How Many Credit Scores Are There?

Contents

There are many different credit scores out there. But the most important thing to know is that there are three main credit scores.

Checkout this video:

Introduction

It’s a common question: How many credit scores are there? The answer, unfortunately, is not so simple. There are dozens of different scoring models in existence, and each one can generate a slightly different score for the same person.

The most well-known credit scoring model is the FICO score, which is used by the vast majority of lenders. However, there are also scores created by VantageScore, Experian, and TransUnion, to name just a few. And within each scoring model, there may be multiple versions (for example, the FICO 8 score vs. the FICO 9 score).

To make things even more complicated, some lenders create their own in-house scoring models that may be based on a combination of different scoring models. So the number of possible credit scores out there is practically endless!

The good news is that you don’t need to understand all the details of every scoring model to have a good credit score. As long as you’re diligently paying your bills on time and keeping your debt levels low, you should be in good shape.

What is a credit score?

A credit score is a number that reflects the risk associated with lending money to a particular consumer. The higher the score, the lower the risk; the lower the score, the higher the risk. Credit scores are used by lenders to help them determine whether or not to lend money to a particular borrower, and if so, how much interest to charge on the loan.

Lenders use different scoring models, so a consumer’s credit score can vary from one lender to another. In addition, each lender sets its own criteria for what constitutes a “good” or “bad” score. As a result, there is no one-size-fits-all answer to the question “What is a good credit score?”

However, there are some general guidelines that can be useful for understanding how credit scores work. For example, most scoring models used by lenders range from 300 to 850. Scores in the upper end of this range are typically considered excellent, while scores in the lower end are generally seen as poor.

In addition, it’s important to keep in mind that not all lenders use the same scoring models. So, even if two consumers have identical credit scores from one lender, they may receive different offers from other lenders. This is why it’s important for consumers to shop around and compare offers before applying for any type of loan.

How many credit scores are there?

There are a lot of different credit scores out there. The number of credit scores you have depends on the scoring model that is being used. The most common scoring model is the FICO score, which is used by 90% of lenders. If you have a FICO score, then you have three different scores, one from each of the credit bureaus (Experian, Equifax, and TransUnion). So, in total, you have nine different credit scores.

Other scoring models include the VantageScore, which is used by about 10% of lenders. If you have a VantageScore, then you have four different scores, one from each of the credit bureaus. So, in total, you have 16 different credit scores.

And there are dozens of other scoring models out there that are used by a variety of lenders. So, the number of credit scores you have depends on the scoring model that is being used.

What are the different types of credit scores?

Credit scores are designed to represent your credit risk, or the likelihood you will pay your mortgage on time. Credit scores are calculated by credit reporting agencies, and the information used to calculate your score can be found in your credit report.

There are different types of credit scores, and lenders may use a different type of score than what’s shown on your credit report. For example, a lender may use a credit scoring model that includes information from your credit report that isn’t included in other types of credit scores.

Your lender may also have its own internal scoring system, which may use information from your credit report that isn’t included in other types of credit scores. When you apply for a loan or line of credit, ask your lender which type of score it uses so you can be sure to get an accurate estimate of how likely you are to be approved.

There are many different types of credit scores available to lenders, and each type of score uses different information from your credit report. The most common type of credit score is the FICO® Score, which is used by more than 90% of lenders when making lending decisions.

Other types of scores include VantageScore®, Empirica®, and Encounter® score is used by some lenders in specific situations. For example, if you have a limited history of borrowing money and don’t have much data on which to base a FICO® Score, a lender might instead use a VantageScore® 3.0 or 4.0 when considering whether to give you a loan.

How do credit scores affect your life?

Your credit score is a number that is used to indicate your creditworthiness. It is a number that lenders use to determine whether or not you are a good candidate for a loan. It is also a number that landlords use to determine whether or not you are a good candidate for an apartment. A high credit score means that you are a low-risk borrower. A low credit score means that you are a high-risk borrower.

There are three different credit scores: FICO, VantageScore, and Experian. FICO is the most widely used credit score. VantageScore is the second most widely used credit score. Experian is the third most widely used credit score.

Your FICO score is based on five factors: payment history, credit utilization, length of credit history, new credit accounts, and types of credit accounts. Your VantageScore is based on six factors: payment history, age of accounts, Percentage of Balances to Credit Limits, total debt and balances, recent behavior and inquiries, and original delinquencies. Your Experian score is based on seven factors: payment history, age and type of accounts, balances and limits, derogatory marks, public records, collections accounts, and inquiries.

Credit scores range from 300 to 850. The higher your score, the better your chances of getting approved for loans and credit cards with favorable terms (low interest rates and fees).

Conclusion

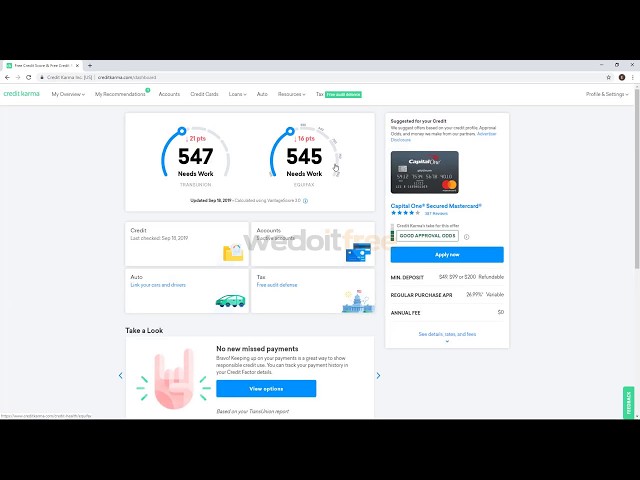

While there are many different scoring models out there, the bottom line is that most lenders will focus on your FICO score when making lending decisions. So it’s important to know what your score is and to check for any errors that could be dragging it down. You can get your free credit score from a number of sources, including Credit Karma and Discover.