How Often Can You Apply for a Credit Card?

Contents

If you’re wondering how often you can apply for a credit card, the answer is that it depends on a few factors. In this blog post, we’ll explore those factors and give you some guidelines to follow.

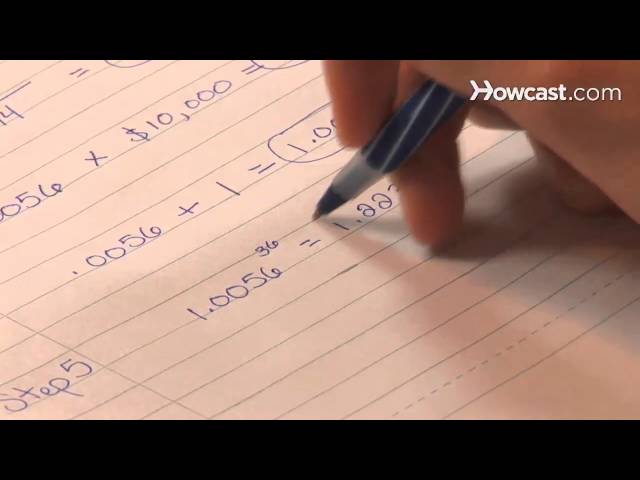

Checkout this video:

Applying for a Credit Card

If you’re looking to add a credit card to your wallet, you might be wondering how often you can apply for a new card. Luckily, there’s no limit on how many credit cards you can apply for. However, you should be mindful of a few things before you start submitting multiple applications. In this article, we’ll go over everything you need to know about applying for a credit card.

How often can you apply for a credit card?

There’s no definite answer to this question since it can depend on the credit issuer, your credit score, and your income. However, as a general guideline, you should try to limit the number of credit card applications you make within a 12-month period to avoid hurting your credit score.

If you’re looking to apply for a new credit card, it’s important to compare your options and choose the card that’s right for you. Once you’ve selected a few cards that you’re interested in, look at each issuer’s application requirements to see if you’re eligible.

If you have good credit, you may be able to get approved for multiple cards without harming your credit score too much. However, if you have fair or poor credit, each new application could cause your score to drop a few points. So if you’re not sure whether or not you’ll be approved for a particular card, it may be best to just apply for one at a time.

In general, it’s best to avoid applying for too many credit cards in a short period of time. This can give the impression that you’re desperate for credit or that you’re not managing your finances well. If possible, space out your applications so that they’re about six months apart. This will help show lenders that you’re responsible with credit and that you only apply for cards when you need them.

The impact of multiple credit card applications

Applying for multiple credit cards can have a negative impact on your credit score. Although each credit card application will only result in a small decrease in your score, multiple applications can add up. Additionally, applying for multiple credit cards in a short period of time can be seen as a red flag by lenders, which could make it more difficult to get approved for future loans or lines of credit.

If you’re planning on applying for more than one credit card, it’s best to space out your applications. This will give you the best chance of getting approved and help avoid any damage to your credit score.

How to space out credit card applications

When you’re trying to improve your credit score, you might think that the more credit cards you have, the better. After all, more credit means a lower credit utilization ratio, right? Well, not necessarily.

It’s true that carrying multiple cards can help reduce your credit utilization ratio. But if you open too many lines of credit at once, you could actually end up hurting your score. That’s because each time you apply for a new card, the issuer will do a hard pull on your credit report. Too manyhard inquiries in a short period of time can negatively impact your score.

The best strategy is to space out your applications so that you’re only opening one or two new lines of credit every six months or so. This will give you time to build up a good payment history on each account before you open another one. And remember, the best way to improve your credit score is to pay all of your bills on time, every time.

Applying for Multiple Credit Cards

Many people want to know if there is a limit to how often they can apply for a credit card. The answer is that there is no set limit, but there are a few things to keep in mind. Applying for multiple credit cards can impact your credit score, so you want to be sure that you can handle the responsibility before you apply.

How to apply for multiple credit cards

It can be tempting to apply for multiple credit cards at the same time, especially if you’re trying to rack up rewards points or cash back. But before you start filling out applications, there are a few things you should know.

First, when you apply for multiple credit cards in a short period of time, it can have a negative impact on your credit score. That’s because each time you apply for a new credit card, the issuer will do a hard inquiry on your credit report. Hard inquiries can stay on your report for up to two years and can ding your score by a few points.

If you’re trying to build or rebuild your credit, it’s best to space out your applications so that you don’t have too many hard inquiries in a short period of time. You can also try to offset the impact of hard inquiries by applying for several cards at once – that way, the inquiries will count as just one hit to your score.

