments on a loan can be calculated using the loan’s interest rate, term, and principal. This calculation can be done by hand or using an online loan calculator.

Checkout this video:

Introduction

Calculating interest payments on a loan can be done in several different ways, depending on the type of loan and the lender. The most common method is to use a simple interest formula, which is applied to the principal amount of the loan. This type of interest is typically used for loans with fixed terms, such as auto or mortgage loans. Other methods used to calculate interest payments may include compound interest formulas or amortization schedules.

What is interest?

Interest is the cost of borrowing money, and it is typically expressed as a percentage of the total loan amount. For example, if you borrow $100 at a 10% interest rate, you will owe $110 to the lender at the end of the loan term. In this case, the $10 in interest is the cost of borrowing the money.

When you take out a loan, you will typically be charged interest on the outstanding balance — that is, the amount of money that you have borrowed but have not yet repaid. The interest rate will be stated as an annual percentage rate (APR), which is the rate that you will be charged for each year that you have a balance on your loan.

To calculate your interest payments, you will need to know your interest rate and your loan balance. You can use this information to calculate your monthly interest payment using the following formula:

Interest Payment = Loan Balance x Interest Rate / 12

For example, if you have a loan balance of $1000 and an interest rate of 5%, your monthly interest payment would be $41.67.

How is interest calculated?

Interest is calculated based on the interest rate, the loan amount, and the length of the loan. You can use an online loan calculator to determine your interest payments.

Simple interest

Simple interest is calculated only on the principal amount of the loan, and it is usually given as a percentage of that amount. The formula for simple interest is:

interest = principal x rate x time

For example, if you take out a $100 loan at 10% interest for one year, the amount of interest you will owe at the end of the year will be $10.

Compound interest is calculated on both the principal and on the accumulated interest of previous periods, and it is usually given as a percentage of thePrincipal. The formula for compound interest is:

A = P(1 + r)^n

Where:

A = the total amount of money after n periods, including interest

P = the principal amount

r = the annual rate of interest in decimal form (for example, 0.05 for 5%)

n = the number of years

For example, if you take out a $100 loan at 10% compound interest for one year, your total owed at the end of that year (including both principal and interest) will be $110.

Compound interest

Compound interest is when you earn interest on your principal, plus the interest that has accumulated so far. In other words, compound interest is “interest on interest.” The effect of compounding usually improves the growth rate of your money.

For example, let’s say you invest $1,000 at 10% annual compound interest. At the end of one year, you’ll have earned $100 in interest ($1,000 x 0.10 = $100). Of this $100 in interest, $10 represents interest on your original principal of $1,000. The remaining $90 is the “compound” interest – it’s the result of earning 10% on that previously earned $10.

In the second year, you’ll earn another 10% on both your original principal and also on that previously earned $10. In other words, in Year 2 you’ll earn 10% on a total base of $1,100 – which results in compound interest of $110 (10% of $1,100).

Over time – and especially with high-yield investments – compound interest can have a dramatic effect. For example: If you were to invest just $50 per week for 40 years at a modest 5% annual return, you would wind up with more than one million dollars!

Of course, with compounding there is always the potential for loss as well as gain – which is why it’s important to consult with a financial advisor to ensure that your investment strategy is consistent with your goals and risk tolerance.

How to calculate interest payments on a loan

Interest is what you pay for the use of someone else’s money. It is a percentage of the amount you borrowed, and it is calculated based on the interest rate, the length of the loan, and the amount of money you borrowed. You can calculate your interest payments by hand or use an online calculator.

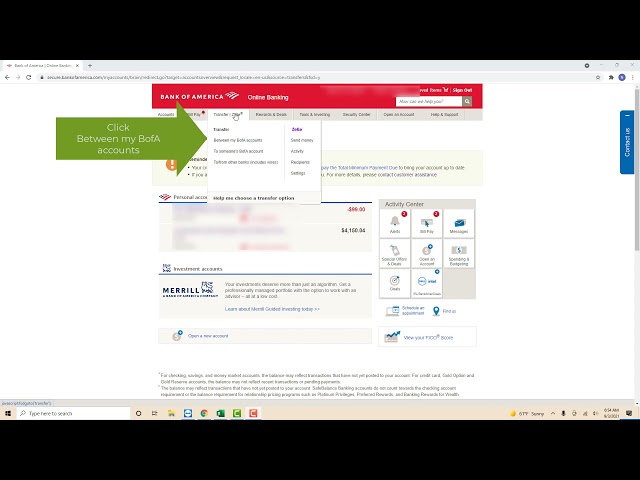

Using a loan calculator

A loan calculator is a simple tool that will allow you to predict how much your monthly loan repayments will be and how much total interest you will pay on your loan. To use a loan calculator, simply enter the amount of money you plan to borrow, the length of time you plan to borrow it for, and the interest rate. The calculator will then give you an estimate of your monthly repayments and total interest payments.

Of course, this is only an estimate – your actual interest payments may be different depending on the type of loan you choose and the terms of your loan agreement. But a loan calculator can still be a helpful way to compare different loans and their costs.

Manually calculating interest payments

There are a few different ways to calculate interest payments on a loan, but the most common method is the “simple interest” method. With this method, interest is calculated based on the principal (the original amount of the loan), the length of the loan, and the interest rate.

To calculate interest payments manually, you can use the following formula:

Interest payment = Principal x Interest rate x Length of loan

For example, if you have a $10,000 loan with a 4% interest rate and a 5-year term, your interest payments would be calculated as follows:

Interest payment = $10,000 x 0.04 x 5

Interest payment = $200 per year

Conclusion

Thank you for taking the time to learn how to calculate interest payments on a loan. This is an important skill to have, as it will enable you to make smart financial decisions when it comes to borrowing money. Interest payments can add up quickly, so it’s important to understand how they work before you take out a loan.

There are many online calculators that can help you figure out your interest payments, or you can use the simple Interest Payment Formula above. Just remember to use the correct interest rate (APR) and loan term when you calculate your payments.

If you have any questions about how to calculate interest payments on a loan, please contact a financial advisor. They will be able to help you understand the process and make sure you are making the best decisions for your financial future.