How Often Should I Apply for a Credit Card?

Contents

You’ve probably heard that you should only apply for a credit card every few months to avoid damaging your credit score. But how often can you actually apply for a credit card without hurting your score?

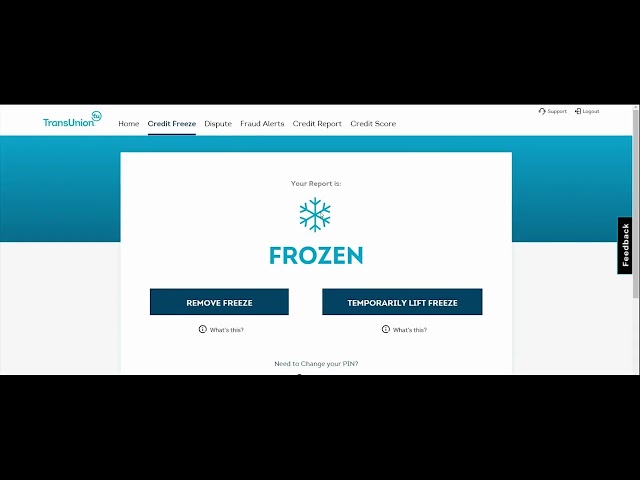

Checkout this video:

Applying for a Credit Card

There are a few things to consider before applying for a credit card. First, you need to make sure you have a good credit score. If you don’t, you may not be approved for the card. Also, consider how often you’ll use the card and what kinds of rewards you’re looking for. Finally, make sure you can pay off the balance every month.

How often can I apply for a credit card?

You can apply for a credit card as often as you like, but beware of applying for too many cards in a short period of time. Each time you apply for a credit card, the issuer will do a hard inquiry on your credit report, which can temporarily lower your credit score.

If you’re looking to build or rebuild your credit history, it’s best to space out your applications so that you don’t have too many inquiries in a short period of time. You should also make sure you’re only applying for cards that you’re likely to be approved for, so that you don’t get too many rejections, which can also damage your credit score.

In general, it’s best to only apply for one or two credit cards every six months or so. This will give you the opportunity to get the cards you want without damaging your credit score too much.

What are the consequences of applying for too many credit cards?

If you apply for too many credit cards in a short period of time, it can have a negative impact on your credit score. Each time you apply for a credit card, the credit card issuer will do a hard inquiry on your credit report. Too many hard inquiries can lead to a lower credit score. In addition, applying for too many credit cards can be viewed as a sign of financial instability, which could also lead to a lower credit score.

Credit Score

Applying for a credit card can help you build credit and improve your credit score. But how often should you apply for a credit card?

How does applying for a credit card affect my credit score?

There are a few ways that applying for a credit card can affect your credit score. One is that when you apply for a credit card, the issuer will do a hard pull of your credit report. This can cause your score to drop a few points.

Another way is that if you are approved for the credit card, you will likely have a higher credit utilization ratio, which can also cause your score to drop.

The best way to avoid these negative effects is to make sure you only apply for credit cards when you are sure you will be approved. This means having a good credit score and income level.

What is a good credit score?

A credit score is a number that reflects the likelihood of you paying your debts on time. This score is important because it affects your ability to borrow money, how much interest you will pay and what kind of loan terms you will be offered.

The higher your credit score, the better. A good credit score is usually considered to be anything above 700. A score of 800 or above is considered to be excellent.

If your credit score is below 700, you may still be able to get a loan, but you will probably pay a higher interest rate. It is important to try to improve your credit score before applying for a loan so that you can get the best terms possible.

There are a few things you can do to improve your credit score, such as paying all of your bills on time, maintaining a good balance on your credit cards and keeping your debt-to-income ratio low. You can also try to get help from a credit counseling service if you are having trouble managing your debt.

Applying for a Credit Card vs. Secured Credit Card

Before you decide to apply for a credit card, you should understand the difference between a regular credit card and a secured credit card. A regular credit card is unsecured, which means that the credit limit is based on your credit score. A secured credit card is secured by a deposit that you make, and your credit limit is based on the amount of the deposit.

What is the difference between a credit card and a secured credit card?

The main difference between a credit card and a secured credit card is that a secured credit card requires a deposit, which is typically equal to your credit limit. The deposit is held as collateral in case you default on your payments. With a regular credit card, the issuer takes on the entire risk if you don’t make your payments.

A secured credit card can help you build or rebuild your credit history by reporting your good payment behavior to the major credit bureaus. And because secured cards require a deposit, they can be easier to get than regular unsecured credit cards, especially if you have bad credit or no credit history.

If you use a secured credit card responsibly and make all of your payments on time, you should be able to qualify for an unsecured credit card within 12 to 18 months. After that, you can close your secured card and get your deposit back.

What are the benefits of a secured credit card?

A secured credit card is a credit card that is backed by a deposit that you make with the issuer. The deposit acts as collateral for the credit line on the card. This means that if you default on your payments, the issuer can take money out of your deposit to cover the balance.

A secured credit card can help you build or rebuild your credit history because it reports your activity to the major credit bureaus. When you use a secured credit card responsibly — by making on-time payments and keeping your balance low — you can improve your credit score over time.

Some secured cards even offer rewards, such as cash back or points, which can be a great way to earn perks while you’re working on building credit. And once you’ve established good credit habits, you may be able to upgrade to an unsecured card and get your deposit back.

Applying for a Credit Card vs. Store Card

When it comes to credit cards, there are a few things you should keep in mind. You don’t want to apply for too many credit cards, as this can hurt your credit score. You also want to make sure you’re using a credit card that offers rewards that you’ll actually use. So, how often should you apply for a credit card?

What is the difference between a credit card and a store card?

There are two main types of cards that you can use to make purchases: credit cards and store cards. Both have their own pros and cons that you should consider before using either one.

A credit card is a type of loan that allows you to make purchases and then pay back the balance over time. interest is charged on the outstanding balance, so it’s important to try to pay off your credit card every month to avoid paying extra in interest charges. Credit cards also generally have higher credit limits than store cards, so they can be a better option for making big purchases.

Store cards are specific to one store or group of stores, and they can only be used to make purchases at those stores. Store cards often have lower credit limits than credit cards, and they usually don’t offer interest-free periods, so it’s important to pay off your balance in full every month. Store cards can sometimes offer exclusive discounts and rewards at the store, so they can be a good option if you regularly shop at one particular store.

What are the benefits of a store card?

When used responsibly, store credit cards can offer a number of benefits to consumers. For one, they can help build your credit score—particularly if you don’t yet have a history of using credit. In addition, many store cards offer rewards programs that allow you to earn points or cash back on purchases made at the retailer. Some even offer exclusive discounts and early access to sales.

Before signing up for a store card, it’s important to do your research. Read the terms and conditions carefully to make sure you understand the interest rate and any fees associated with the card. In addition, be aware of the credit limit—if you’re planning to use the card for larger purchases, you’ll want to make sure it will be high enough to cover them.