How Do I Unfreeze My Credit With TransUnion?

Find out how to unfreeze your credit with TransUnion by following these simple steps.

Checkout this video:

Introduction

It’s important to keep an eye on your credit score and credit report, especially if you’re planning on making any large purchases, such as a home or a car. If you find that your credit score has dropped, it could be due to some negative information on your credit report.

One way to improve your credit score is to “unfreeze” your credit with the credit bureau TransUnion. This means that you will have access to your full credit report and can work on improving your score. In order to unfreeze your credit, you will need to provide TransUnion with some personal information, such as your name, address, date of birth, and Social Security number. You will also need to provide a form of identification, such as a driver’s license or passport.

Once you have provided all of the required information, TransUnion will send you a confirmation letter within five business days. Once you receive this letter, you will be able to access your full credit report and begin working on improving your credit score.

How to Unfreeze Your Credit With TransUnion

If you’ve been the victim of identity theft or you’re simply trying to protect your credit, you may have considered freezing your credit. A credit freeze means that your credit file is off-limits to creditors and others who may try to access it. This can help prevent identity theft and stop criminals from opening new accounts in your name. If you’ve already frozen your credit and you need to unfreeze it for a new credit application, you’ll need to contact TransUnion.

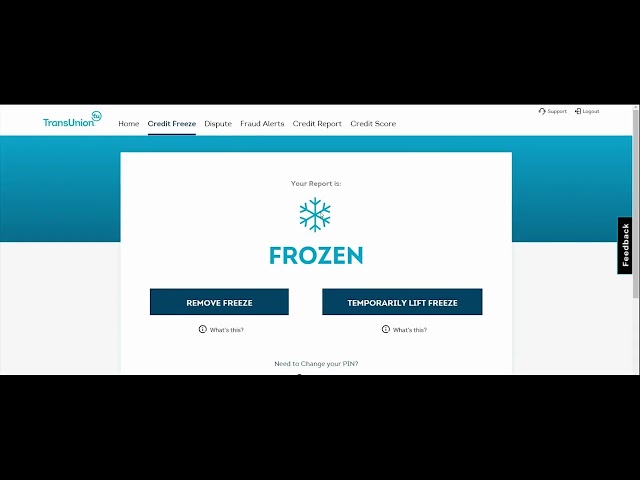

Online

If you have a TransUnion account, you can unfreeze your credit online by logging in and clicking on the “Account Freeze” section. From there, you will be prompted to enter your personal information and the last four digits of your Social Security number. Once your identity has been verified, you will be able to thaw your credit report immediately.

By Phone

Unfortunately, you cannot unfreeze your credit online or through the TransUnion mobile app. You will need to call TransUnion customer service at 1-888-909-8872 to unfreeze your credit report.

Conclusion

As you can see, there are a few simple steps you can take in order to unfreeze your credit with TransUnion. By following these steps, you can ensure that your credit report is updated and accurate, and that you can continue to access credit products and services.