Another thing to keep in mind is that most credit card issuers have rules in place limiting the number of new accounts you can open in a given period of time. For example, Chase won’t approve you for more than one personal credit card every 30 days. And if you’ve opened five or more new accounts (across all issuers) in the past 24 months, you probably won’t be approved for a new Chase card at all.

If you still want to apply for multiple credit cards, there are a few things you can do to increase your chances of being approved:

-Check your credit score ahead of time to make sure it meets the issuer’s requirements.

-Apply for cards from different issuers so that you don’t run into any company-specific rules limiting the number of new accounts you can open.

-Choose cards that complement each other – for example, if you have one card that earns cash back and another that offers rewards points, you can maximize your earnings by using them together.

The impact of multiple credit card applications

While it’s perfectly fine to apply for multiple credit cards, you should be aware of the potential impact on your credit score.

Each time you apply for a credit card, the issuer will do a hard inquiry on your credit report. This can temporarily knock a few points off your score.

Additionally, having multiple credit cards can actually be beneficial to your score. It can help improve your credit utilization ratio, which is a key factor in determining your credit score.

If you’re considering applying for multiple credit cards, just be sure to space out your applications so that you don’t end up with too many hard inquiries on your report.

How to space out credit card applications

You can usually apply for multiple credit cards within a short period of time, but it’s not always in your best interest to do so.

Some issuers will approve you for multiple cards within a few days, while others may take weeks or even months to render a decision. If you’re lucky enough to have your applications approved in quick succession, you may be tempted to open all of your new accounts at once and start using them right away.

Doing so could hurt your credit scores in the long run, however. That’s because each time you apply for a credit card (or any other type of loan, for that matter), the lender will pull your credit report and take a hard inquiry into account when making its decision.

Hard inquiries can ding your scores by a few points and stay on your report for up to two years, so it’s best to spacing them out as much as possible. In general, you should aim to have no more than one hard inquiry every six months.

If you’re not sure when you last applied for a new credit card, you can view your credit report at annualcreditreport.com to see all the hard inquiries that have been made in the past two years.

Applying for a Credit Card After Being Denied

If you have been denied for a credit card, it’s important to know how often you can reapply. The good news is, there is no set time frame that you have to wait. However, it’s generally a good idea to wait at least 30 days before reapplying. This will give you time to improve your credit score and make sure you are in a better position to get approved.

How to apply for a credit card after being denied

If you’ve been denied for a credit card, it can be tough to know where to go next. Fortunately, there are some steps you can take to increase your chances of being approved the next time you apply.

First, make sure to check your credit report for any mistakes that may have been made. If you find any errors, dispute them with the credit bureau.

It’s also important to make sure you’re using the right credit card application strategy. For example, if you have bad credit, you may want to apply for a secured credit card instead of a traditional unsecured card.

If you’ve been denied for a specific credit card, try applying for a different card from the same issuer. For example, if you were denied for a Chase Sapphire Reserve® Card, you might have better luck with a Chase Freedom® Card.

Finally, remember that each time you apply for a credit card, it will result in a hard inquiry on your credit report. Too many hard inquiries can hurt your credit score, so make sure to only apply for cards when you’re confident you’ll be approved.

The impact of multiple credit card applications

If you’ve been rejected for a credit card, it can be tempting to just keep applying until you find one that approves you. But this can actually backfire and make it even harder to get approved for a card in the future.

When you apply for a credit card, the issuer will do a hard pull on your credit report. This can temporarily lower your credit score by a few points. If you apply for multiple cards in a short period of time, this can have an even bigger impact on your score.

What’s more, each time you apply for a card and are rejected, this is also recorded on your credit report. So if issuers see that you’ve been applying for a lot of cards recently and have been denied each time, they may be less likely to approve you in the future.

It’s best to wait at least six months between credit card applications so that your score has time to recover and issuers can see that you’re making an effort to improve your credit standing. In the meantime, there are other things you can do to build up your credit so that you’re more likely to be approved when you do apply for a new card.

How to space out credit card applications

It can be tempting to apply for multiple credit cards at once, especially if you’ve been denied for one or more cards. However, doing so can actually hurt your chances of getting approved in the future.

When you apply for a credit card, the issuer will do a hard pull on your credit report. This can temporary ding your score by a few points. If you apply for several cards in a short period of time, it will look like you’re desperate for credit and could make issuers more likely to deny your application.

Instead, it’s best to space out your applications. Only apply for one or two cards every few months. This will minimize the impact on your credit score and give you a better chance of getting approved.