How a Credit Card Works: The Basics

Contents

How a Credit Card Works: The Basics

Credit Card Works: The Basics’ style=”display:none”>Checkout this video:

What is a credit card?

A credit card is a plastic card that gives the cardholder a set limit of funds which they can borrow from the credit issuer. The cardholder can use their credit card to make purchases up to their credit limit and can choose to either pay off their balance in full each month or make minimum payments. Credit cards also typically come with other benefits such as rewards programs, cash back, and 0% APR introductory periods.

How do credit cards work?

A credit card is a plastic card that gives the cardholder a specified line of credit. The card is issued by a financial institution, such as a bank, and can be used to make purchases. In order to make a purchase, the cardholder must have a credit card account with the issuer and must have sufficient funds in the account to cover the purchase.

The credit card network

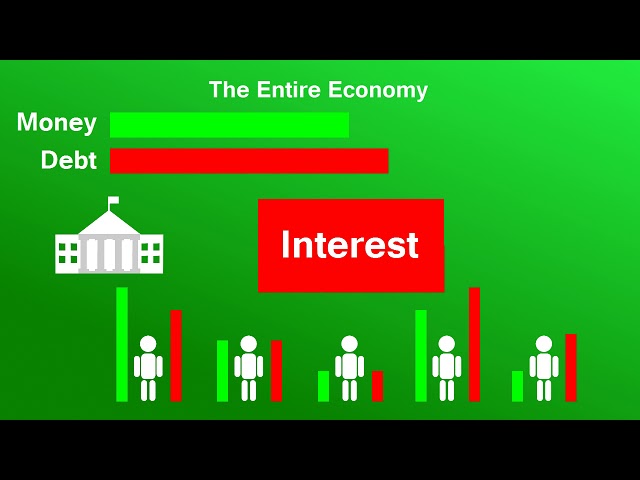

The credit card network is a system that allows credit card companies, banks, and merchants to process transactions. When you use your credit card to make a purchase, the transaction is sent to the credit card network. The network then routes the transaction to the appropriate party, whether that’s the merchant’s bank or the credit card issuer.

The credit card network is made up of four main players:

-Credit card issuers: These are the companies that issue credit cards, such as Visa, Mastercard, and American Express.

-Acquirers: These are the banks or other financial institutions that process transactions for merchants.

-Processors: These are the companies that provide acquirers with the technology and services needed to process transactions.

-Merchants: These are the businesses that accept credit cards as payment.

The four players in the network work together to ensure that every transaction is processed smoothly and efficiently.

The credit card issuer

The credit card issuer is the financial institution that issues the credit card to the consumer. The issuer creates a line of credit for the consumer to use and sets a credit limit, which is the maximum amount that the consumer can borrow. The issuer also charges interest on any outstanding balance and may charge fees for late payments or other violations of the terms of the credit agreement.

The issuer is typically a bank or other financial institution, but it can also be a retail store or other organization that offers credit products to consumers.

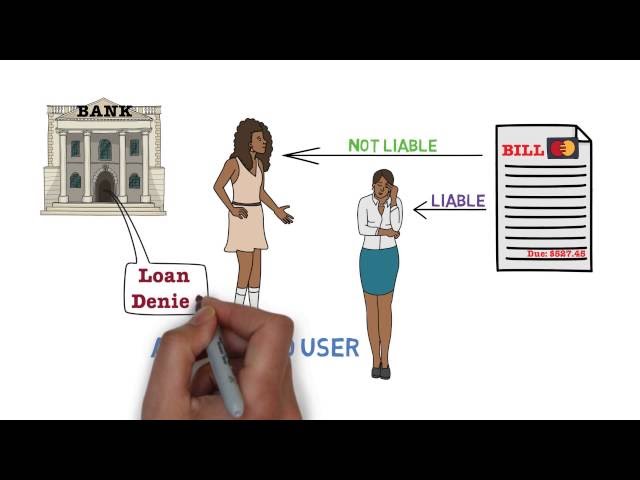

The credit cardholder

A credit card is a plastic card issued by a financial company that lets cardholders borrow money up to a certain limit in order to purchase items or withdraw cash. In order for someone to be approved for a credit card, they must first fill out an application with their personal information and financial history.

If the individual is approved for the credit card, they will be sent a physical card in the mail with their name and credit limit printed on it. In order to use the credit card, the individual will need to sign the back of the card in the designated area. The signature serves as an agreement between the cardholder and the issuing company that they will use the card responsibly and pay back any debt accrued.

To make a purchase with a credit card, the cardholder simply needs to hand their credit card to the merchant and sign a receipt. The merchant will then run the credit card through a machine that will approve or decline the transaction based on the available funds in the account. If approved, the funds for the purchase are transferred from the issuing company to the merchant and then onto the account of the person who made the purchase.

It is important to note that although credit cards offer convenience, they also come with responsibility. Cardholders are expected to make at least their minimum monthly payment on time in order to avoid late fees and accruing interest charges. If a cardholder is unable to make their payments, they may find themselves facing damaging effects on their credit score which can impact their ability to borrow money in the future.

