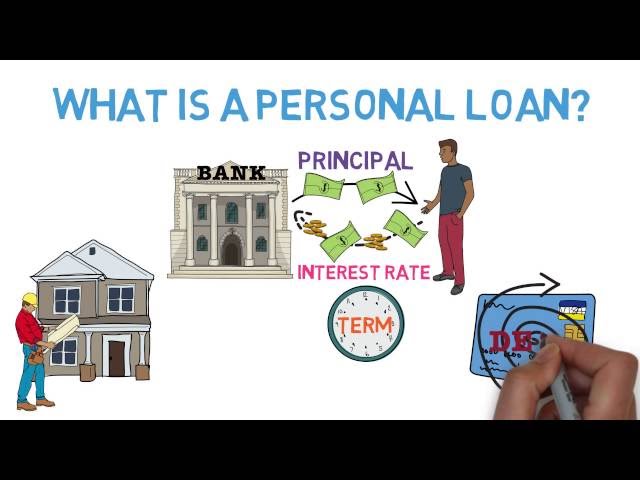

How a Personal Loan Works: The Basics

Contents

You may be able to use a personal loan for a variety of things, from consolidating debt to financing a large purchase. But how do personal loans work? We break down the basics for you.

Checkout this video:

Introduction

A personal loan is a type of loan that can be used for a variety of purposes, including consolidating debt, financing a large purchase, or making a major life change. Personal loans are typically unsecured, which means they are not backed by collateral like a home or car. This makes them different from secured loans like mortgages and auto loans.

Personal loans are one of the most popular types of loan because they offer a fixed interest rate and predictable monthly payments. This can make them much easier to budget for than other types of loans, like credit cards, which have variable interest rates.

How a personal loan works

A personal loan is a type of loan that can be used for a variety of purposes. You can use a personal loan to consolidate debt, finance a large purchase, or even cover emergency expenses. Personal loans are typically unsecured, which means they are not backed by collateral. This can make them a more expensive option than secured loans, but they can still be a good option if you have good credit and can qualify for a lower interest rate.

Applying for a personal loan

When you apply for a personal loan, you’ll need to provide some basic information about yourself and your finances. The lender will use this information to determine whether you qualify for a loan and, if so, how much they’re willing to lend you.

Here’s what you can expect to provide when you apply for a personal loan:

-Your name, address, date of birth and Social Security number

-Your employment information, including your employer’s name and address, your job title and how long you’ve been employed

-Your income information, including your monthly income before taxes

-Your asset information, including any money you have in savings or investments

-Your debts and expenses, including other loan payments, credit card bills and child support or alimony payments

Once you’ve provided this information, the lender will run a credit check. This is a review of your credit history that allows the lender to see how well you’ve managed debt in the past. Based on the results of your credit check, the lender will give you a preliminary decision on whether or not you qualify for a loan.

How personal loan interest is calculated

Personal loan interest is usually calculated daily. This means that every day, the interest charge is added to your outstanding loan balance. The actual amount of interest you’re charged each day will depend on the amount of your loan, the interest rate, and the length of your loan term.

For example, let’s say you take out a $10,000 personal loan with a 5% interest rate and a two-year repayment term. Each day, you’ll be charged $0.68 in interest ($10,000 x 0.05 / 365). So after one year, you’ll owe a total of $11,336 ($10,000 + $1,336 in interest). And at the end of two years, you’ll owe $12,713 ($11,336 + $1,377 in interest).

Of course, personal loan terms and interest rates can vary depending on the lender. Some lenders may charge a flat interest rate while others may charge a variable rate that can fluctuate along with market conditions. It’s important to compare offers from multiple lenders to make sure you’re getting the best deal possible.

How personal loan repayments are structured

When you take out a personal loan, you agree to repay the borrowed amount plus interest over a set period of time, typically one to five years. Your monthly payment will be the same every month, and you’ll know up front exactly how much you’ll need to pay each month and when your loan will be paid off.

Personal loan repayment terms can vary depending on the lender, but usually, you’ll make fixed monthly payments. Some lenders may offer variable repayment terms, which means your monthly payments could increase or decrease depending on changes to the prime rate.

If you have a variable rate personal loan, make sure you can afford the potential higher payments before you commit to the loan.

Conclusion

Assuming you make all of your payments on time, a personal loan can be a great way to finance a large purchase or consolidate high-interest debt. personal loans typically have a lower interest rate than credit cards, so you can save money on interest over the life of the loan.

Before taking out a personal loan, it’s important to understand how they work. This article covers the basics of how personal loans work, including how to qualify and what to expect.

When you’re ready to apply for a personal loan, start by comparing offers from multiple lenders to find the best rate and terms for your needs.