How to Calculate Interest on a Car Loan: The Formula

Contents

How to calculate interest on a car loan? The answer isn’t as simple as you might think. Check out this blog post for a step-by-step guide on the formula.

Checkout this video:

Introduction

Introduction

Calculating the interest on a car loan is actually very simple. All you need is the loan amount, the interest rate, and the number of months you have to pay back the loan. With that information, you can use this formula to calculate your monthly interest payment:

Interest payment = Loan amount x Interest rate / Number of months

For example, let’s say you have a $15,000 car loan with an interest rate of 3% and you have to pay it back over 36 months. Using the formula above, your monthly interest payment would be:

Interest payment = $15,000 x 0.03 / 36

Interest payment = $41.67

So each month, you would need to pay $41.67 in interest on your car loan.

What Is Interest?

Interest is the price of money, and it is calculated as a percentage of the total loan amount. The higher the interest rate, the more expensive the loan will be. The lower the interest rate, the less expensive the loan will be.

The interest rate is used to calculate the monthly payment for a car loan. The monthly payment is determined by dividing the total amount of the loan by the number of months in the term of the loan. The interest rate is also used to calculate how much interest you will pay over the life of the loan.

The interest rate on a car loan is usually expressed as an Annual Percentage Rate (APR). The APR includes both the interest rate and any fees that are charged by the lender. The APR is typically higher than the interest rate because it includes these additional fees.

How to Calculate Interest on a Car Loan

You can use an interest calculator to simplify the process of determining how much interest you will pay on your car loan. The interest rate is the percentage of the loan that is charged as interest, and it is usually a higher rate than the APR. The APR is the annual percentage rate and is the rate that includes all fees and charges associated with the loan.

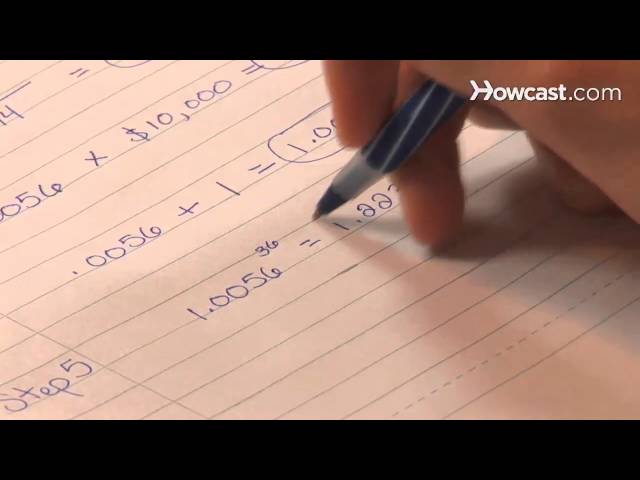

The Formula

The Formula

The interest rate on a car loan is usually expressed as an annual percentage rate, or APR. The simplest way to calculate the interest on a car loan is to use a formula that takes into account the principal amount of the loan, the length of the loan in months, and the APR.

The formula looks like this:

Interest = P × r × t

where:

P = Principal (the amount you borrow)

r = Annual Percentage Rate (APR) /12 (the monthly interest rate)

t = Number of months for the loan

For example, let’s say you borrow $20,000 for 48 months at an APR of 4.5%. The monthly interest rate would be 4.5%/12 or .375%. The number of months for the loan would be 48. So, the formula would look like this:

Interest = $20,000 × .00375 × 48

or

Interest = $450

The Interest Rate

The interest rate is the percentage of the loan that you will pay in interest. The higher the interest rate, the more you will have to pay in interest. The lower the interest rate, the less you will have to pay in interest. In order to calculate your monthly payment, you need to know the annual percentage rate (APR) of your loan. The APR is the interest rate plus any fees that are charged by the lender.

The Loan Amount

The loan amount is the total amount of money you borrow from the lender. This includes the car’s purchase price as well as any additional fees or charges, such as taxes and DMV fees.

##Heading: The Annual Percentage Rate (APR)

##Expansion:

The APR is the interest rate charged by the lender on your car loan. This rate can be fixed or variable, but for the sake of simplicity, we will assume it is fixed for this example.

##Heading: The Loan Term

##Expansion:

The loan term is the length of time you have to repay the loan. Car loans typically have terms of 24, 36, 48, or 60 months.

The Loan Term

The loan term is the amount of time you have to pay back your loan. It can be anywhere from one year to seven years, and the longer the term, the lower your monthly payments will be. Loan terms usually range from 24 to 60 months.

The interest rate is the amount of interest you pay on your loan each year. The interest rate can be fixed or variable. A fixed interest rate means that your interest rate will not change during the life of your loan. A variable interest rate means that your interest rate may change during the life of your loan, and usually does so in relation to a benchmark such as the prime rate. Variable rates are generally lower than fixed rates, but they can go up or down, so there is more risk involved.

How to Use an Online Interest Calculator

It’s actually quite simple to calculate the interest on a car loan using an online interest calculator. All you need to do is enter the loan amount, the loan term, the interest rate, and the date of first payment. The online calculator will do the rest!

But if you want to know how to calculate interest on a car loan without using an online calculator, the formula is actually quite simple. Just follow these steps:

First, you need to calculate the daily periodic rate by dividing the annual percentage rate by 365 (the number of days in a year).

Next, you need to figure out the number of days between payments. To do this, simply count the number of days from the date of your first payment until your next payment is due.

Now, multiply the daily periodic rate by the number of days between payments and by the loan balance. This will give you your interest amount for that particular payment period!

How to Lower the Interest Rate on a Car Loan

If you’re looking to lower the interest rate on your car loan, there are a few things you can do. One is to shop around for a better deal from other lenders. Another is to try to negotiate a lower rate with your current lender. And finally, you can look into refinancing your car loan at a lower interest rate.

Conclusion

To calculate the interest on your car loan, you need to know the loan amount, the interest rate, and the length of the loan. The interest rate is usually stated as an Annual Percentage Rate (APR). The length of the loan is usually given in months.

Here is the formula:

Interest = Loan amount x Interest rate x Length of loan / 12

For example, let’s say you have a $10,000 loan with a 5% APR and a 60-month term. The interest would be:

Interest = $10,000 x 0.05 x 60 / 12 = $250