How Much Can You Borrow on a Home Equity Loan?

Contents

How much can you borrow on a home equity loan? Read on to find out everything you need to know about taking out a home equity loan.

Checkout this video:

Home Equity Loan Basics

A home equity loan is a type of loan in which the borrower uses the equity of their home as collateral. Home equity loans are typically used for home improvement projects, to pay off debt, or to fund large purchases. The loan amount is based on the value of the home and the borrower’s equity.

What is a home equity loan?

A home equity loan is a fixed-rate loan based on the difference between what you owe on your home and its current market value. You receive the full loan proceeds and then pay it back in predictable, fixed monthly payments based on terms up to 30 years. Because it’s a fixed-rate loan, your monthly payment won’t change (outside of property taxes, insurance premiums or homeowner’s association fees). And unlike a HELOC, you won t have to worry about rising interest rates increasing your monthly payment.

How does a home equity loan work?

A home equity loan is a second mortgage that allows you to borrow against the value of your home. Your home equity is calculated by subtracting how much you still owe on your mortgage from the appraised value of your home. In most cases, you can borrow up to 80% of your home’s equity. So if your home is valued at $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity. You can generally borrow in one lump sum and make fixed monthly payments.

What are the benefits of a home equity loan?

A home equity loan is a type of loan that allows you to borrow against the value of your home. Home equity loans are attractive to borrowers because they typically have lower interest rates than other types of loans, and they are often tax-deductible.

There are two main types of home equity loans: fixed-rate and variable-rate. With a fixed-rate loan, you will have the same monthly payment for the life of the loan. With a variable-rate loan, your interest rate may change periodically, which can cause your monthly payment to increase or decrease.

Benefits of a home equity loan include:

-The interest rate is usually lower than the interest rate on other types of loans.

-The interest on a home equity loan is often tax-deductible.

-You can use the money from a home equity loan for any purpose, including home improvements, education expenses, medical bills, or consolidating other debts.

How Much Can You Borrow on a Home Equity Loan?

A home equity loan is a loan that uses your home as collateral. Home equity loans are usually for a shorter term than a first mortgage and have a fixed interest rate. You can usually borrow up to 85% of your home’s value, minus the amount of any outstanding mortgages. So, if your home is worth $300,000 and you have a $200,000 mortgage outstanding, you could borrow up to $40,000.

Factors that affect how much you can borrow

There are several factors that affect how much you can borrow on a home equity loan, including the value of your home, your credit score, and the loan-to-value ratio (LTV).

The value of your home is the most important factor in determining how much you can borrow on a home equity loan. The equity in your home is the difference between the market value of your home and the amount you still owe on your mortgage. For example, if your home is worth $200,000 and you have a mortgage balance of $100,000, you have $100,000 in equity.

Your credit score is another important factor in determining how much you can borrow on a home equity loan. Your credit score is a measure of your creditworthiness and it is used by lenders to determine whether or not you qualify for a loan and what interest rate you will be offered. Generally speaking, the higher your credit score, the better chance you have of getting approved for a loan and the lower interest rate you will be offered.

The final factor that affects how much you can borrow on a home equity loan is the loan-to-value ratio (LTV). The LTV is the ratio of the outstanding balance on your mortgage to the appraised value of your property. For example, if you have an outstanding mortgage balance of $100,000 and an appraised value of $200,000, your LTV would be 50%. In general, lenders will allow you to borrow up to 80% of the appraised value of your property less the outstanding balance on your mortgage. However, some lenders may allow you to exceed this limit if you have a good credit history or strong income.

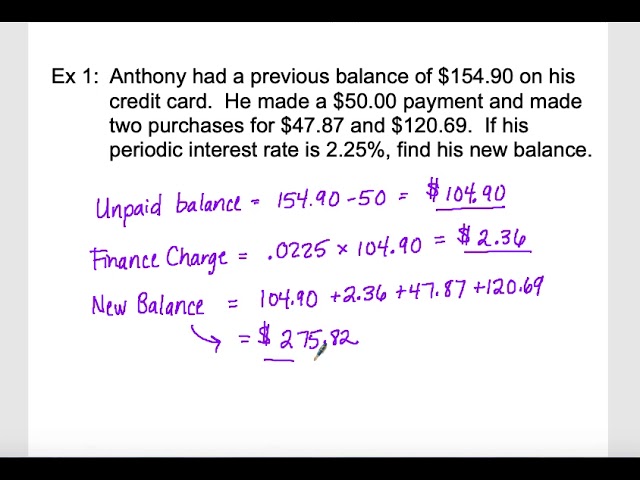

How to calculate how much you can borrow

To calculate how much you can borrow, lenders use two ratios—the loan-to-value ratio (LTV) and the combined loan-to-value ratio (CLTV). Your LTV is your loan amount divided by your home’s appraised value. Say your home is worth $250,000 and you owe $100,000 on your primary mortgage. That makes your LTV 75% ($100,000 divided by $250,000). To calculate your CLTV, add the balance of any outstanding loans on your property to your desired home equity loan amount, then divide that number by your home’s value. Again using the example above, if you wanted to take out a $30,000 home equity loan, you would have a CLTV of 116% [($100,000 + $30,000) ÷ $250,000].

Most lenders require that your CLTV not exceed 80%. So in our example above with a $250,000 home value and an LTV of 75%, you could borrow up to $25,000 ($250,000 x .80 = $200,000 – $100,000 outstanding balance = $100,002 available equity). But because of the higher risk associated with a higher LTV or CLTV ratio loans may be subject to stricter qualifying criteria.

How to get the best deal on a home equity loan

If you’re thinking about taking out a home equity loan, there are a few things you need to know. First, you’ll need to figure out how much you can borrow. Second, you’ll need to find the best deal on a home equity loan. Here’s a look at both of these things:

How much can you borrow on a home equity loan?

The amount you can borrow on a home equity loan depends on several factors, including the value of your home and your lending limit. In general, you can borrow up to 80% of the value of your home. So, if your home is worth $100,000, you could potentially borrow $80,000. However, your lending limit may be lower than this, so it’s important to check with your lender before you apply for a loan.

How to get the best deal on a home equity loan?

There are a few things you can do to get the best deal on a home equity loan. First, shop around and compare rates from different lenders. Second, make sure you have good credit before you apply for a loan. Third, consider using an online lender instead of a traditional bank. This can often help you get a better rate.