How do I get a credit card?

Most people get their first credit card by signing up for an account with a major credit card issuer such as Visa, Mastercard, or American Express. You can usually do this online, over the phone, or in person at a brick-and-mortar bank or credit card issuer’s office.

To sign up for an account, you’ll need to provide some personal information, including your name, address, date of birth, and Social Security number. You may also be asked to provide income information and list any existing debts you have. Once you’ve been approved for an account, you’ll receive a credit card in the mail with your name and account number on it.

Once you have a credit card, you can use it to make purchases anywhere that accepts credit cards. When you make a purchase, the merchant will typically ask for your name, credit card number, expiration date, and the security code (also known as the CVV) on the back of your card. You’ll then sign a receipt to complete the transaction.

If you decide you want to cancel your credit card account for any reason, you can do so by contacting your credit card issuer and requesting that they close your account.

How do I use a credit card?

A credit card is a plastic card that gives the cardholder a line of credit with which to make purchases or withdraw cash. There are numerous credit card issuers, and each has different terms, conditions, and benefits. In order to use a credit card, the cardholder must first understand how the credit card system works and the basic rules of using a credit card.

Credit card rewards

When you use a credit card, you’re essentially borrowing money that you will need to pay back with interest. However, many credit cards offer rewards programs that can give you cash back, points, or miles for your spending. These programs can be a great way to save money on your everyday expenses, but it’s important to understand how they work before signing up for a card.

There are two main types of credit card rewards programs: cash back and points. Cash back programs simply give you a percentage of your spending back as cash, which you can then use to pay down your balance or for other expenses. Points programs, on the other hand, give you points for every dollar you spend that can be redeemed for travel, merchandise, or gift cards.

Most rewards programs have tiers that offer different levels of rewards based on your spending. For example, you may get 1% cash back on all purchases up to $1,000 per month, and 2% cash back on all purchases over $1,000 per month. Some cards also offer bonus rewards in specific categories like travel or dining.

Before signing up for a credit card with a rewards program, make sure to read the terms and conditions carefully. Some cards have annual fees that may negate the value of the rewards you earn, and some programs have restrictions on how and when you can redeem your points or cash back. It’s also important to remember that if you carry a balance on your credit card from month to month, the interest you accrue will likely outweigh any benefits of the rewards program.

Credit card points

Credit card points are a great way to save money on your purchases. By using your credit card points, you can get cash back, gift cards, or even free travel. However, it’s important to know how credit card points work before you start using them.

Here’s a quick rundown of how credit card points work:

-Most credit cards offer points for every dollar you spend.

-You can typically redeem your points for cash back, gift cards, or travel.

-Some credit cards also let you transfer your points to airline or hotel loyalty programs.

-Points usually have an expiration date, so be sure to use them before they expire.

-Credit card companies often offer bonus points for signup bonuses and special promotions.

Credit card cash back

Credit card cash back is a type of credit card reward program. With this type of program, you can earn cash back on your credit card purchases. Typically, you’ll earn a certain percentage back on every purchase you make. For example, you might earn 1% cash back on every purchase, or 5% cash back on purchases made at grocery stores.

There are two main types of credit card cash back programs: rotating category programs and tiered programs. With a rotating category program, the categories that earn rewards rotate every quarter. This means that you’ll have to keep track of the categories and make sure you’re spending in the right categories to earn rewards. Tiered programs, on the other hand, offer different rewards tiers based on how much you spend each month. For example, you might earn 1% cash back on all purchases up to $1,000, 2% cash back on all purchases between $1,000 and $3,000, and 3% cash back on all purchases over $3,000.

To start earning cash back with a credit card, simply use your card for your everyday purchases. There is no need to sign up for anything or keep track of special categories—you’ll automatically start earning rewards based on your spending habits. Be sure to pay your bill in full and on time each month to avoid interest charges and late fees that can offset your rewards earnings.

What are the benefits of using a credit card?

Credit cards offer a lot of benefits to consumers. They are a convenient way to make purchases, and they can help you build your credit history. Credit cards can also be used for cash advances and balance transfers. Let’s take a look at some of the other benefits of using a credit card.

Convenience

Most people use credit cards for the convenience of not having to carry around cash or write checks. You can use your credit card to buy almost anything — from a cup of coffee to a new car.

Security

One of the main benefits of using a credit card is that it can help you to stay safe and secure when you are making purchases. With a credit card, you can be sure that your money is safe if you should happen to lose your wallet or have it stolen. In addition, if you use a credit card to make an online purchase, your personal information will be much more secure than if you were to use a debit card or even cash.

Rewards and points

Credit cards offer a variety of rewards and points programs that can save you money on everything from travel to groceries. Some cards offer cash back, while others offer points that can be redeemed for merchandise, travel, or gift cards. You can even find cards that offer a combination of cash back and points. If you are a frequent traveler, you may want to consider a card that offers travel rewards, such as free flights or hotel stays.